Powered by solar, wind and lithium-ion batteries, the clean energy transition is reshaping the world.

Just over a year ago, I would not have believed that statement.

Back then, I did not appreciate just how fast these changes were multiplying. I have since learned a ton about energy transitions and climate tech, crunched the data and triangulated insights.

Today, I have no doubt about the clean energy transition and the impact it will have on our lives and societies. The phrase energy transition is also an understatement and few people alive have lived through one before to know any different. Looking at history overcomes our collective amnesia to see how important energy transitions have been, and hints at the path we are on now.

This post explains what is driving the transition and explores emerging opportunities. Fairly new to the topic? This could be an overview that helps orient as you learn more. Already playing your role in the transition? You might find a perspective that challenges your thinking or surprises you. You could even be nudged to build or join a company to tap into the energy transition's huge opportunities ahead.

Let's go.

Introduction

The following headline insights are short summaries. In the Key Takeaways section below, we revisit each insight in more detail. In the main sections, we then discuss each point in the most depth.

Insight 1: Plummeting Solar and Battery Costs Are Now At Tipping Points

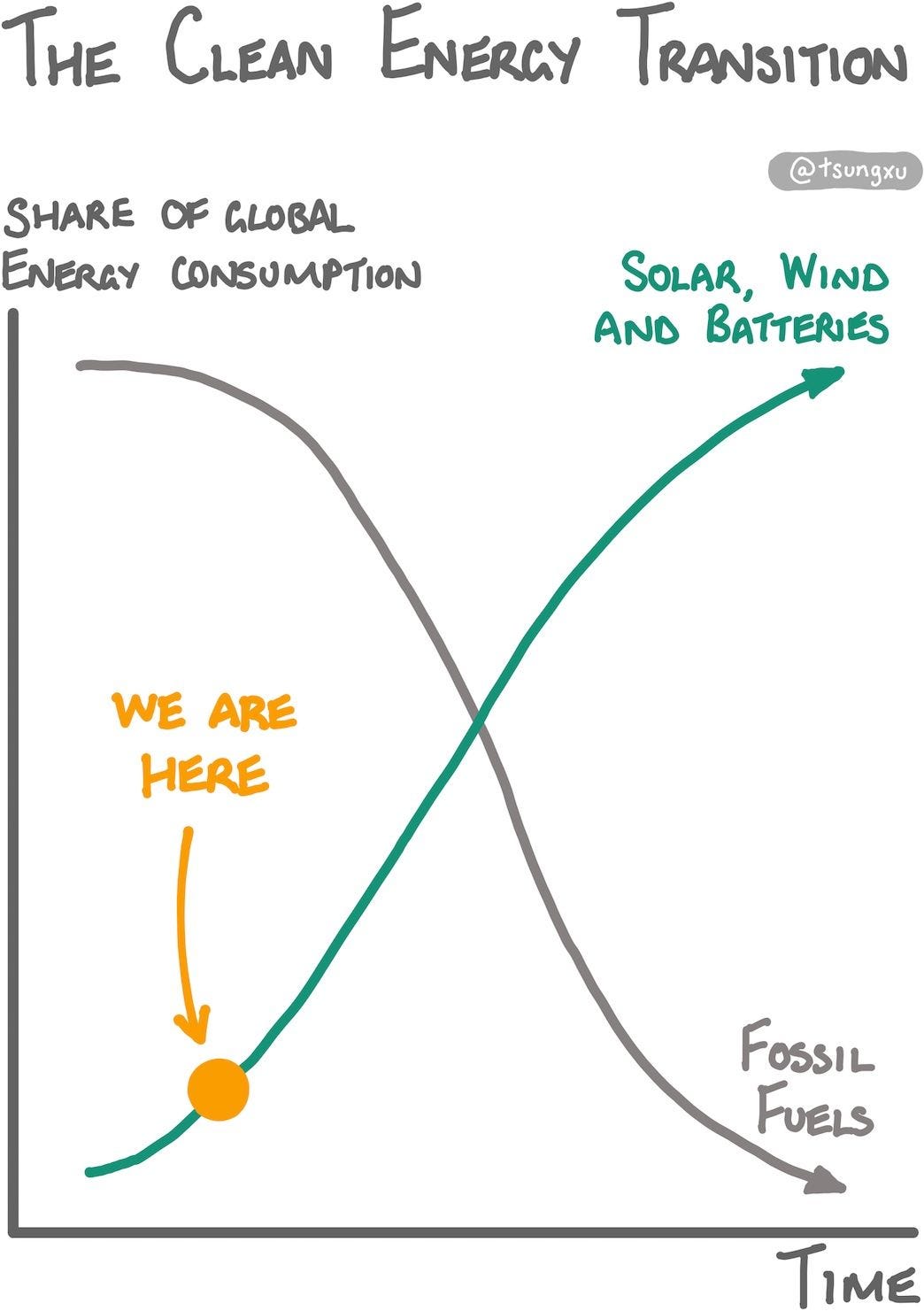

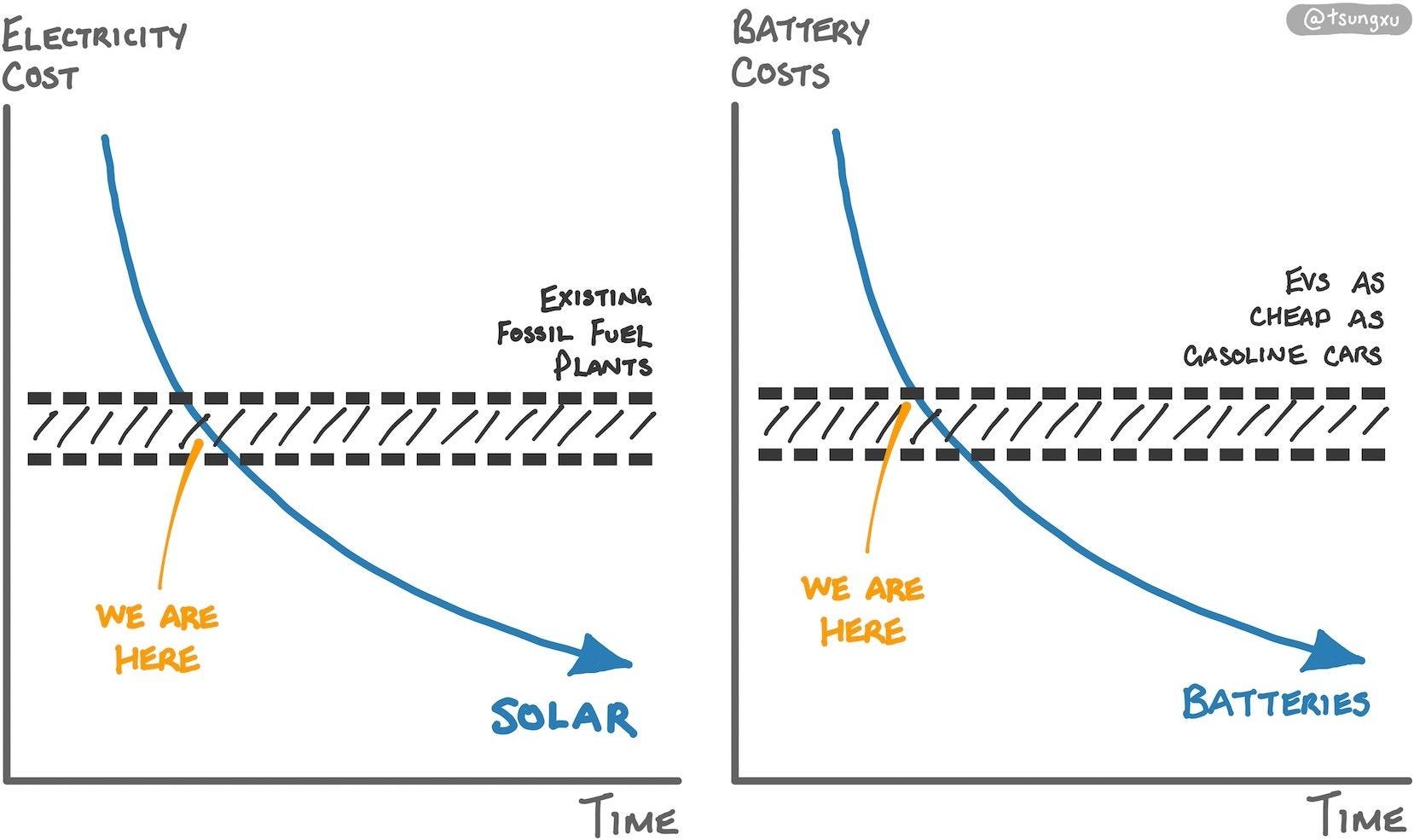

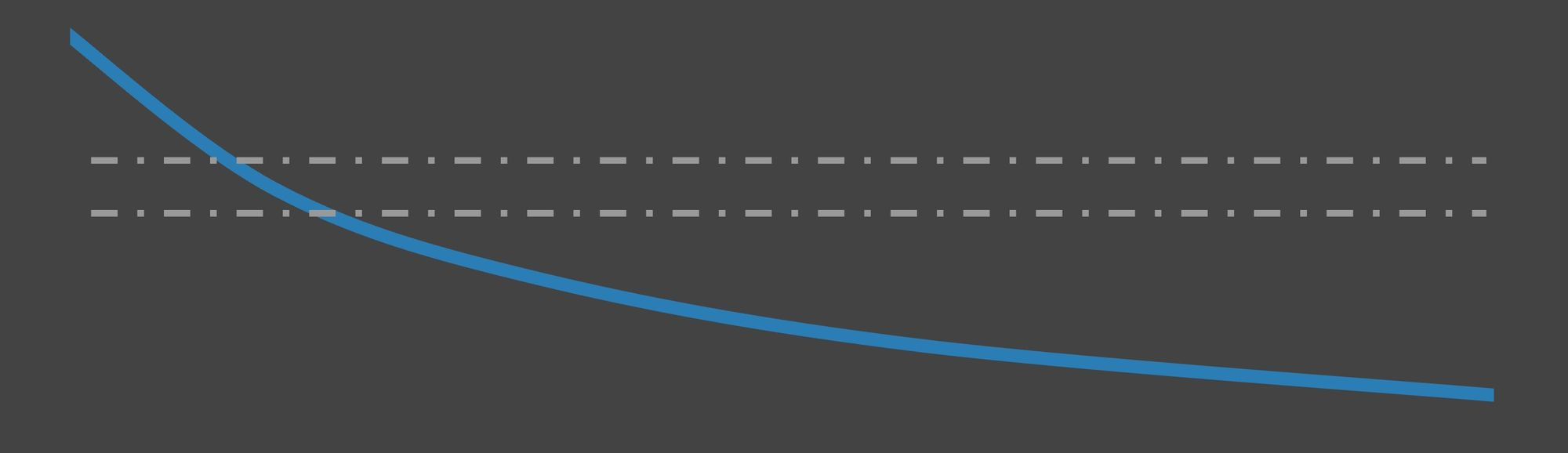

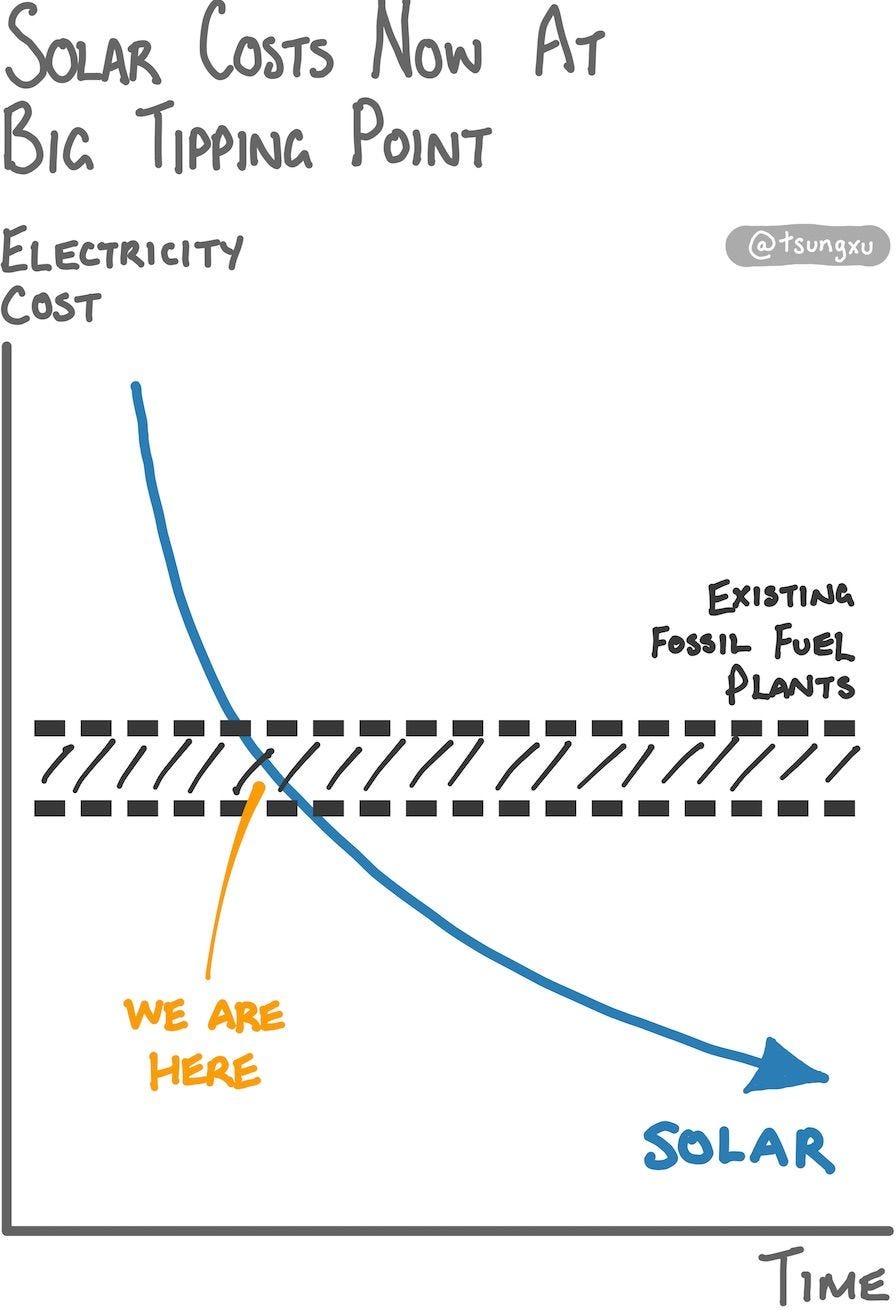

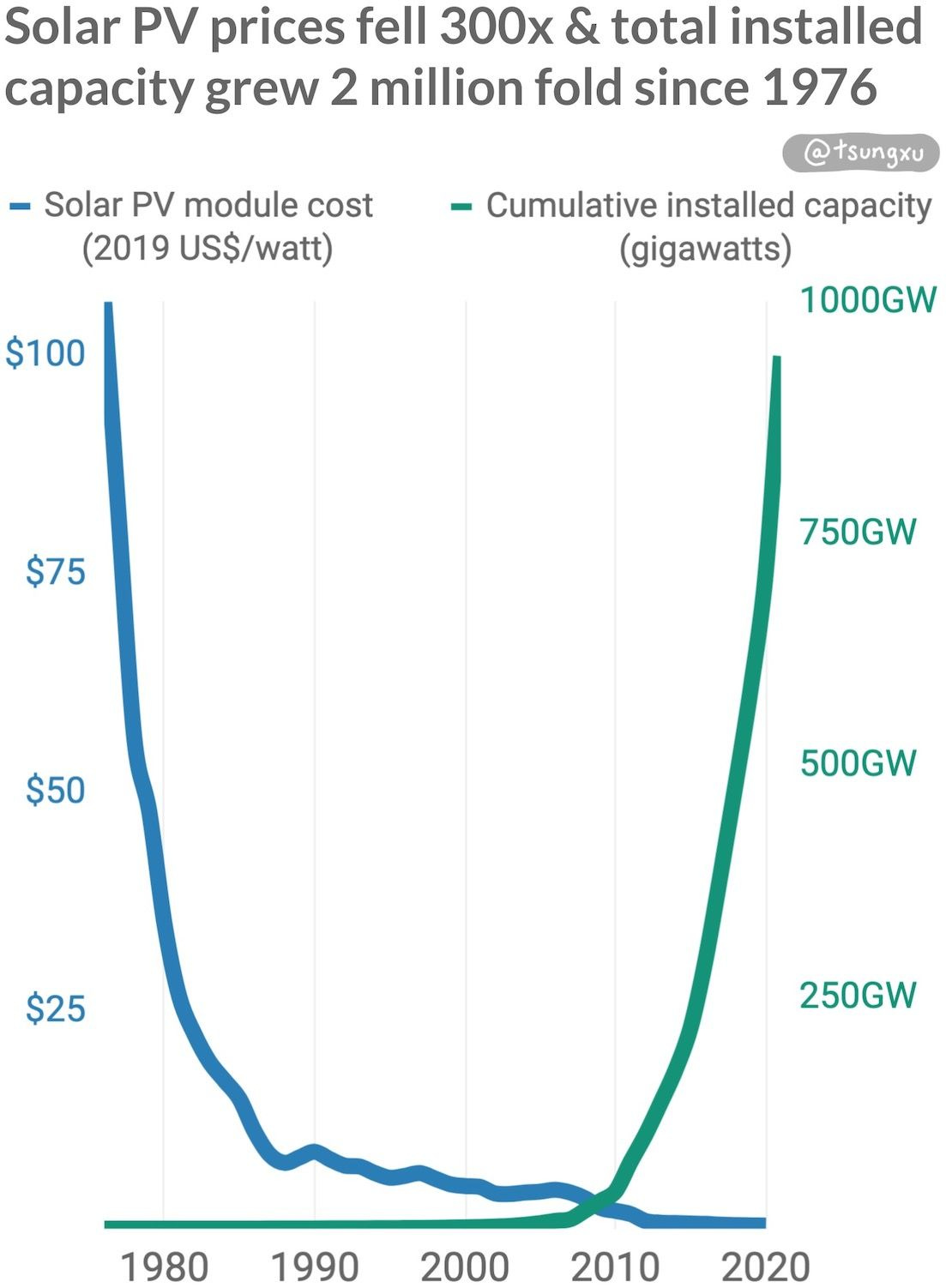

Solar and lithium-ion batteries costs keep falling, and are now at tipping points of sustained and rapid growth, as shown in these charts.

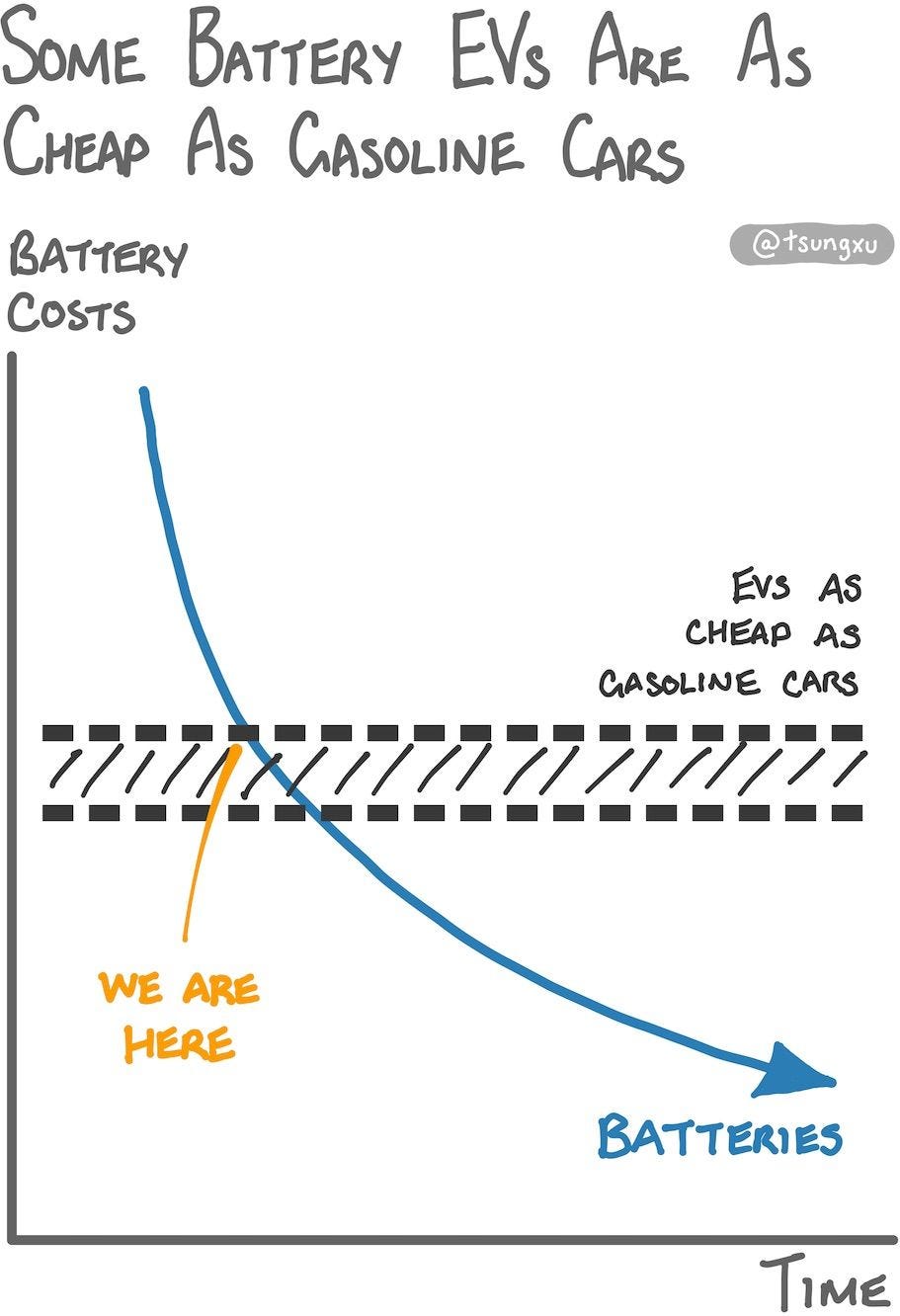

In generating electricity, solar and wind are rapidly rising to replace fossil fuels. In mobility, lithium-ion battery prices have allowed electric vehicle (EVs) costs to be comparable to gas-guzzling cars.

These tipping points are accelerants propelling us towards a clean energy future.

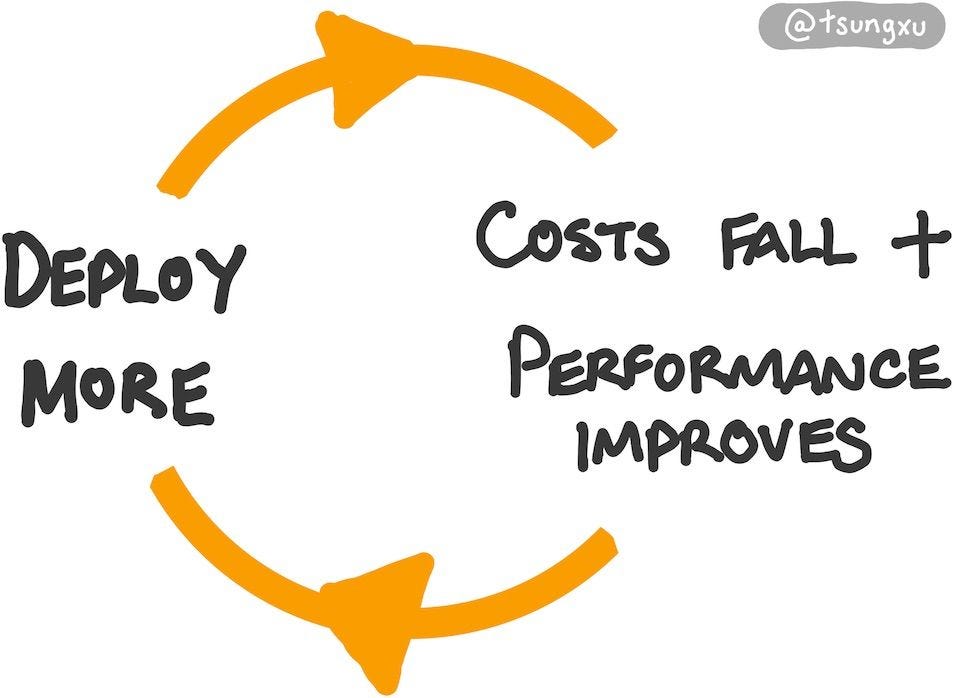

Insight 2: As Production Scales, Solar, Wind and Batteries Become Cheaper and Better

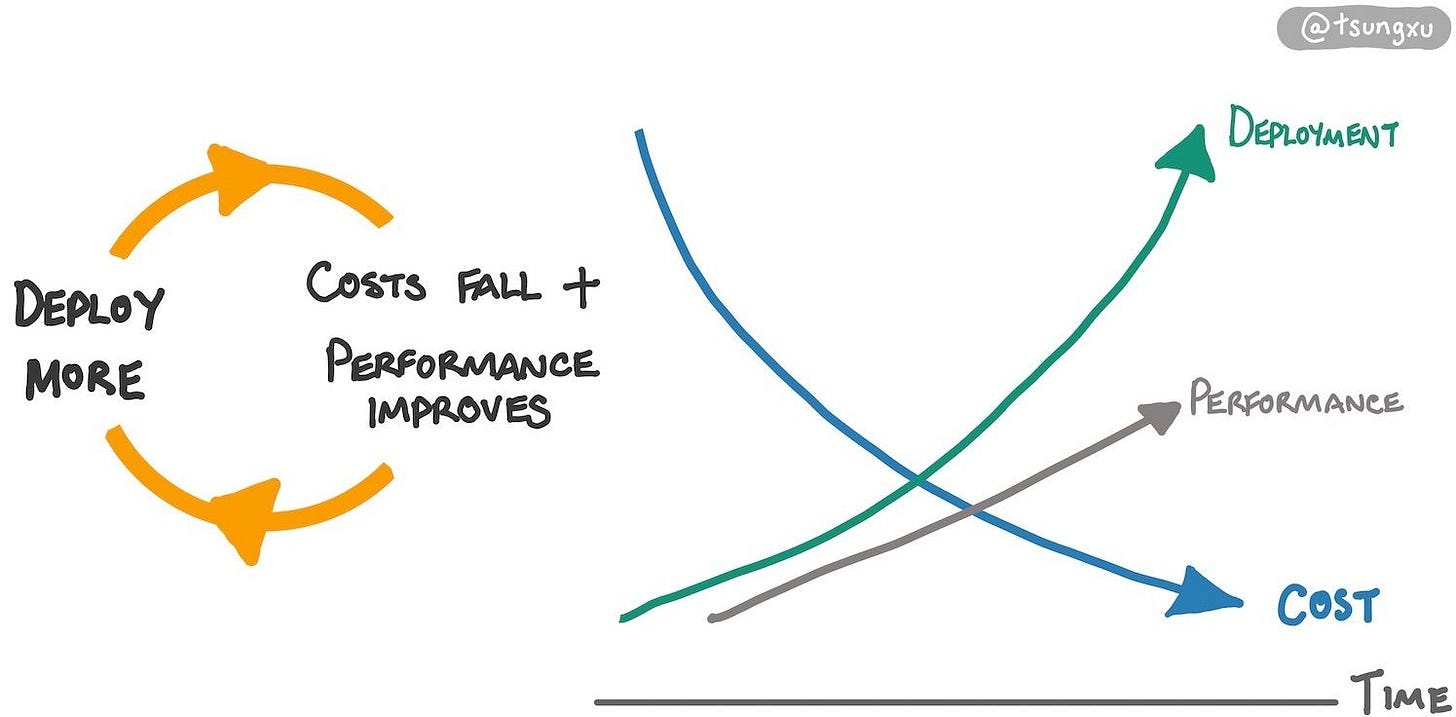

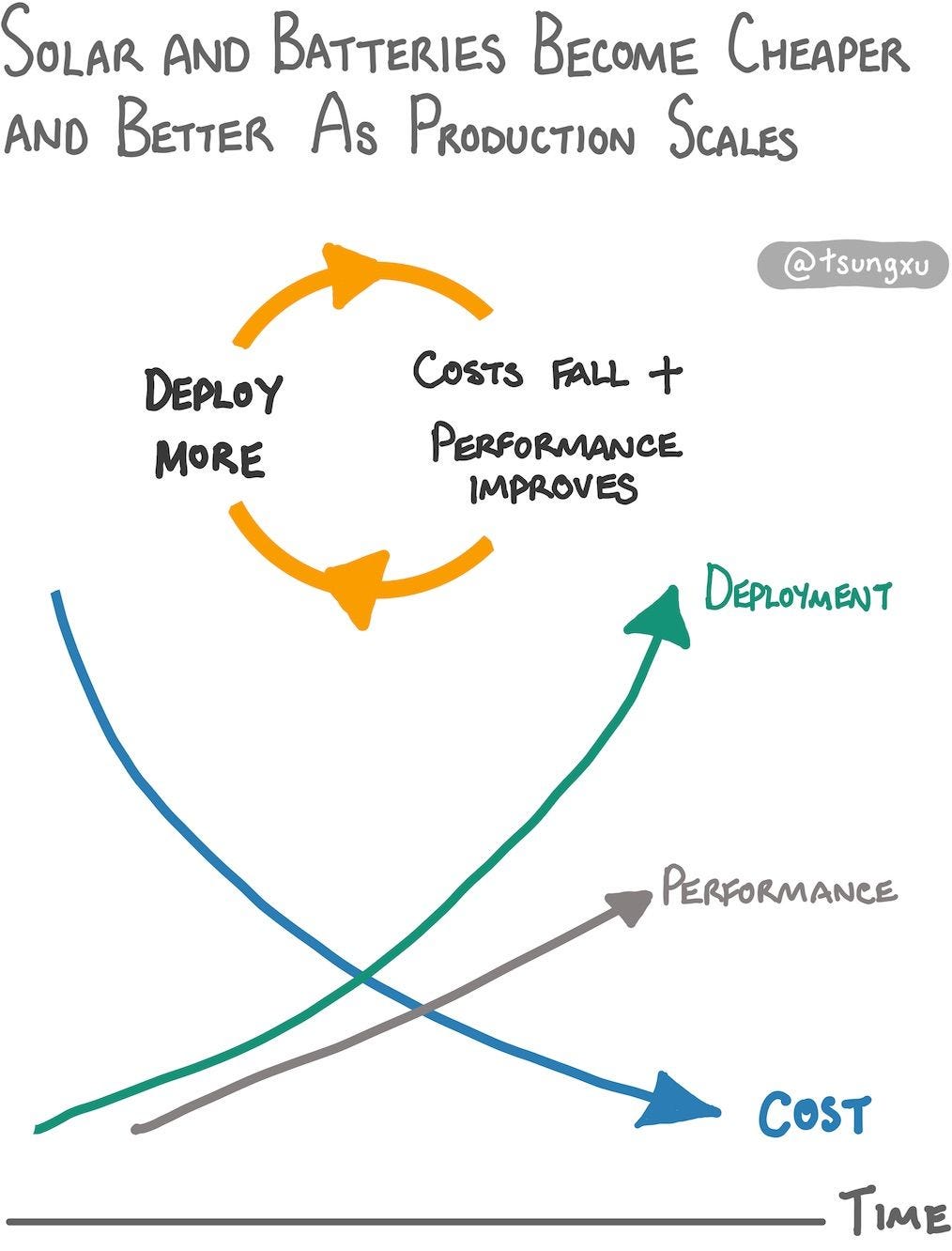

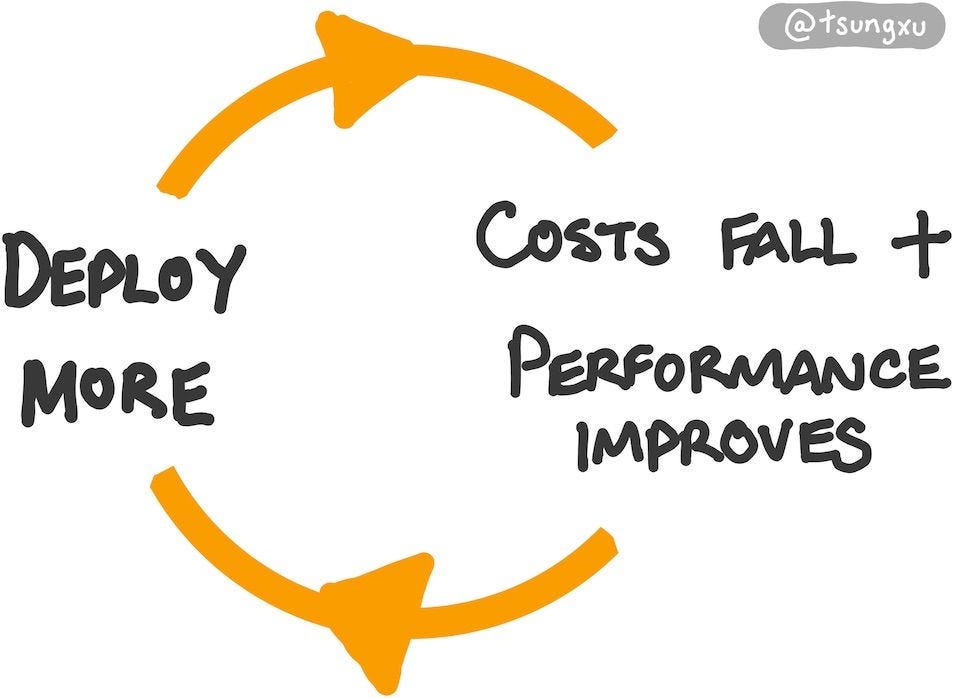

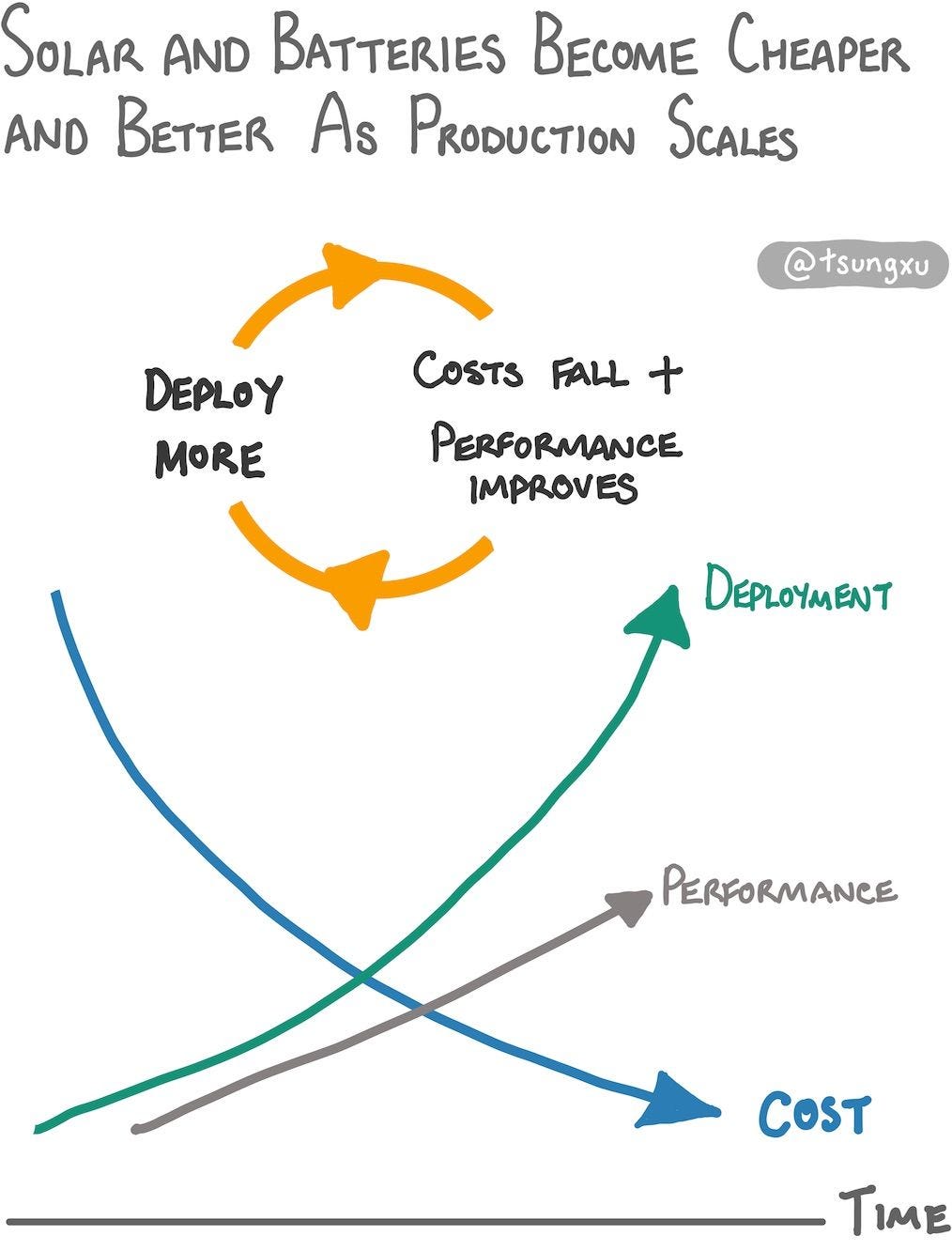

We can manufacture solar panels and wind turbines to generate energy, and batteries to store it. This allows more of these resources to be deployed whilst costs fall and improving performance, shown below.

In previous energy transitions, this self-reinforcing cycle had never been sustained over multiple decades. As a result, predictions about clean energy deployments and costs have been persistently underwhelming.

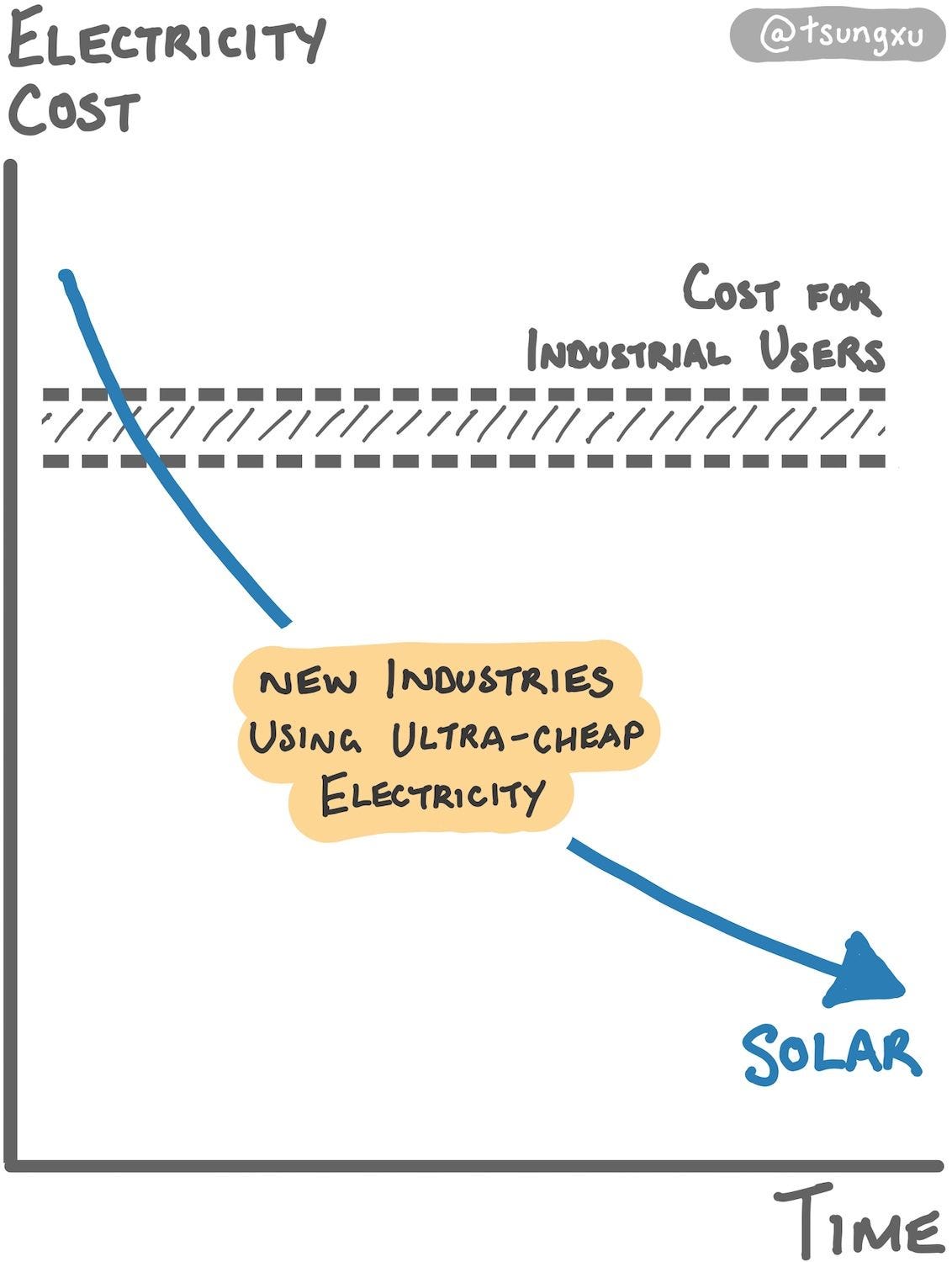

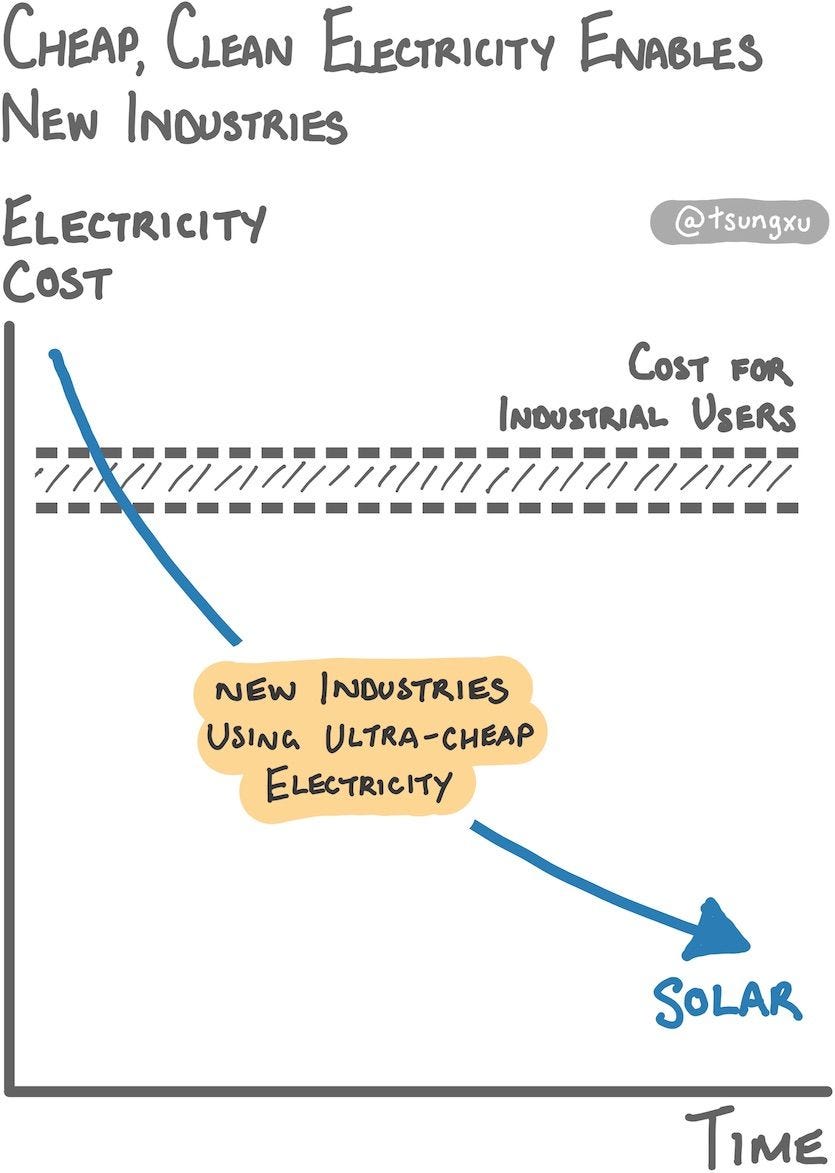

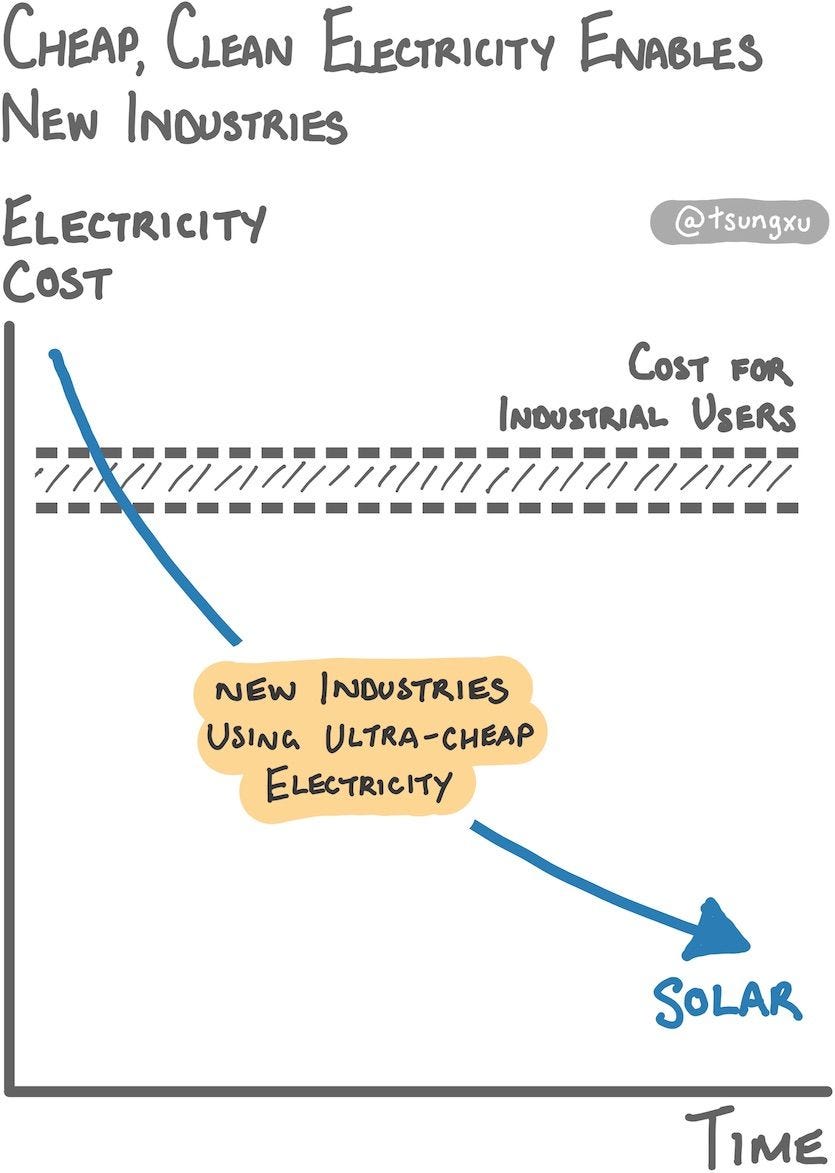

Insight 3: Cheap, Clean Electricity Enables New Industries

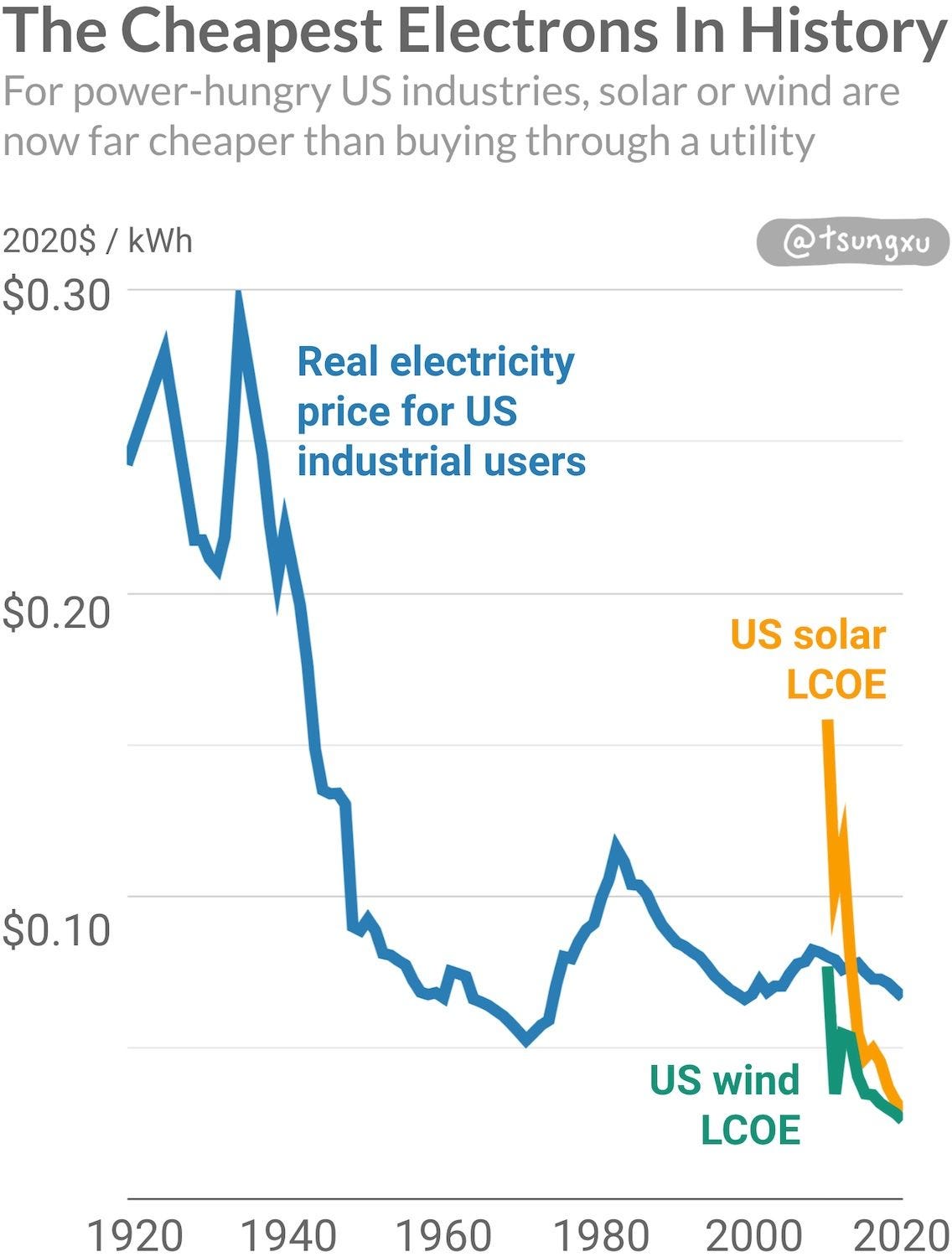

Already historically cheap, the price of electricity from solar and wind will keep falling. Solar will likely drive most of the cost reductions.

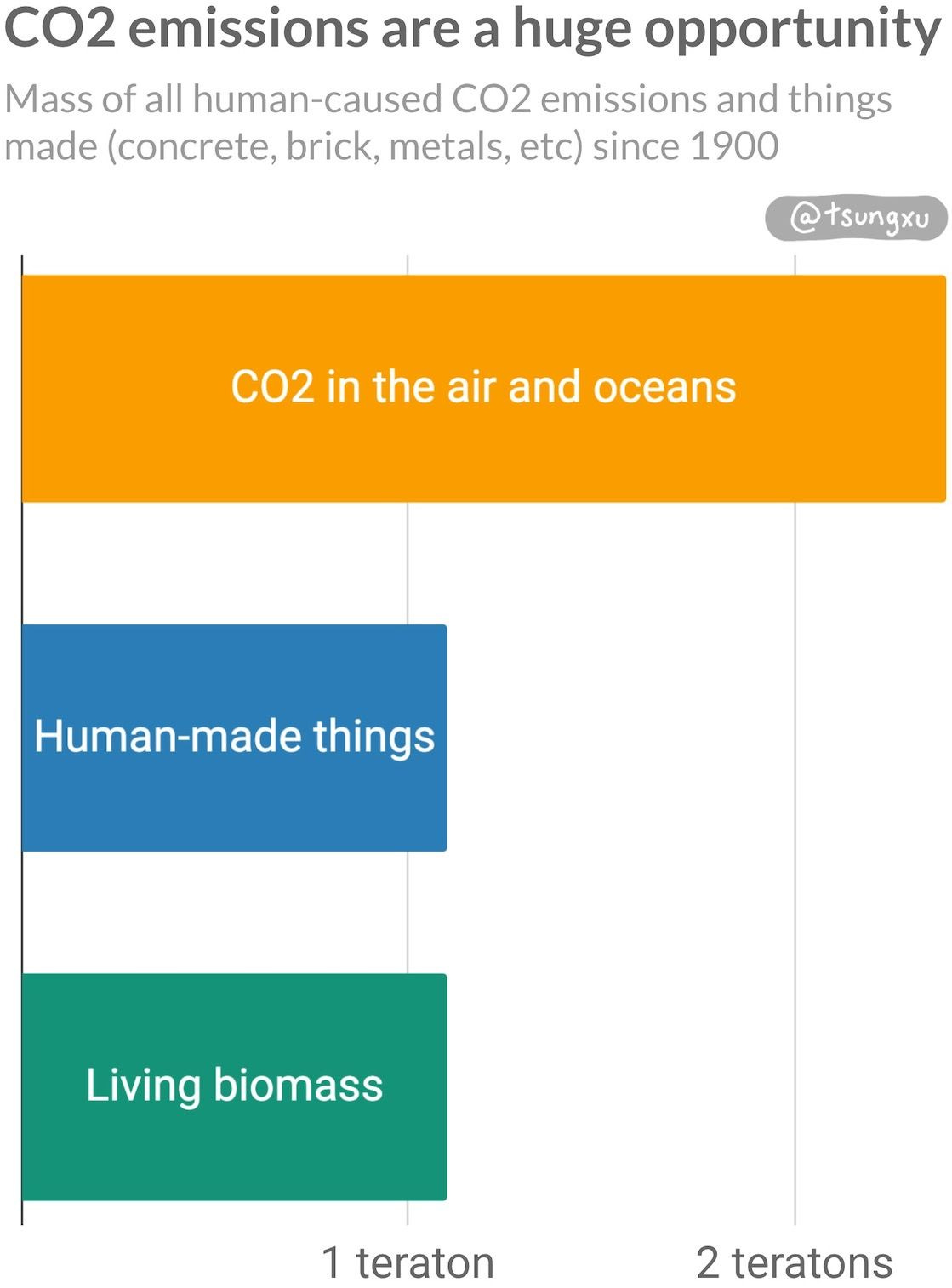

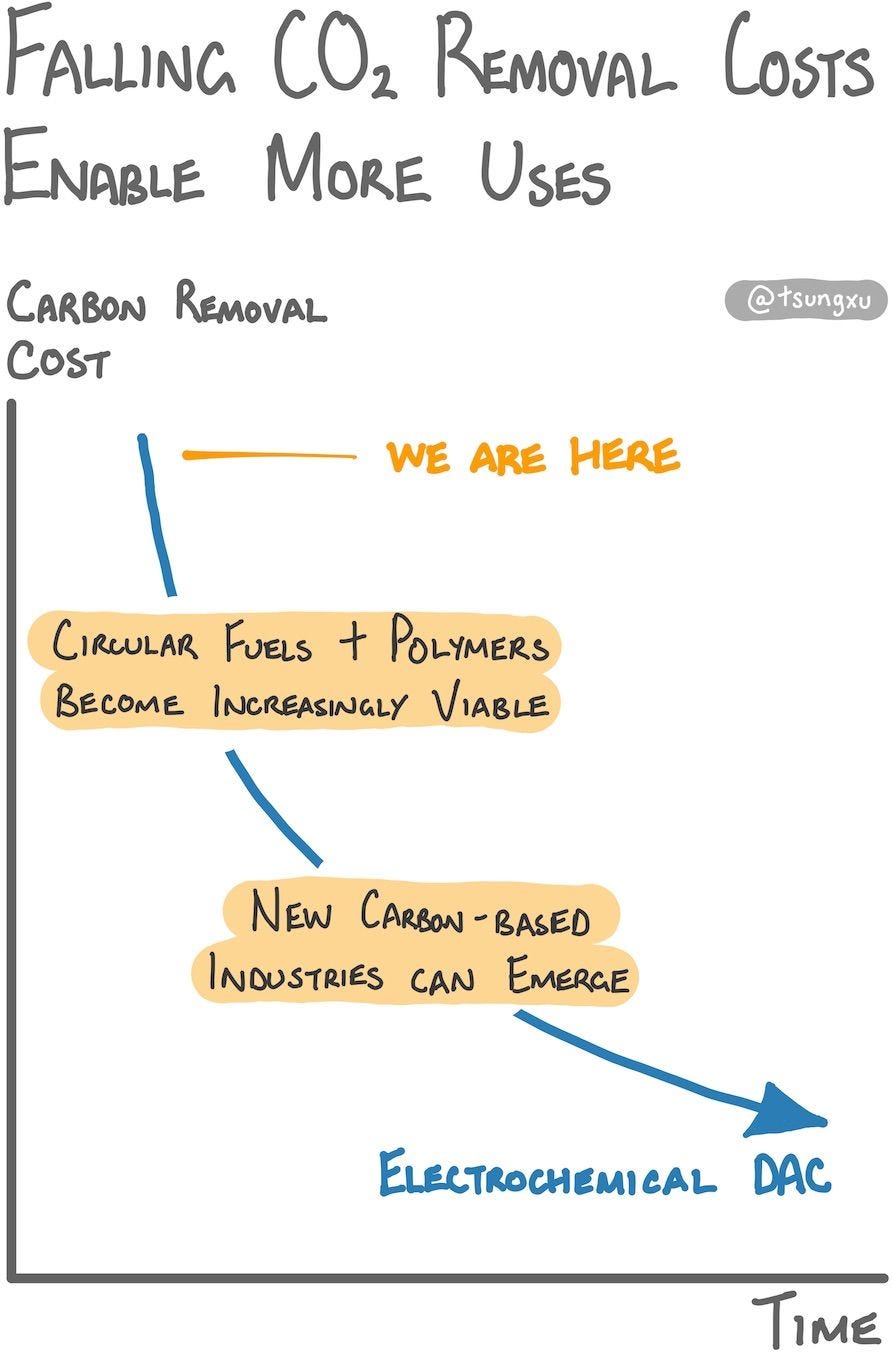

Electricity prices are becoming cheap enough for new electrochemical industries to thrive, as shown above. Emerging opportunities include electricity-driven direct air capture, and production of new materials.

We'll see later that entrepreneurs who see the speed of the energy transition are the ones building the future of it.

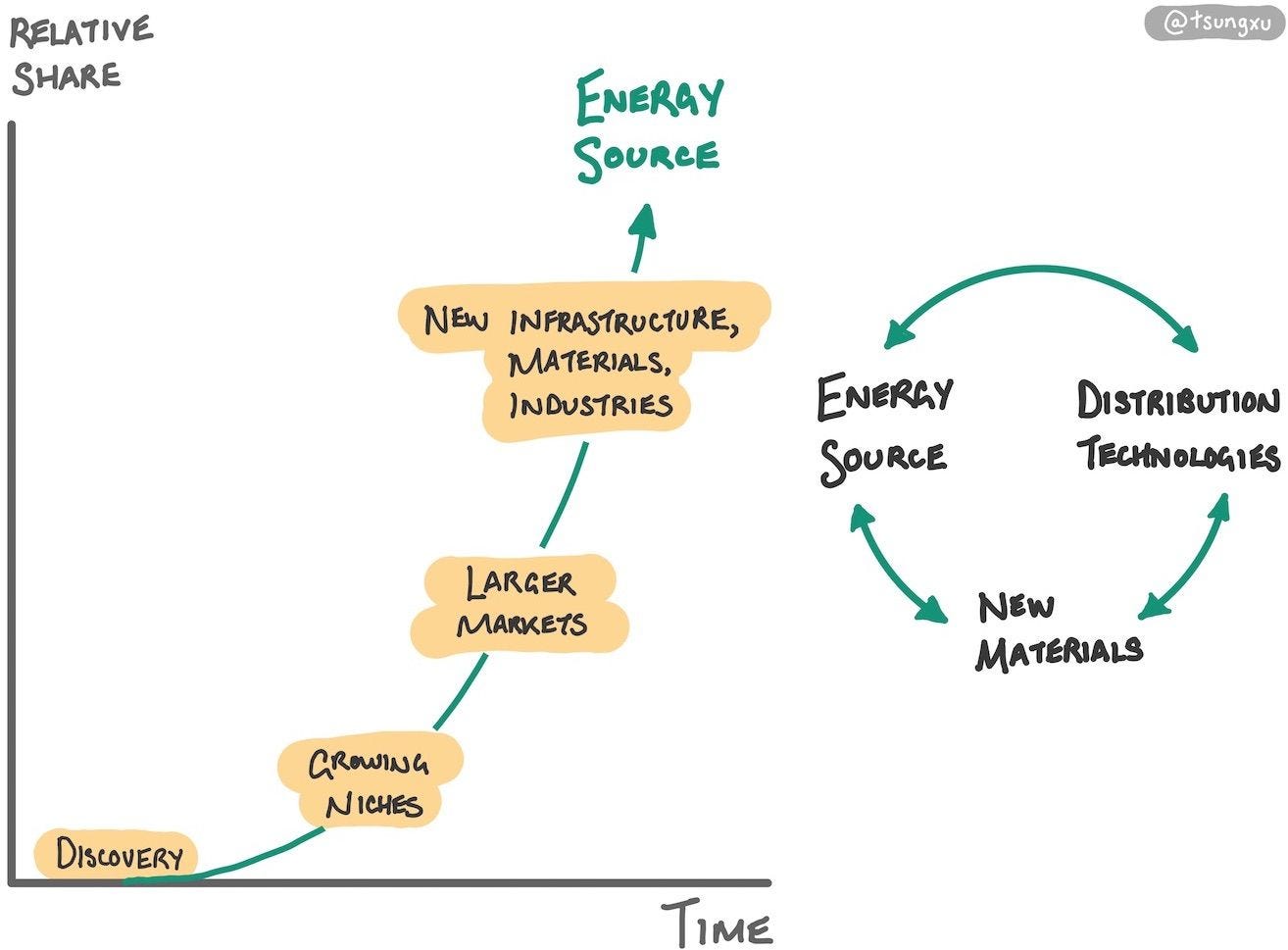

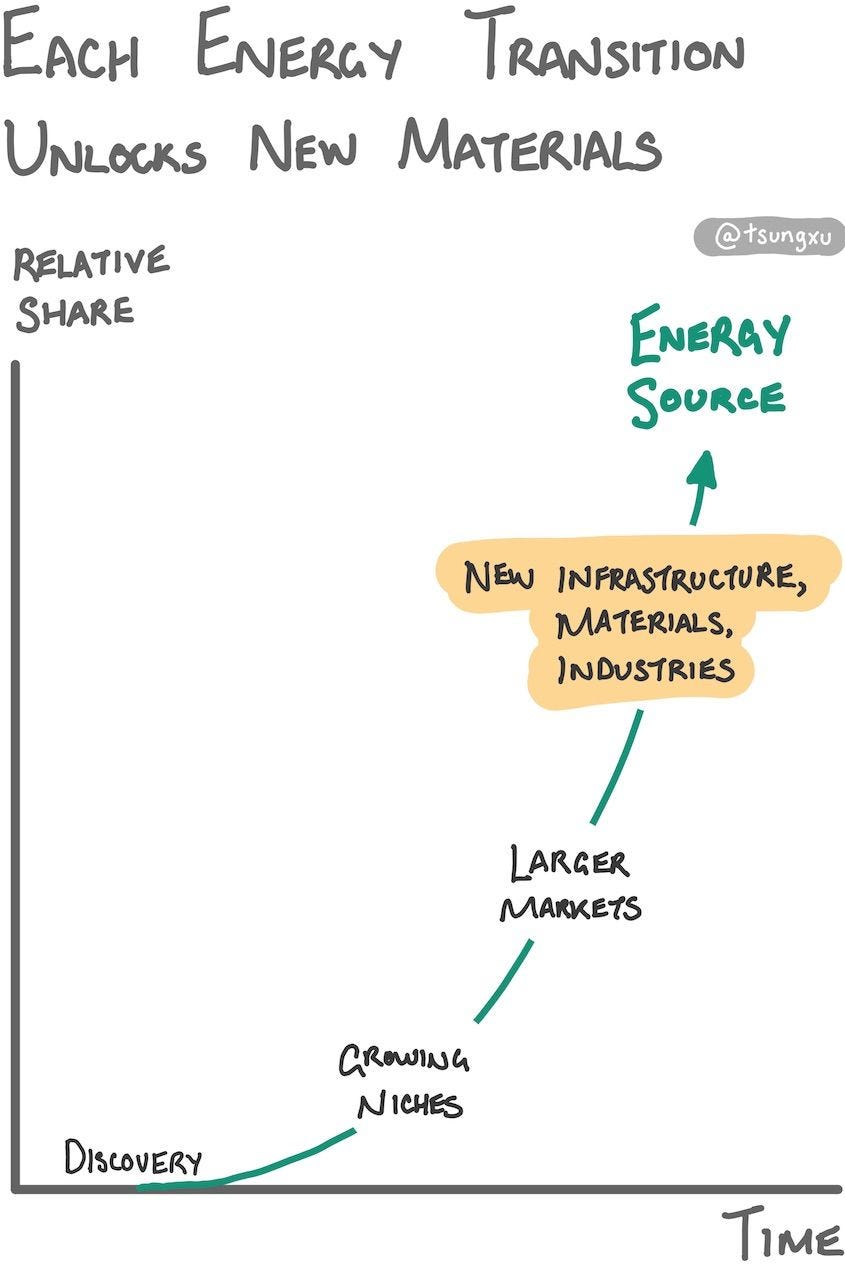

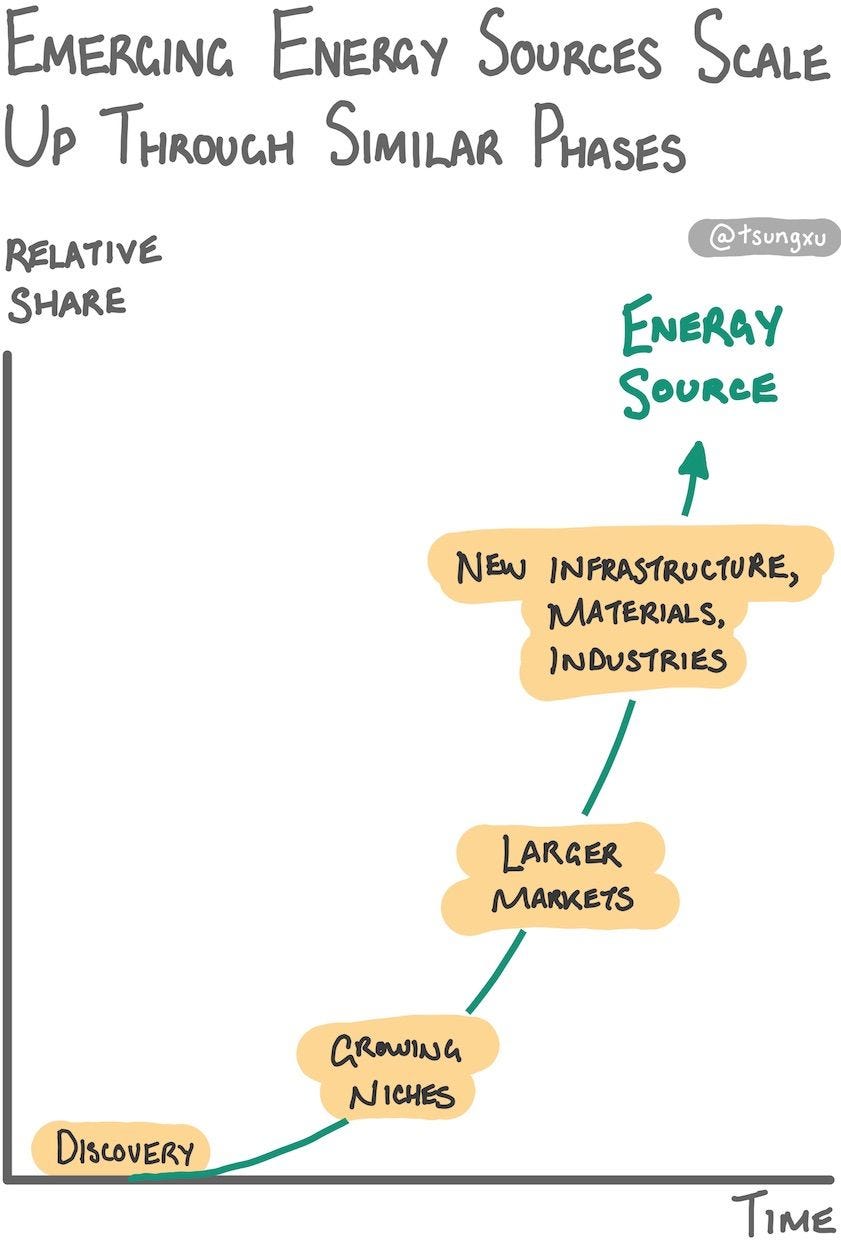

Insight 4: Emerging Energy Sources Scale Up Through Similar Phases

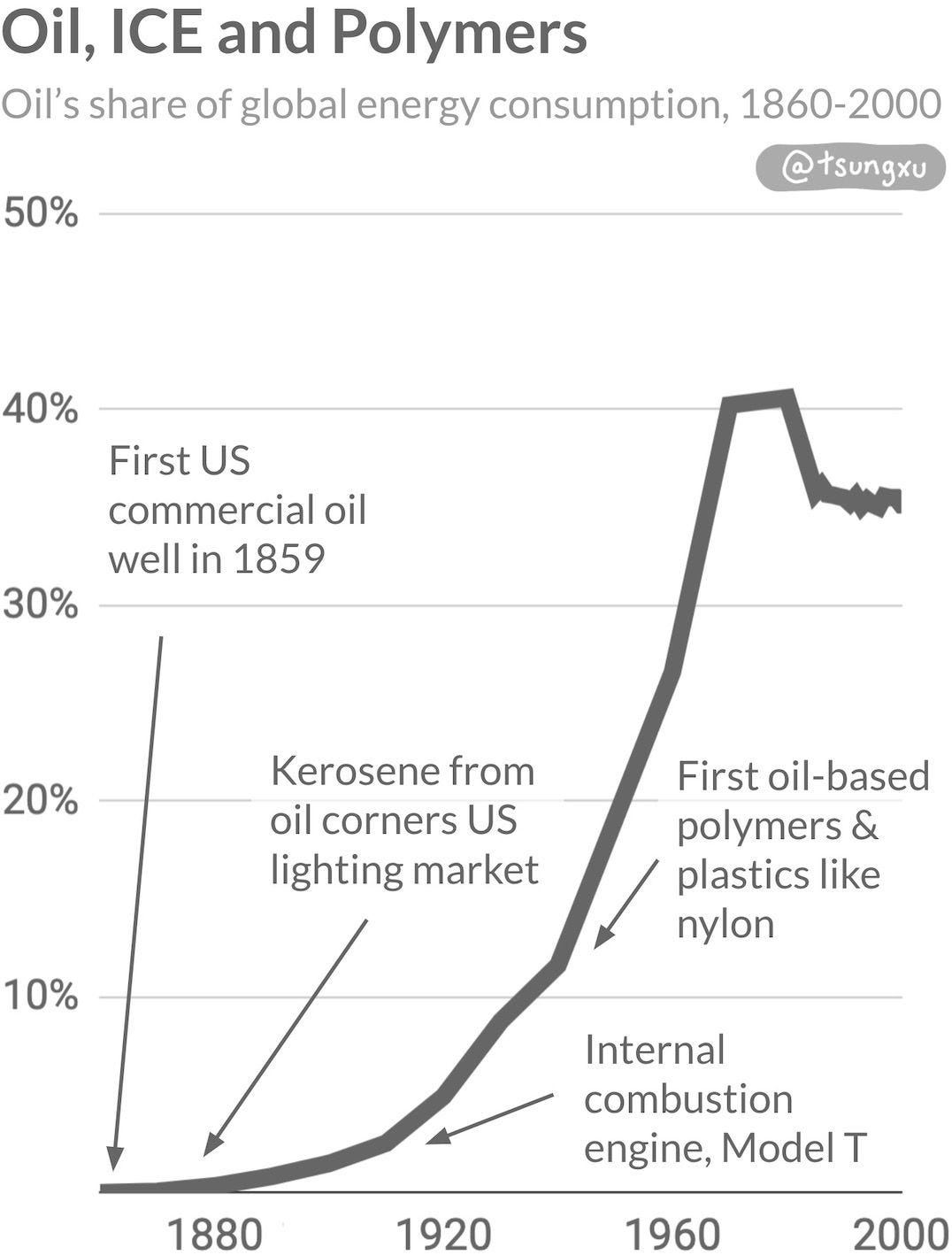

The coal, oil and electricity transitions have scaled up through similar phases, which you can see in the chart below. Today solar, wind and batteries are also scaling up through these phases.

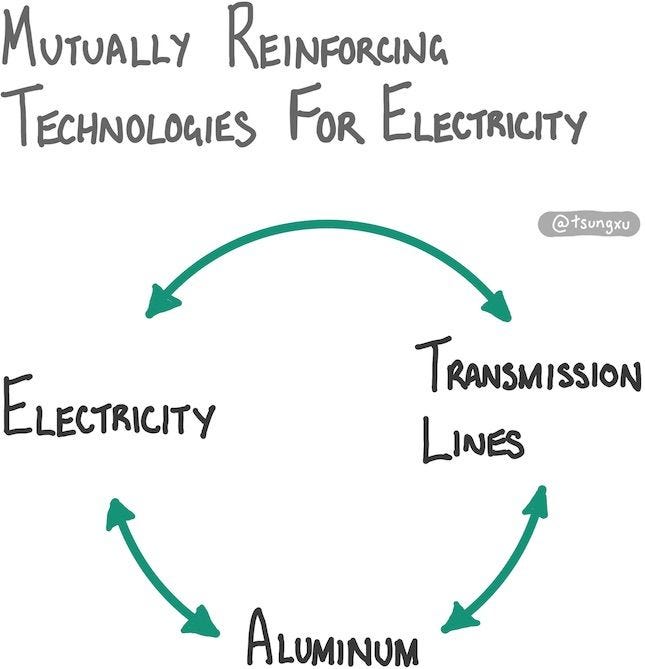

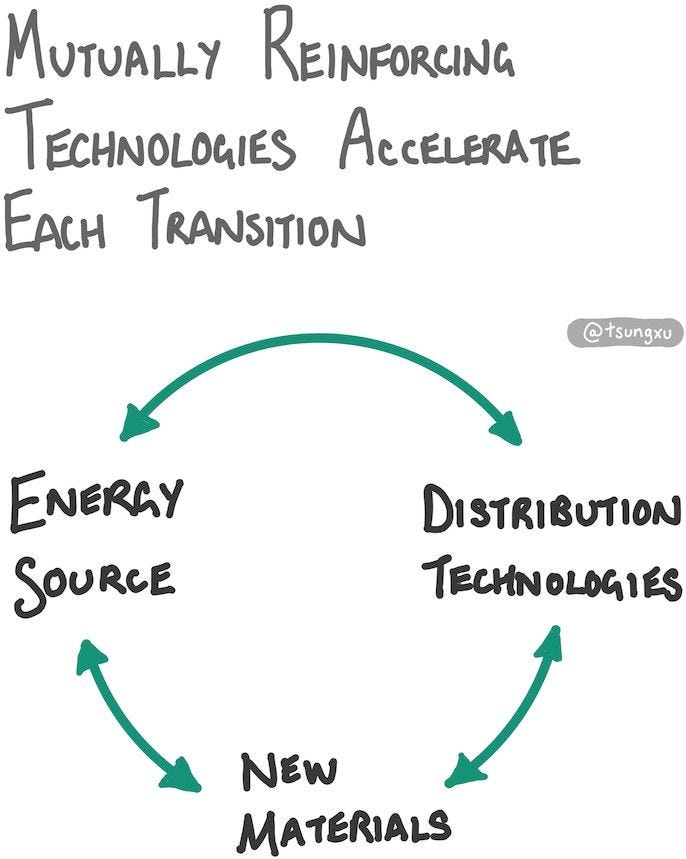

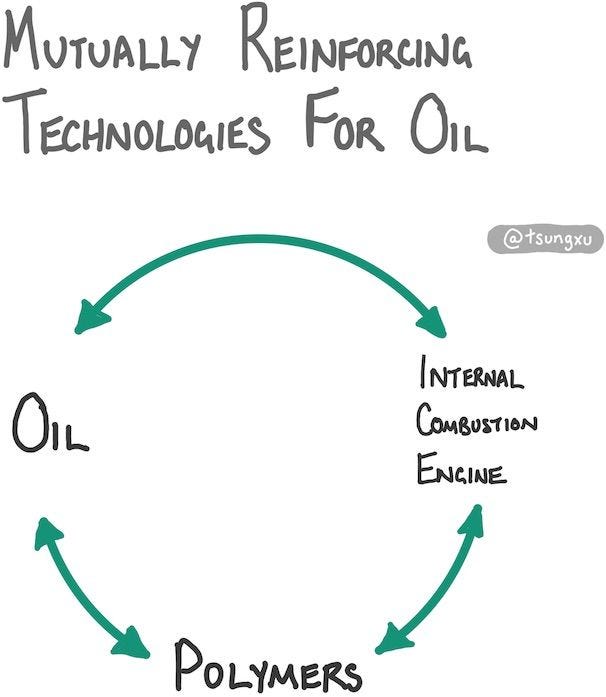

Energy sources have mutually reinforcing feedback loops with other technologies, which help to drive further adoption. For example, the internal combustion engine and petrochemicals drove more demand for oil, allowing it to gain an increasing share of global energy use in the early to mid 20th century.

These feedback loops and phases can help guide how far along we are in the transition and what opportunities are emerging.

How to read this guide

Make no mistake that this is a long read. If you are feeling motivated, just keep reading. There is an overall narrative connecting the sections, but each section is largely self-contained.

If you just want the tl;dr, that would be the key takeaways. Then, you could choose a section to dive into further using the table of contents.

Table of Contents

1) Plummeting Solar and Battery Costs Are Now At Tipping Points

2) As Production Scales, Solar, Wind and Batteries Become Cheaper and Better

1 Patterns in Previous Energy Transitions

1.1 Coal: Steam, Locomotives and Iron

1.2 Oil, Internal Combustion Engines and Polymers

2.1 Solar Adoption: Slow, Then All At Once

2.2 Falling Costs Have Opened Up Larger Markets

2.3 Solar’s Growth Keeps Being Underestimated

3 Storage: Batteries, EVs and More

3.1 LIB Adoption Is Even Faster Than Solar

3.2 EVs Are Rapidly Replacing ICE Cars

3.3 LIB and EV Producers Outpacing Tech Giants’ Growth

3.4 Storage For Grids Is Booming

3.5 Home Energy Storage: Three Approaches

4 As Energy Becomes Even Cheaper…

4.1 Electricity Prices Had Been Stagnant, Until Solar and Wind

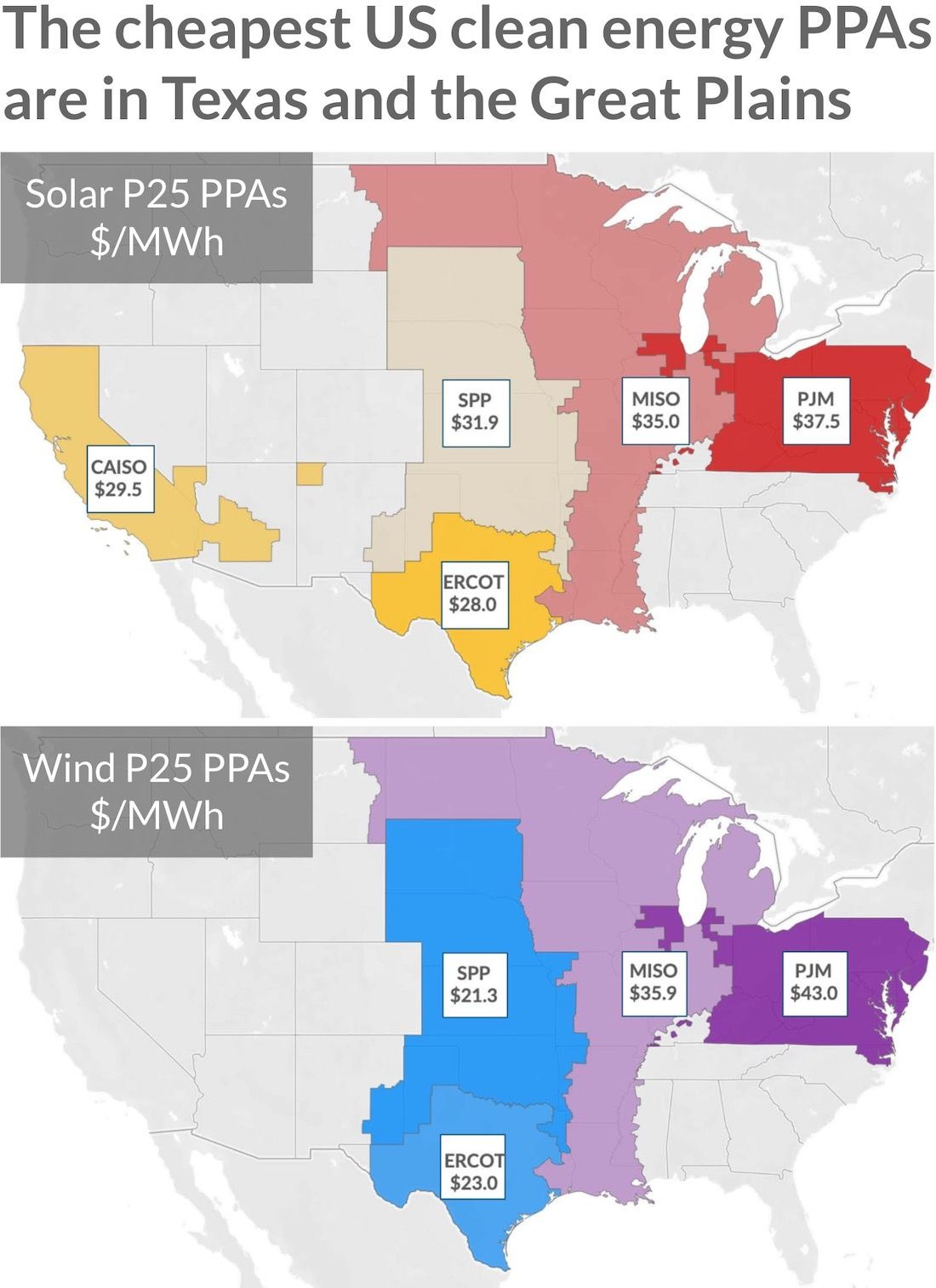

4.2 Lowest Prices In Sunbathed and Windy Regions

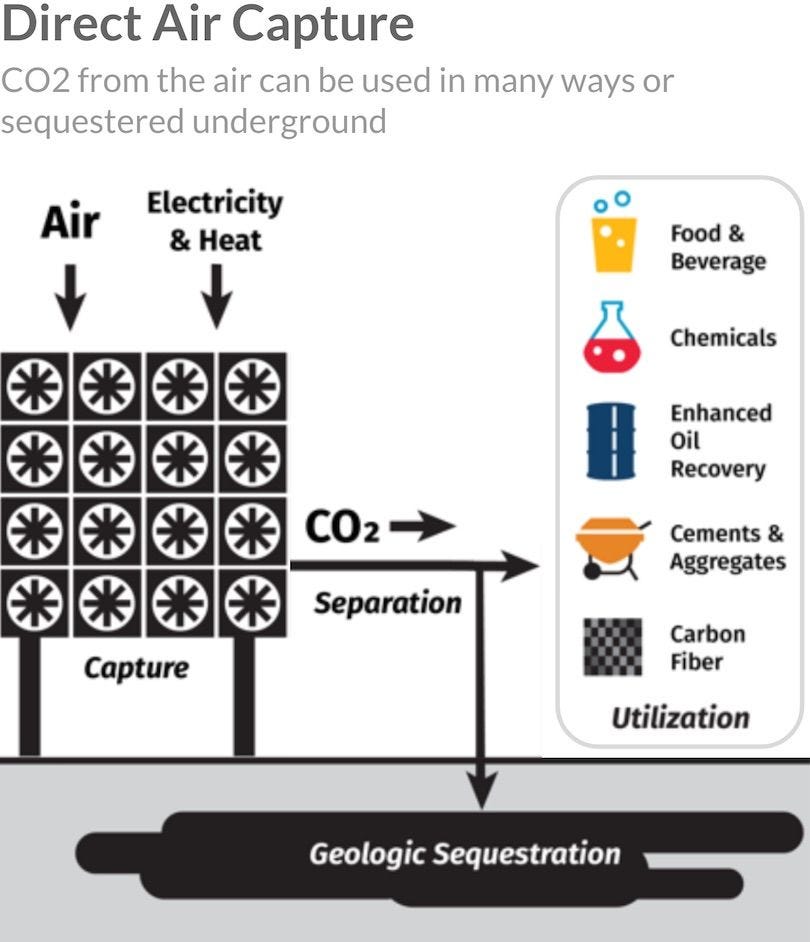

5 Opportunity: Removing & Using CO2

5.1 Negative Emissions Derisk Climate Scenarios

5.2 Direct Air Capture Is A Promising Approach

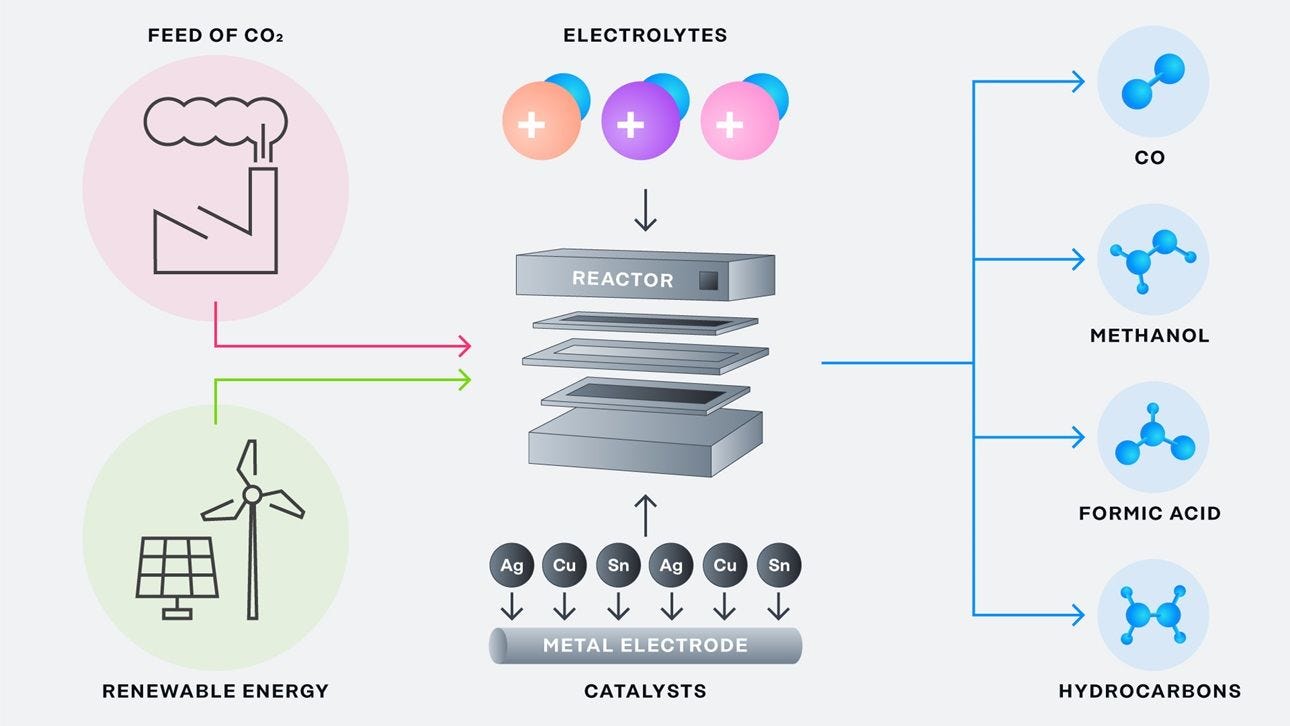

5.3 Clean CO2 to “X” May Outcompete Fossil Fuels

5.4 Existing Markets: CO2 As End Product

6 Opportunity: Emerging Materials

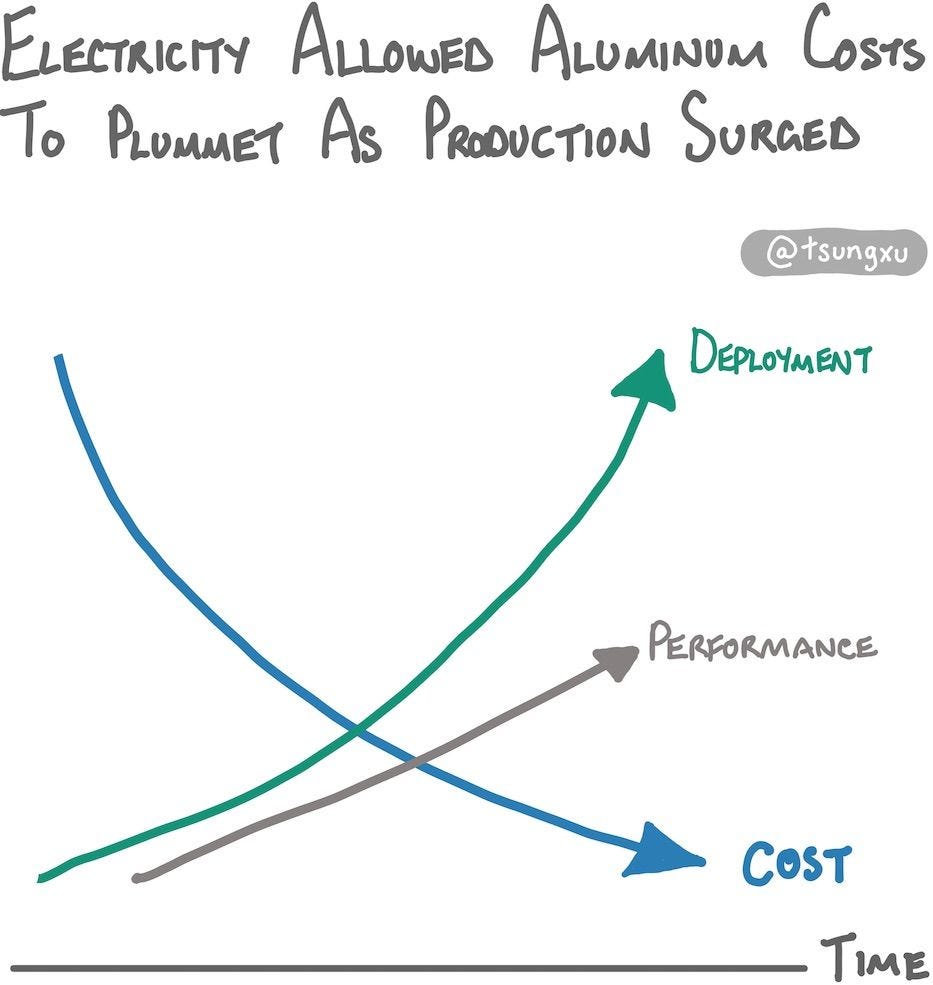

6.1 Low-cost Electricity Allowed Aluminum To Scale

8.1 Insanely cheap solar, wind and storage power almost everything

8.2 EVs of all types and are taking over transportation

8.3 Battery storage is everywhere, but in EVs above all

8.4 Most existing industries are electrified, all are low-carbon

Motivations

Energy (and climate) is an incredibly exciting and impactful problem space to be working on.

This space tackles two things in my mind. One is the risks of climate change, where we all should try to avoid the worst outcomes. Two is the continuing progress in energy technology, without which human progress could stagnate.

For over a year, I have been learning about the clean energy transition. I spoke to dozens of clean tech founders and engineers and absorbed books, research reports, papers, podcasts and countless articles.

Two things became clear.

First, solar and lithium-ion battery technologies were the core of the energy transition. Their rapid pace of adoption and dramatic cost reductions was unprecedented for energy technologies.

Second, very few insiders I talked to or learned from seemed to think solar and batteries would be as impactful as I was starting to think.

Was I wrong? I get that there are a plethora of technology, implementation, policy and other problems. Would these put the brakes on the path to a clean, cheap energy future?

As I continued my research, I gathered more data points and conviction that clean energies would be incredibly impactful.

When I was researching, I did not come across an article like this, but it would have really helped me orient myself. I hope this piece can help as a guide for at least a few people who are curious about the transition and where it could be going.

In writing this, I aim to find fellow tinkerers and builders who see the opportunities and may want to discuss and test ideas together.

Why The Clean Energy Transition Is Underestimated

It’s hard for us to fathom what we’ve never lived through. Few people alive today witnessed previous energy transitions happen. This makes it easy to underestimate how impactful they were, and how quickly they tend to happen once in motion. After all, the rise of coal, oil and electricity each happened over one hundred years ago in developed countries.

As almost no one alive had lived through the Spanish Flu one hundred years ago, COVID showed us how short our collective memory usually is for rare events of planetary scale.

It’s easy to think that the rapid scaling of solar, wind and battery technology cannot be sustained. Each transition goes through growing pains. But when there’s insatiable demand, industries find ways to meet it. That was the case for coal, oil and electricity as we’ll see, and it is the case today for cheap, clean energies.

There's the related concern that the decades-long cost reductions for solar and batteries will flatten out. As we'll cover, this is very unlikely. Existing technology and processes will keep improving and new technologies will be commercialized.

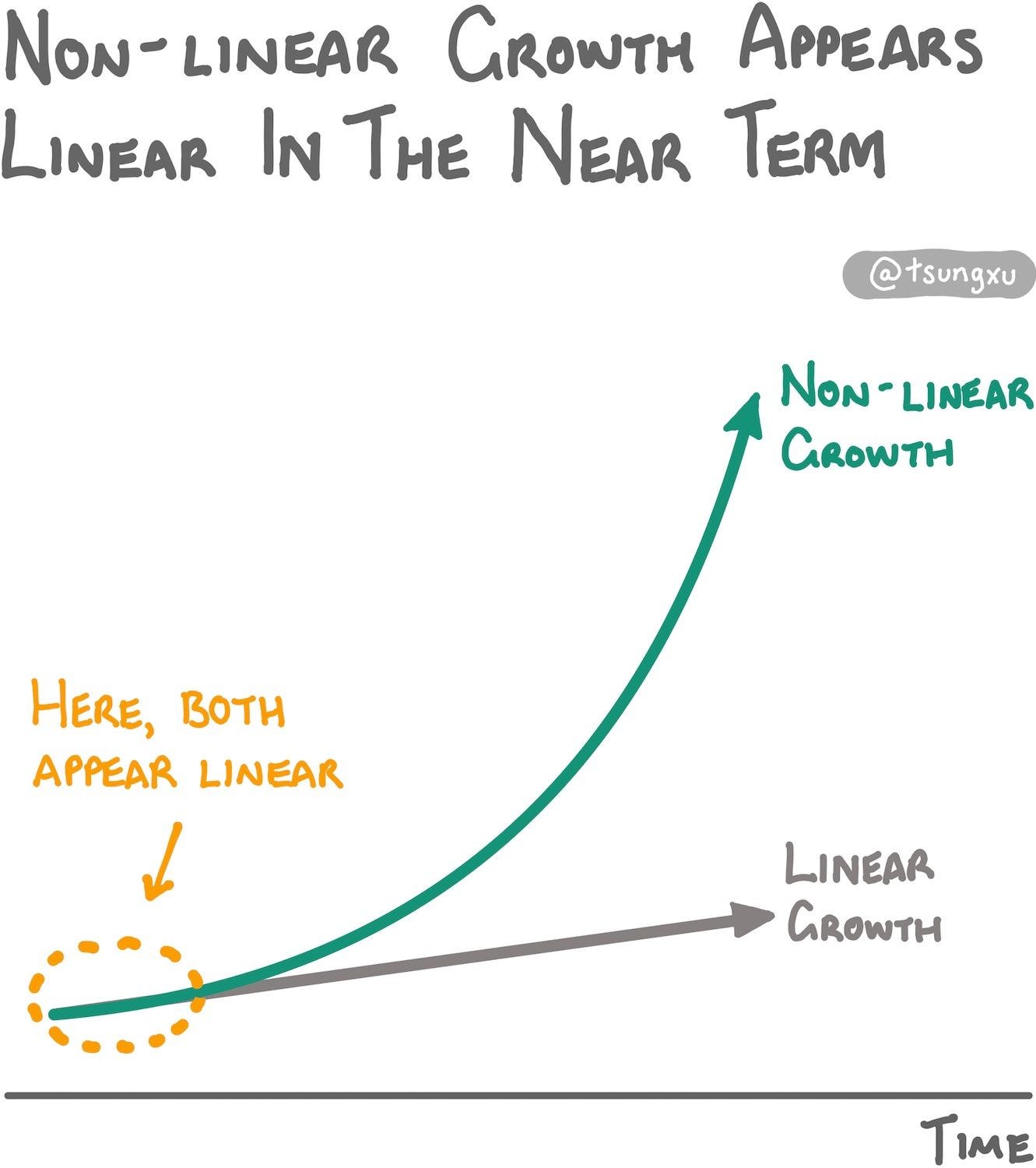

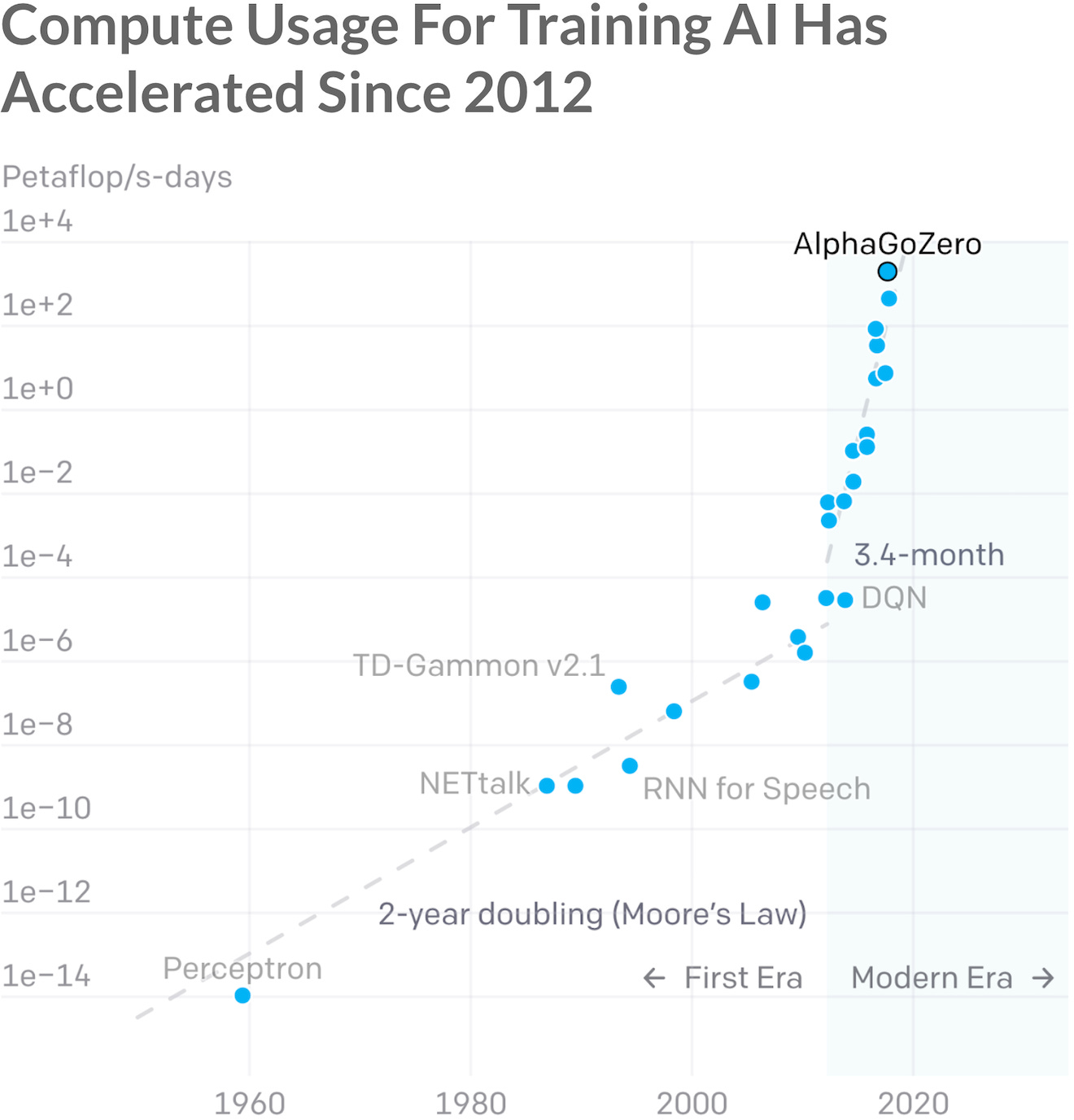

It’s hard to think about technologies and change as being non-linear. Let's show this with an example. Suppose you start with one grain of sand. Say that this one grain duplicates every year. How many years would it take for this one grain to replicate into the total number of sand grains on Earth? Assume there's 7.5 billion billion (7.5 x 10^18) grains of sand in the world.

What's your guess? 10,000 years? 1,000? It takes less than 63 years or doublings. If the lone sand grain duplicates every two years (ie grows at 41.4% per year), it only takes twice as long to hit that mark. These examples seem extremely counterintuitive, but it’s hard for people to think in this way. Those with startup experience tend to better grok non-linear thinking, as initial traction and growth are everything.

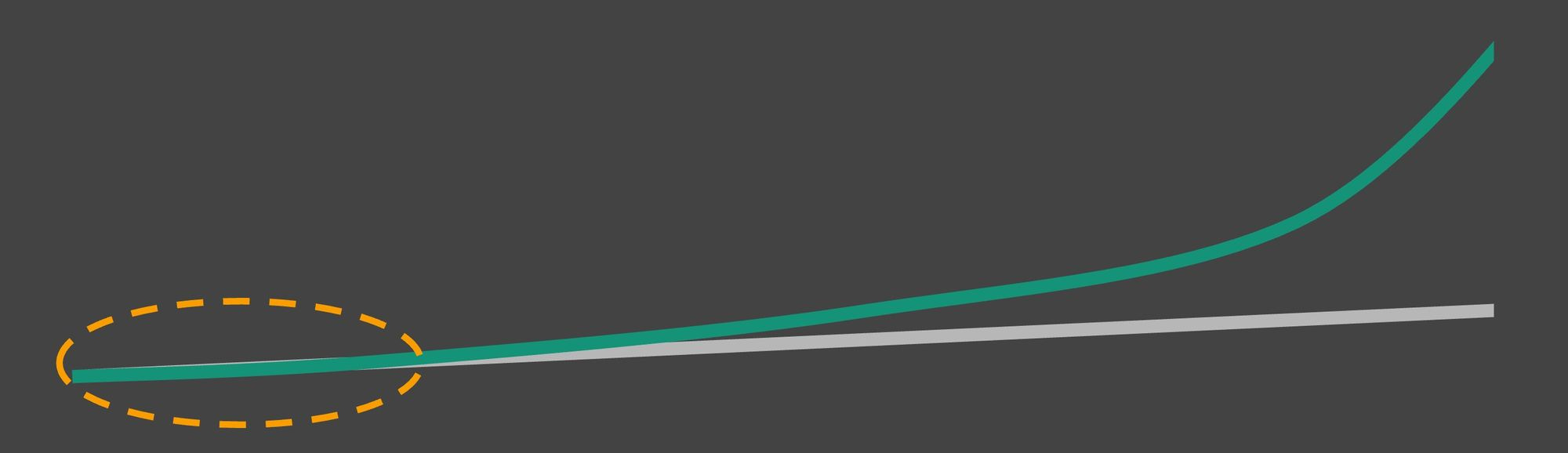

Solar, wind and batteries have grown and will continue to grow for some time like this. The problem is that over a few-year short time horizon, accelerating growth looks deceptively linear, as shown here.

Solar has grown at an average of almost forty percent every year since 1976, when good data began. From the sand grains example, you might recognize that this is a near doubling every two years. How much do you think installed solar capacity has scaled up since then? By over two million times. Of course, these growth rates will slow as we move up the S-curve. But already, we have installed enough solar to be only about a factor of 15 away from it being the primary generating source of electricity globally.

In our time, there’s a perception that we cannot quickly scale products made of atoms as fast as those of bits. Conventional wisdom holds that software scales better than hard tech. As we’ll see, this perception is not true, as some physical products in clean tech industries are scaling very, very fast.

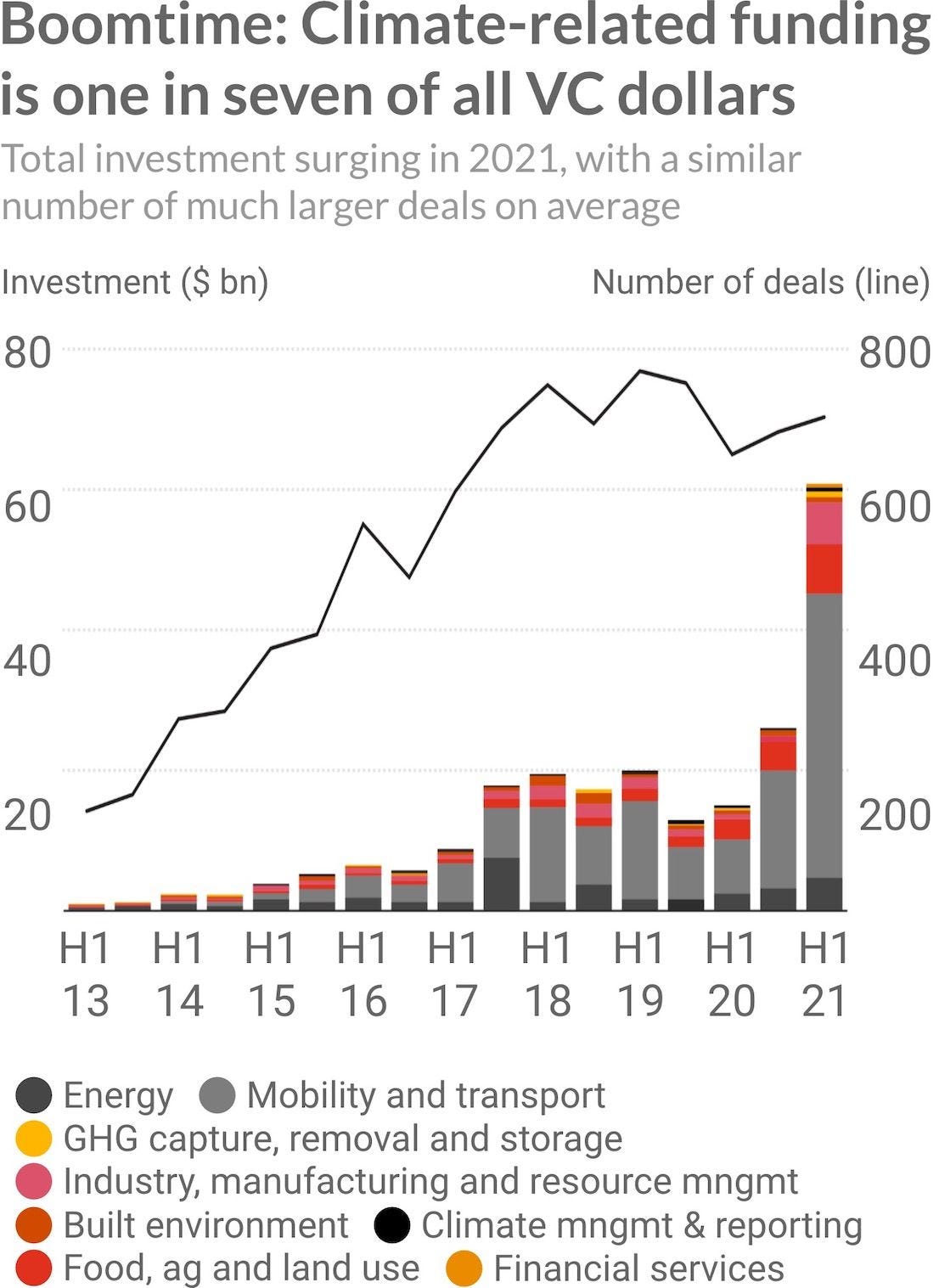

This view probably stops many bright and driven people in developed countries working on deep and hard technologies. However, there are promising signs though that more people are looking to work in clean energy and climate.1

Key Takeaways

Let’s take a closer look at the four headline insights from the introduction.

1) Plummeting Solar and Battery Costs Are Now At Tipping Points

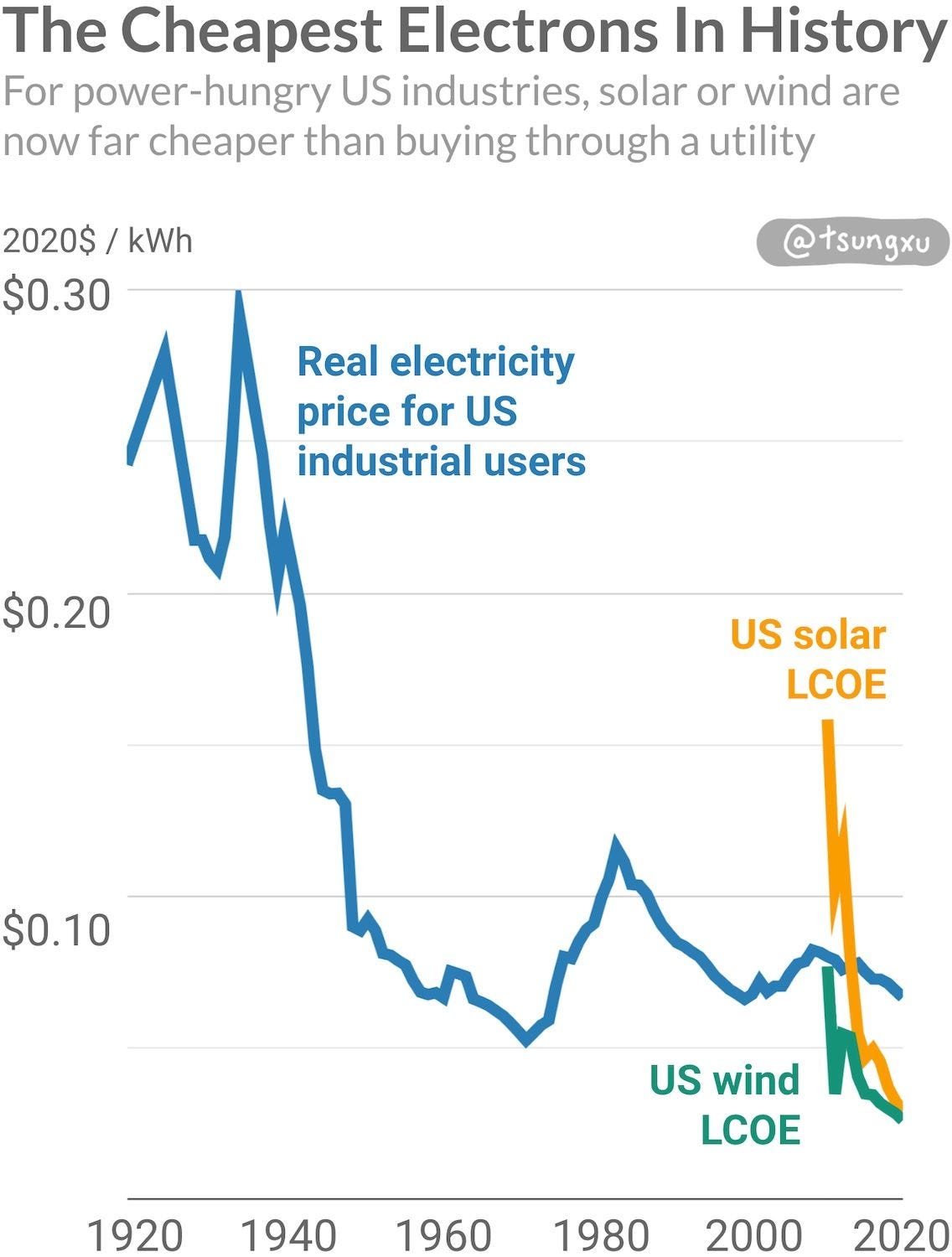

Solar has already become the cheapest energy source in history, alongside wind. Since 1976, solar costs (in dollars per watt) have fallen an average of over 12% per year.

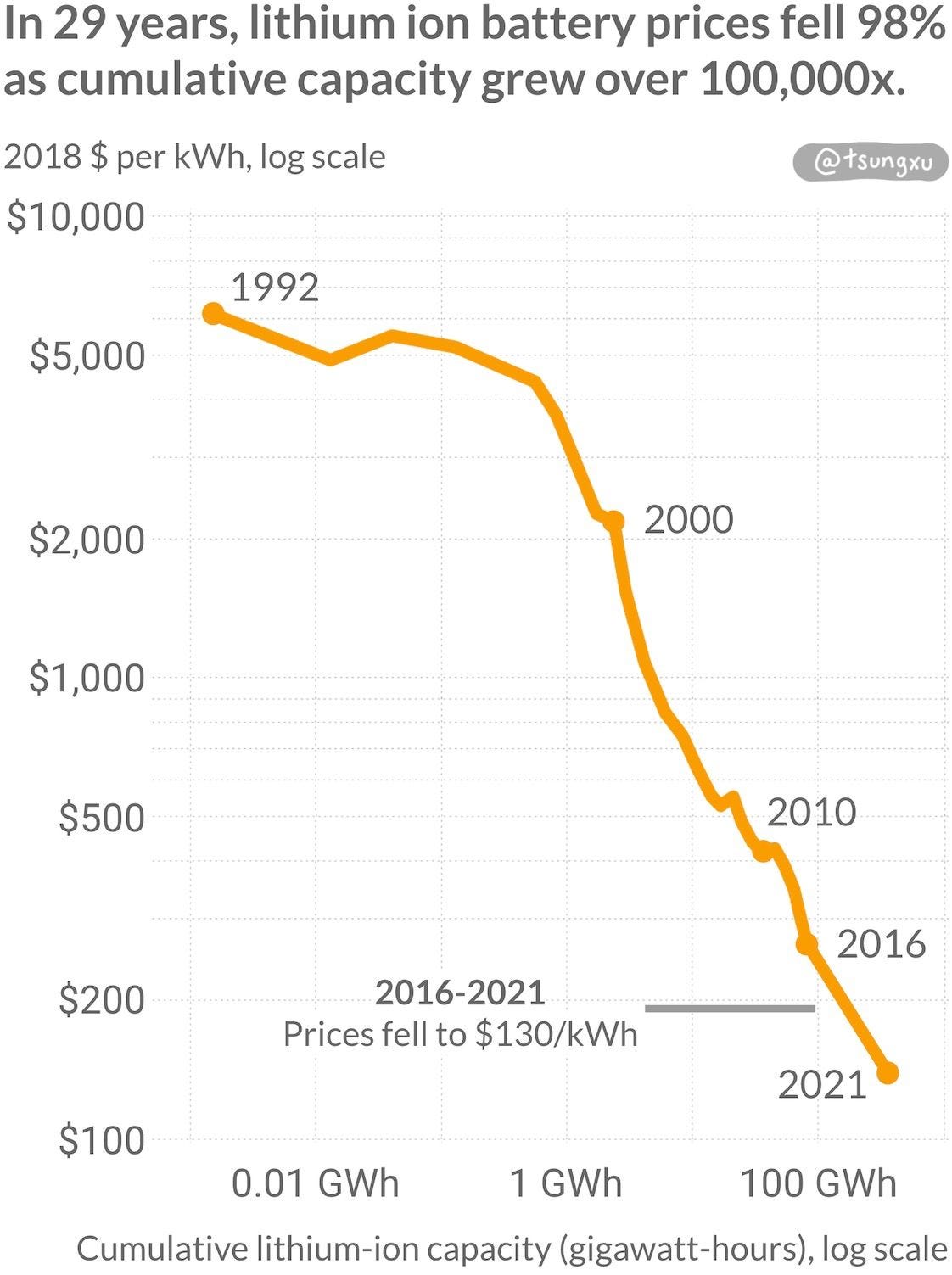

Since first being commercialized in 1991, lithium-ion batteries costs (in dollars per kWh) have fallen a similar 12.9% per year on average.

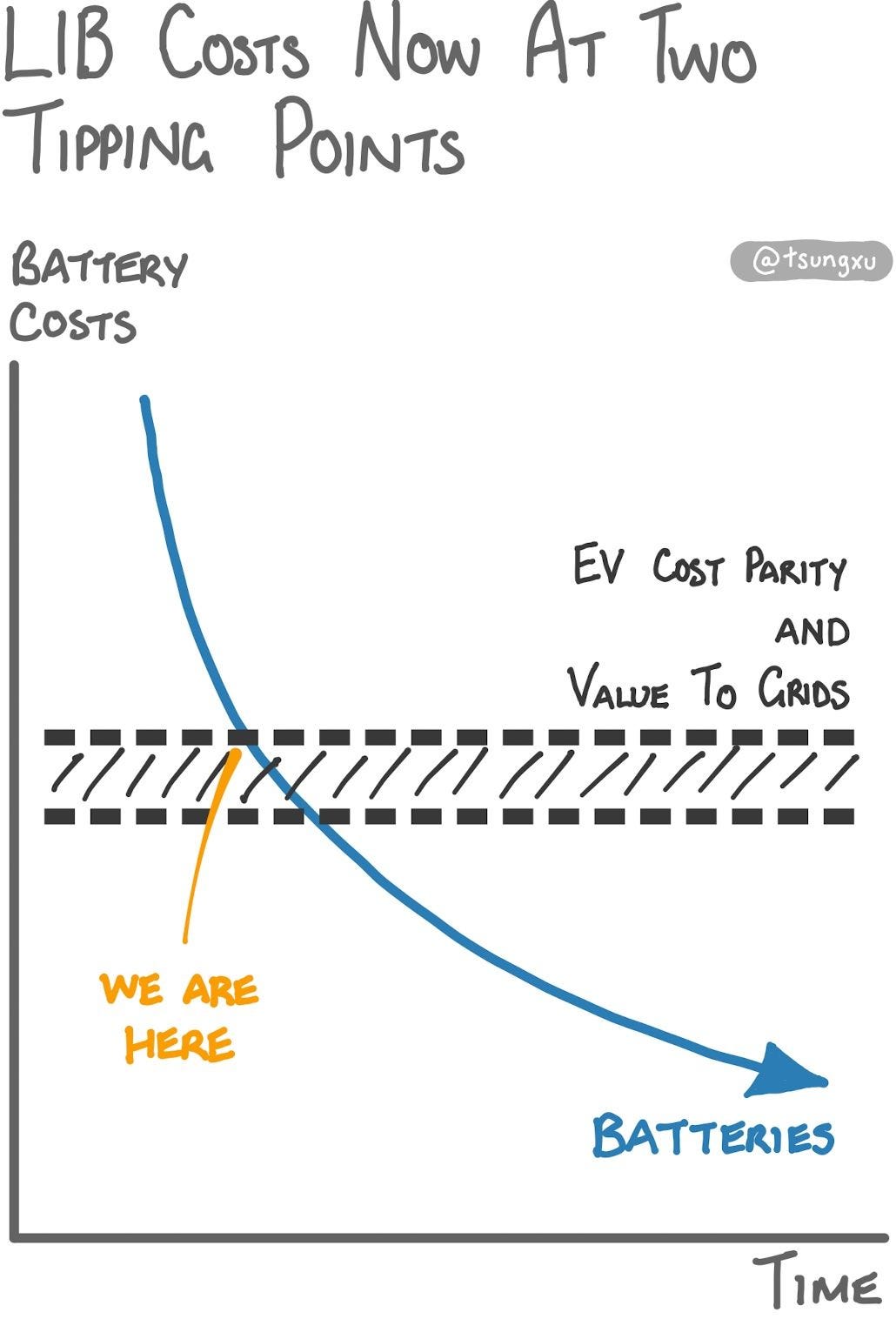

These falling solar, wind and battery prices have recently hit tipping points that will drive continued growth.

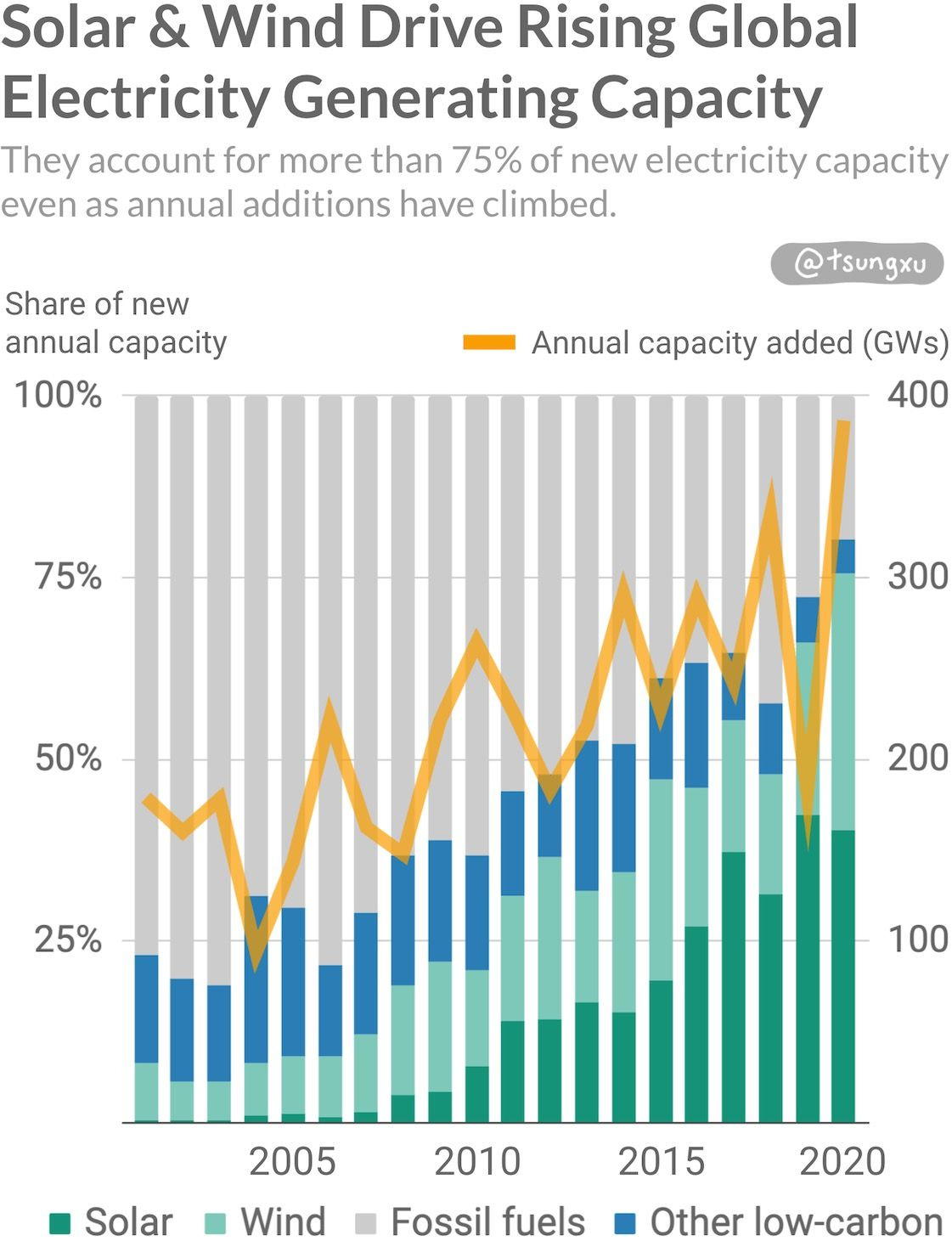

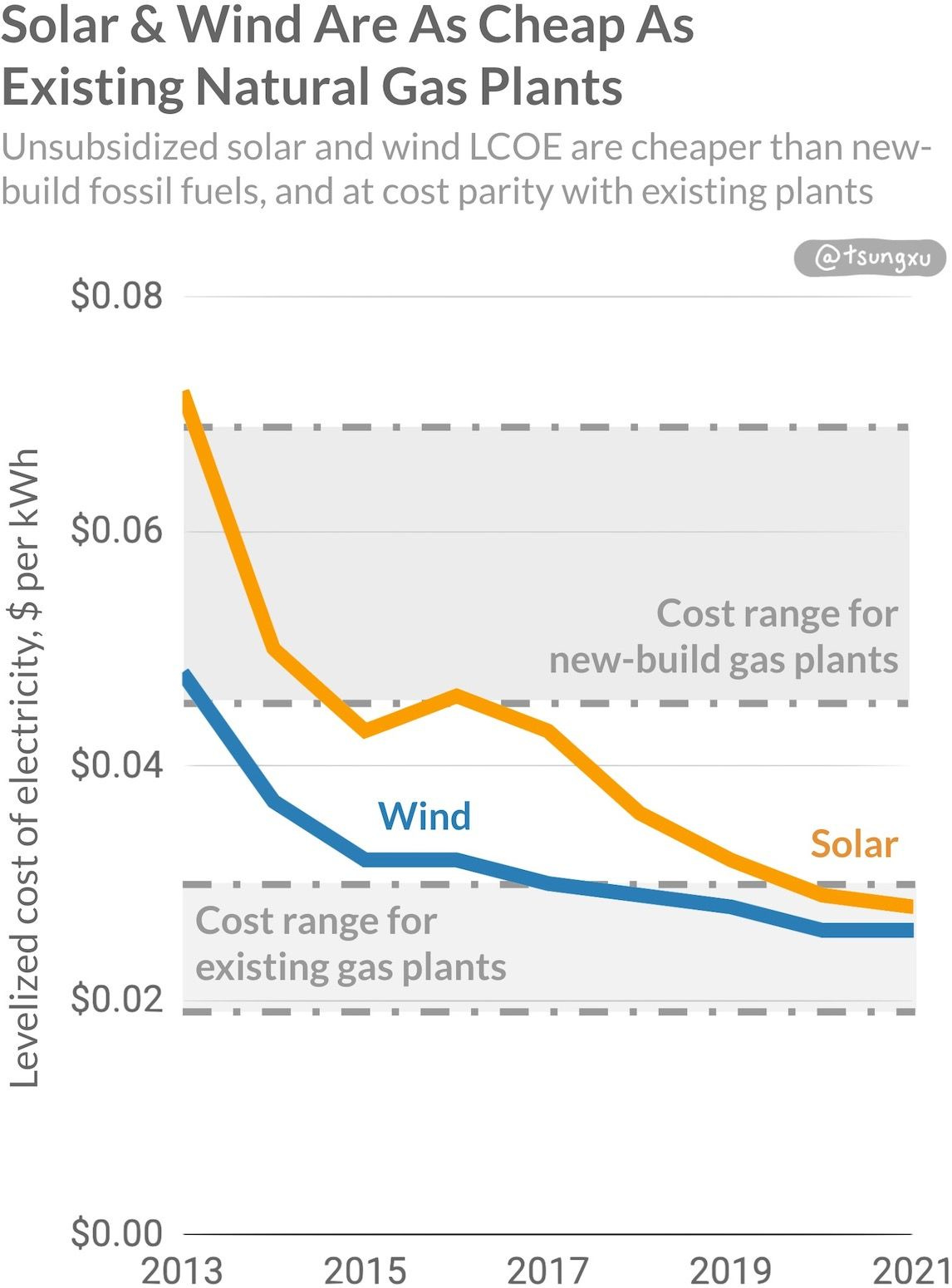

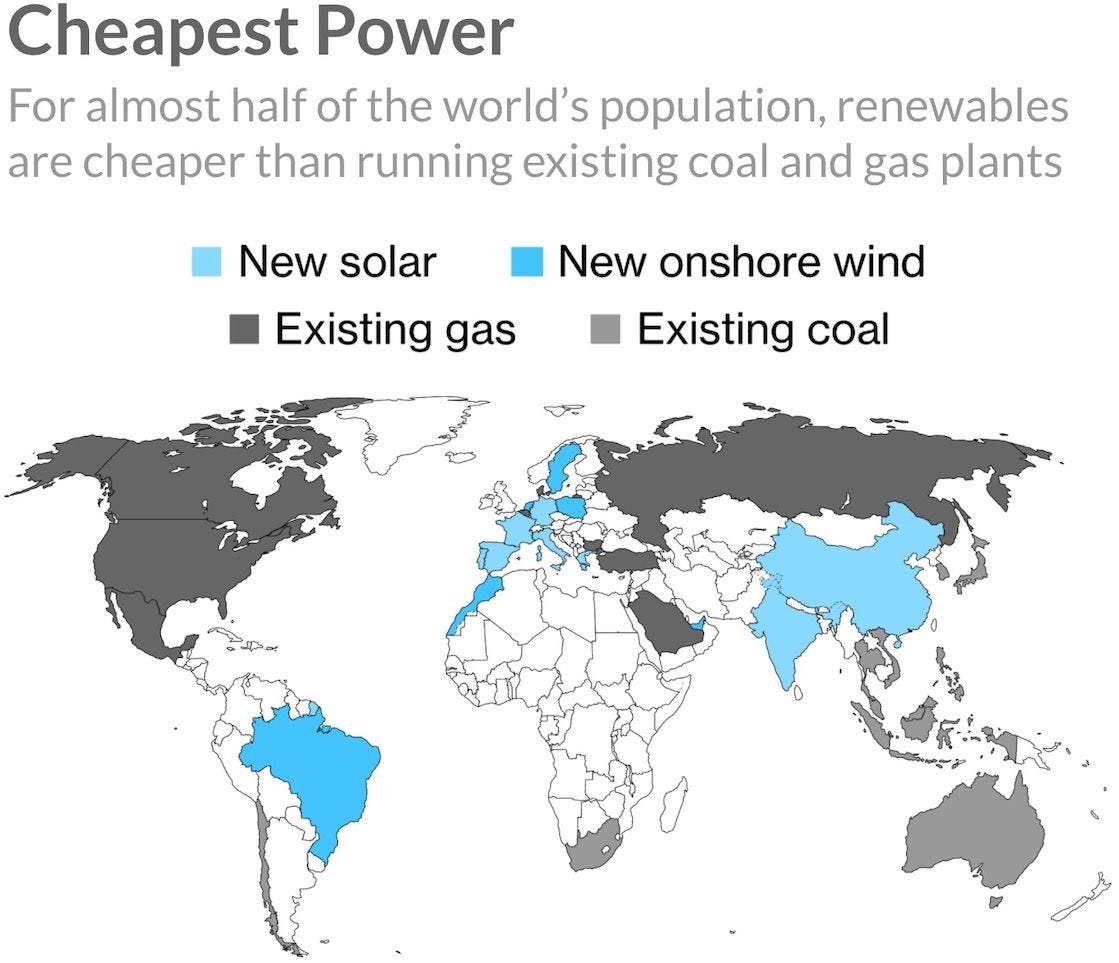

The cost of solar or wind-sourced electrons are now cheaper than running existing fossil plants in many parts of the world. This is a tipping point that substantially grows the market size for solar and wind power.

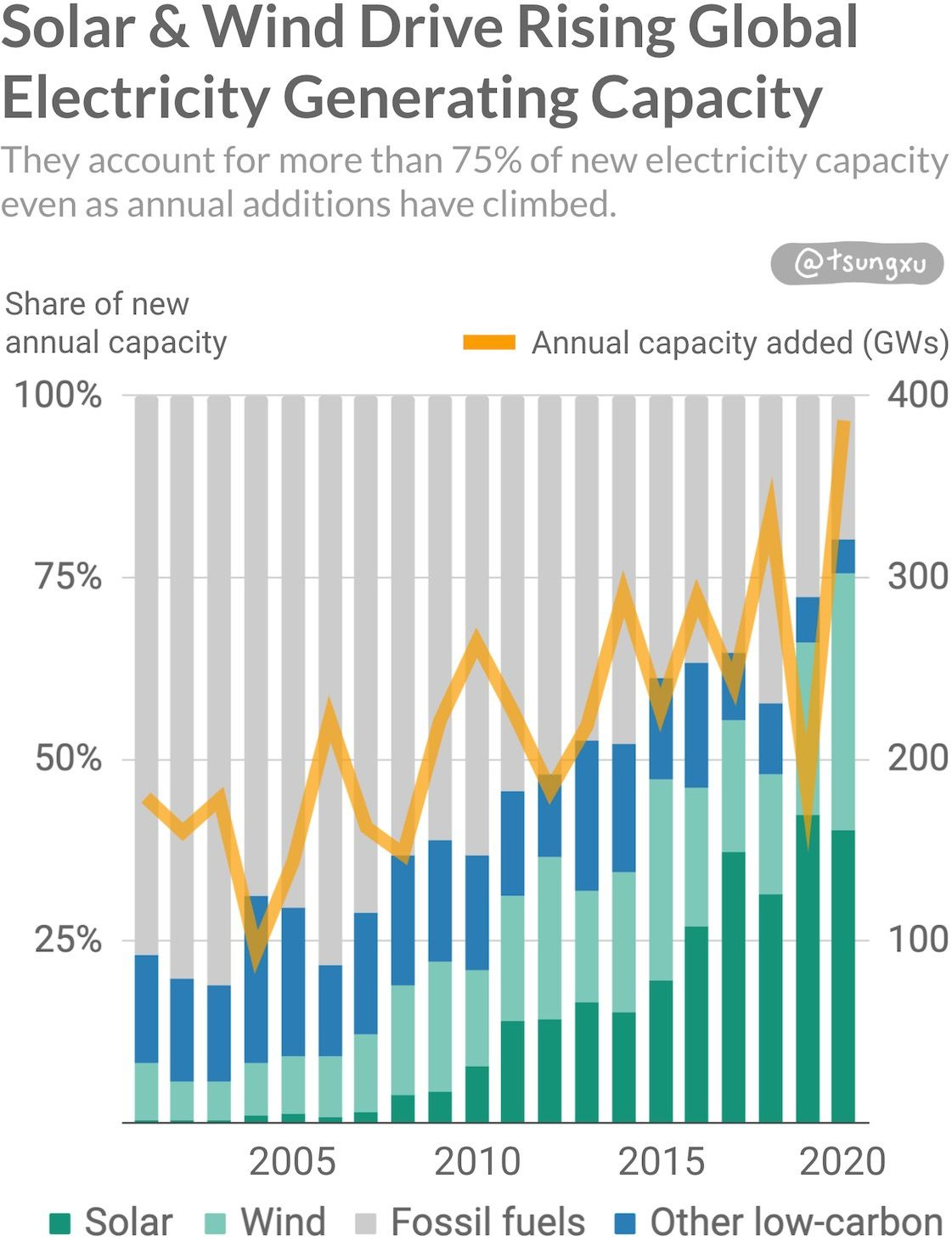

As shown above, this has led to solar and wind surging to over 75% of new global capacity to generate electricity in 2020, up from low single digit percentages in the early 2000s. As costs keep falling, solar and wind will continue to outcompete fossil fuels in more regions.

Lithium-ion batteries are now crossing cost thresholds that are powering booms in both EVs and stationary storage.

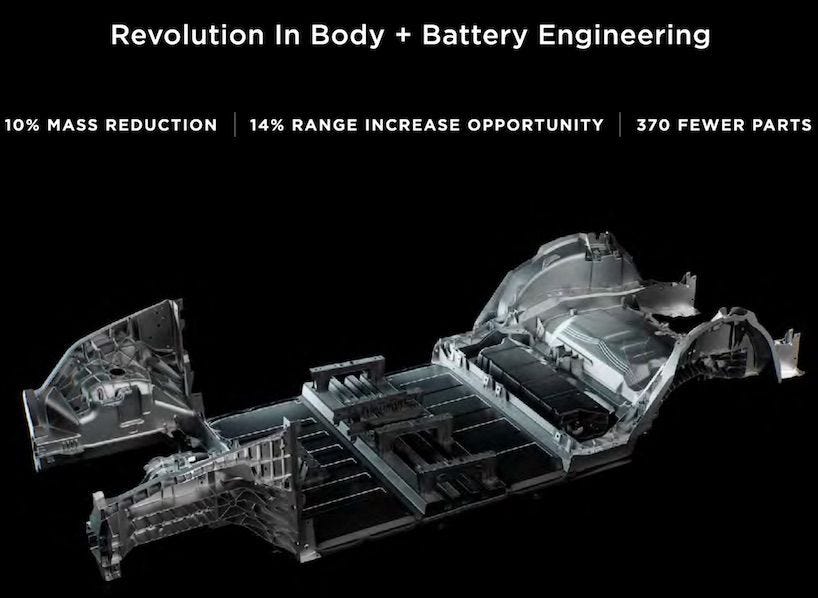

The Tesla Model 3 is as cheap as competing gasoline models from Audi, Mercedes and BMW, but outsold them all in 2020. In the next few years, a growing number of pure electric models in more countries will become as cheap as gasoline competitors. Low cost, high performance batteries are making electrified vehicles increasingly cost competitive from two wheelers to electric boats and trucks.

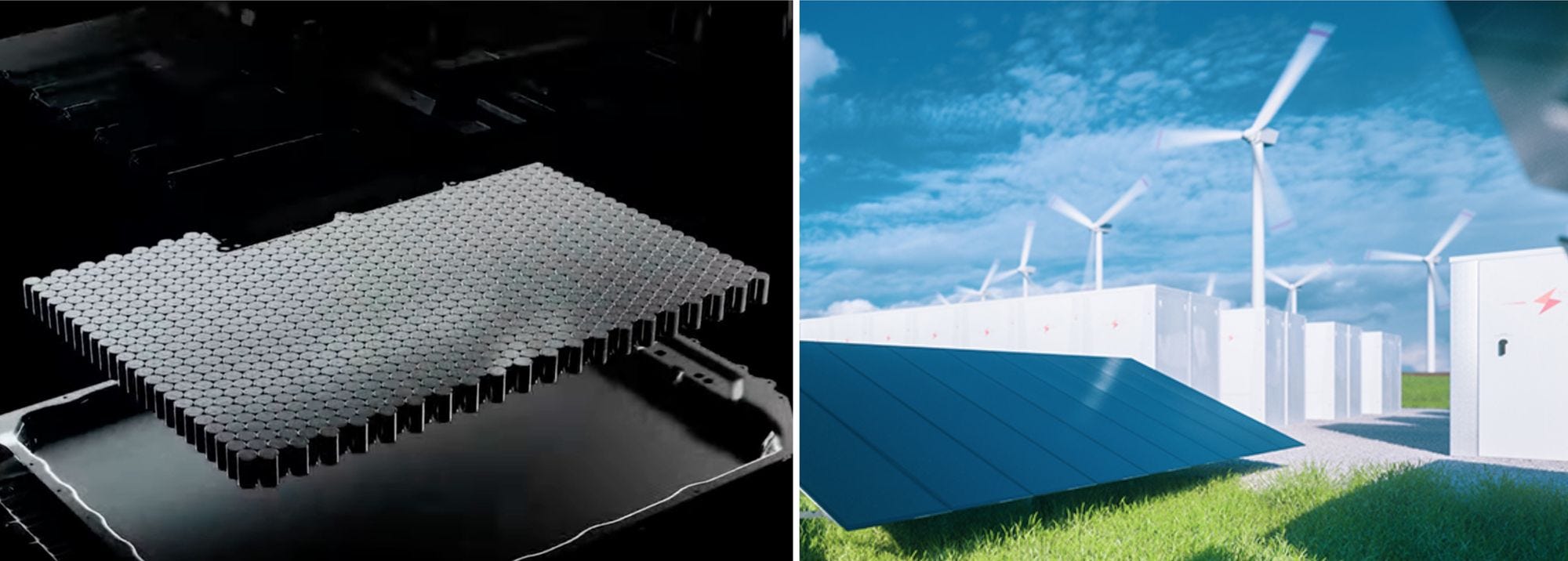

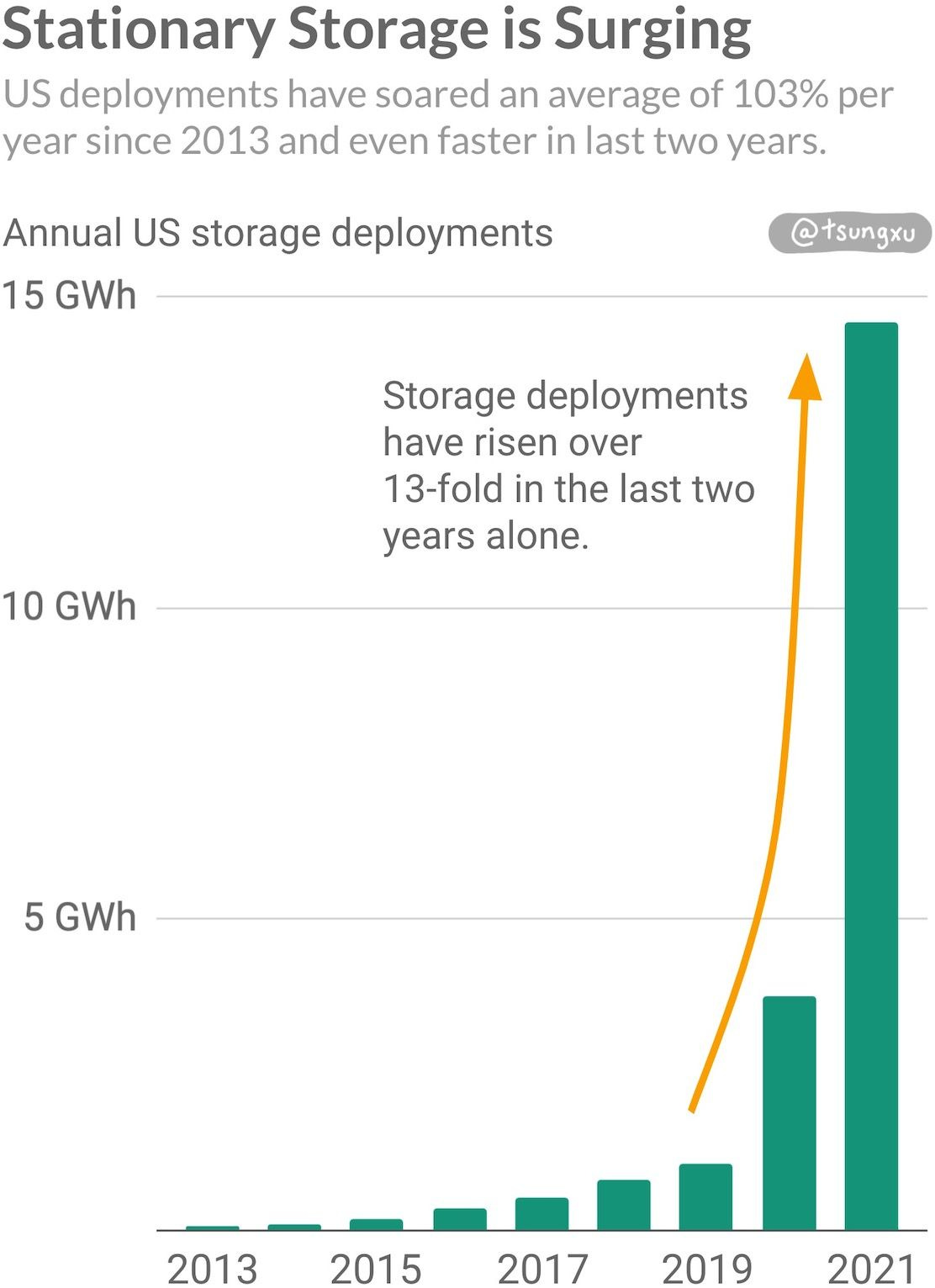

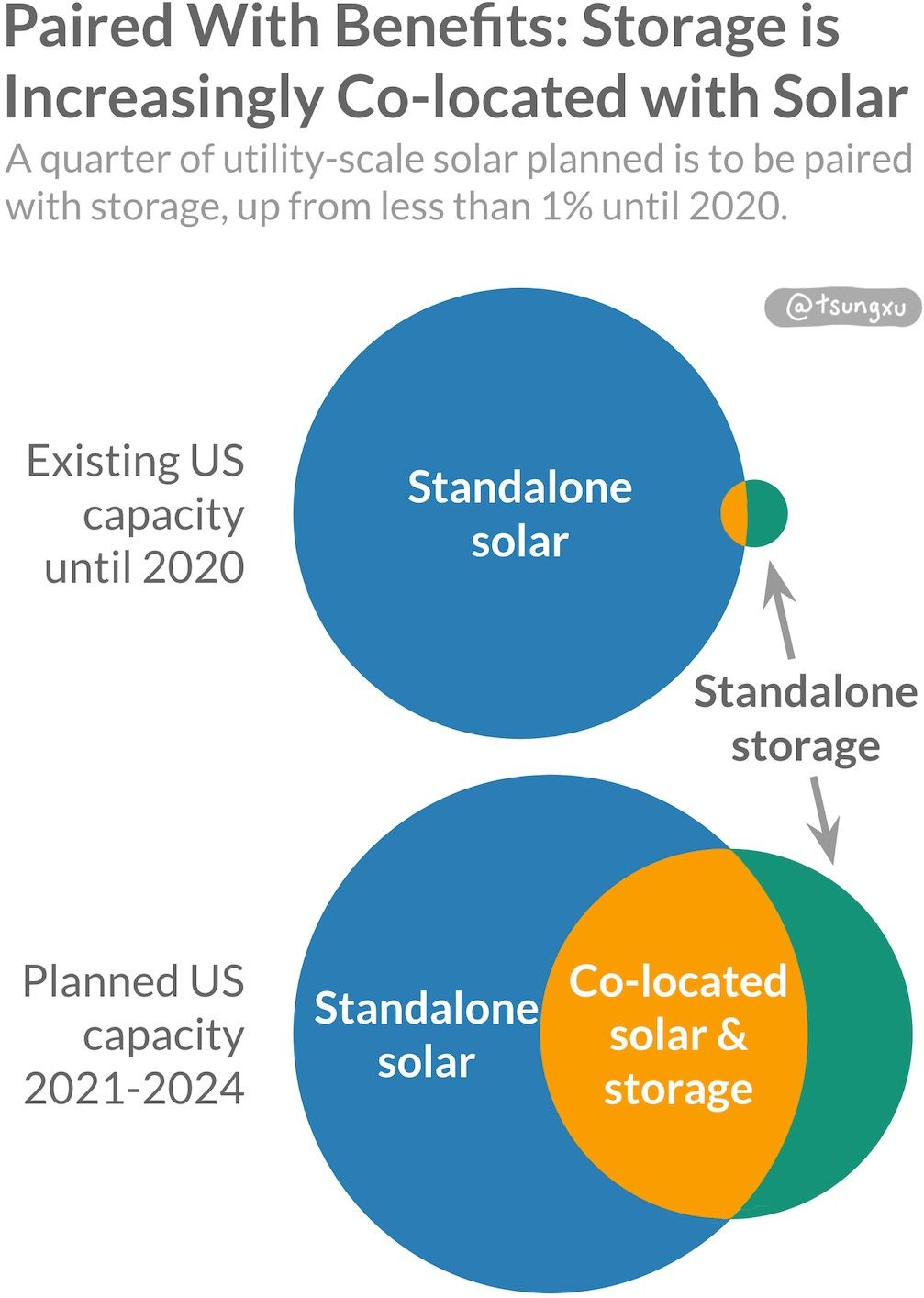

Storing electricity in large batteries is driving down the cost of more consistent clean energy. Battery deployments on grids in the US, China and other areas are soaring, and increasingly being paired with utility-scale solar plants. When paired, solar and batteries are mutually beneficial, being more valuable than batteries alone.

2) As Production Scales, Solar, Wind and Batteries Become Cheaper and Better

We are seeing sustained, incredible growth from these clean energy technologies.

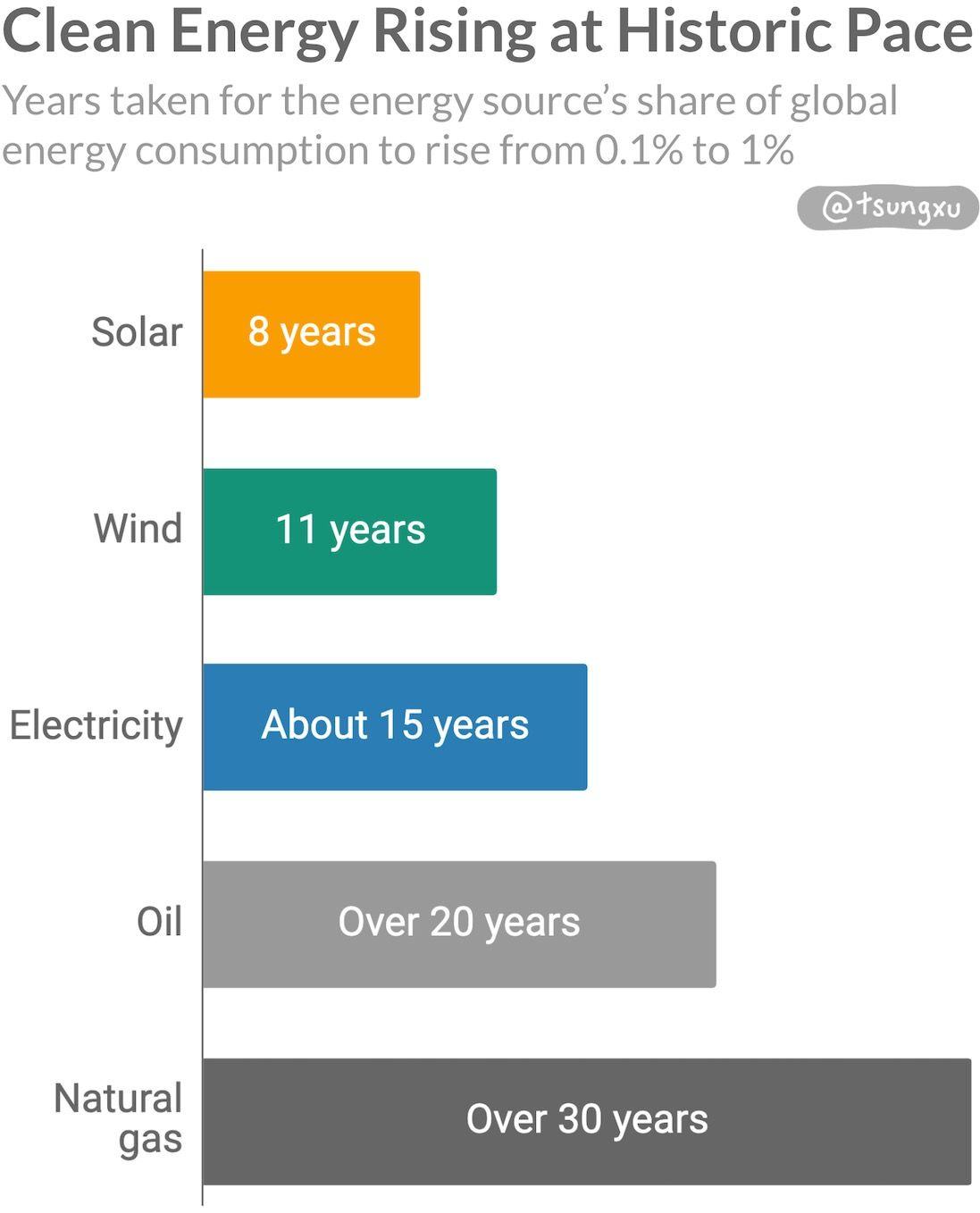

Solar is the fastest growing energy source in history.

Electricity generated from solar has grown at nearly 40% compounded annual rate (CAGR)2 for the last twenty years. Wind is no slouch either, having generated almost 22% more electricity every year, on average, during the same timeframe.

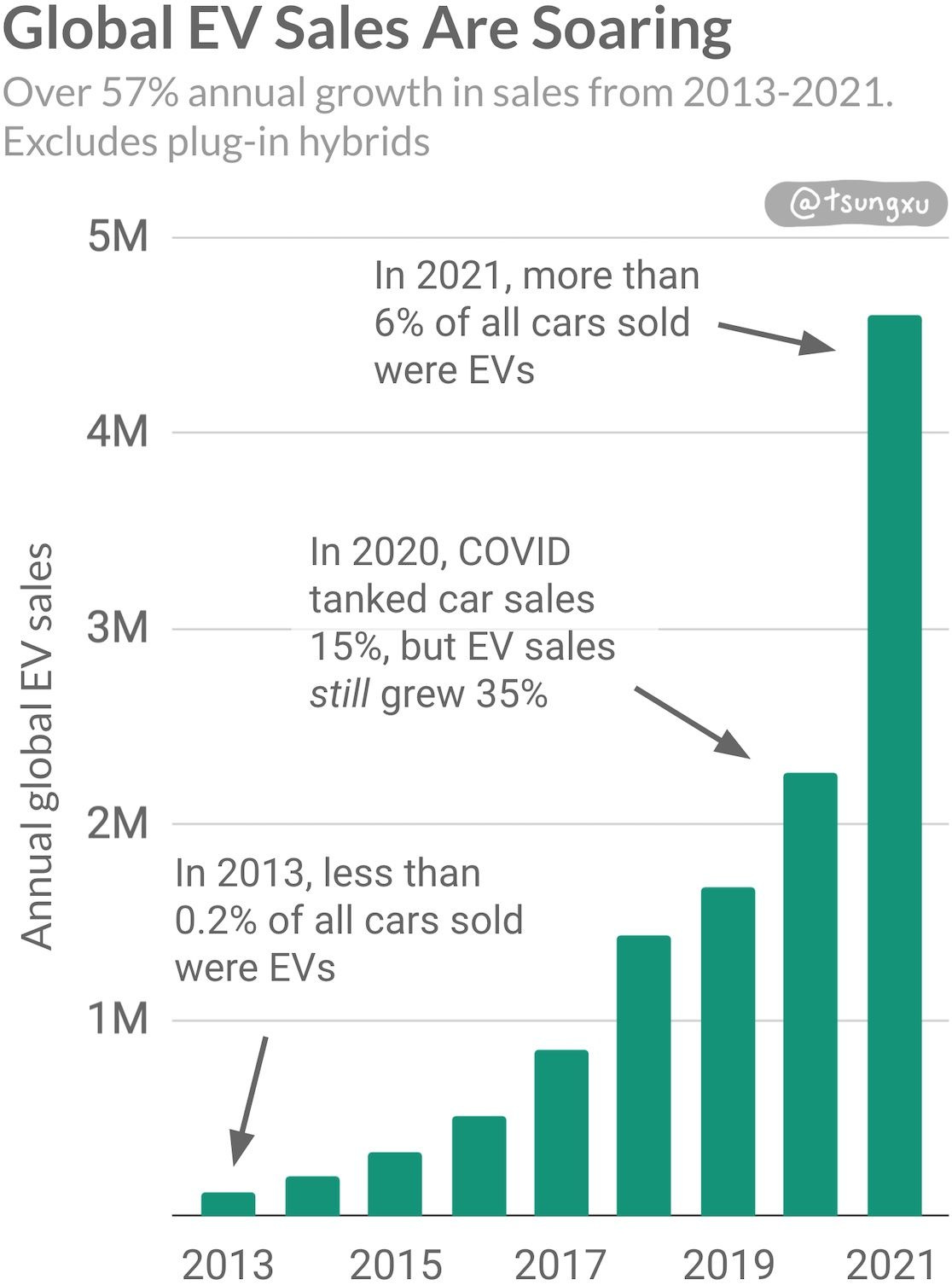

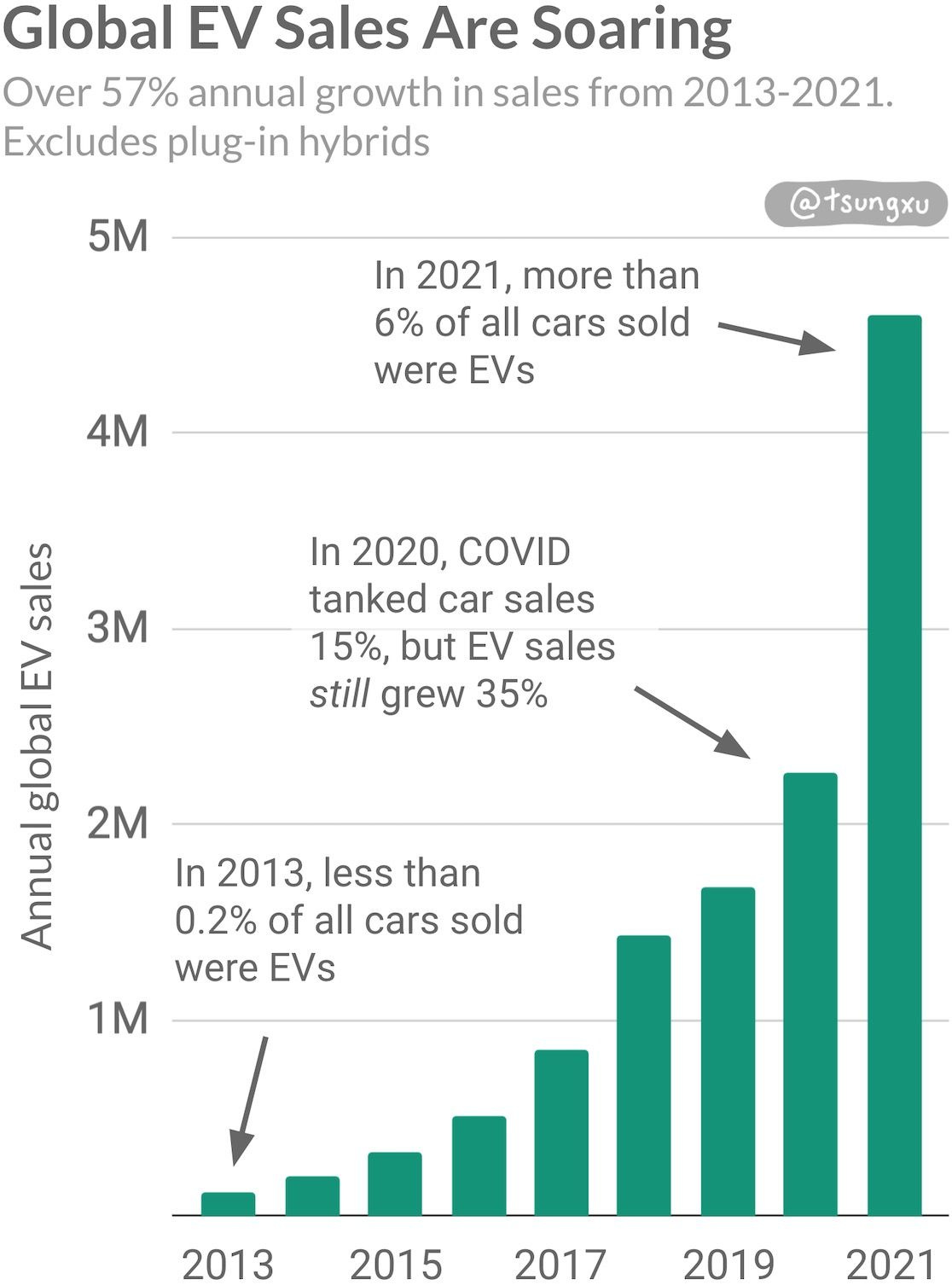

Meanwhile, electric vehicles (EVs) and large-scale storage are driving booming demand for lithium-ion batteries. EV sales have grown at around 57% CAGR in the last nine years, as shown in this chart. Storage for the grid is keeping pace, with global battery deployments growing at 58% CAGR in the last eight years.

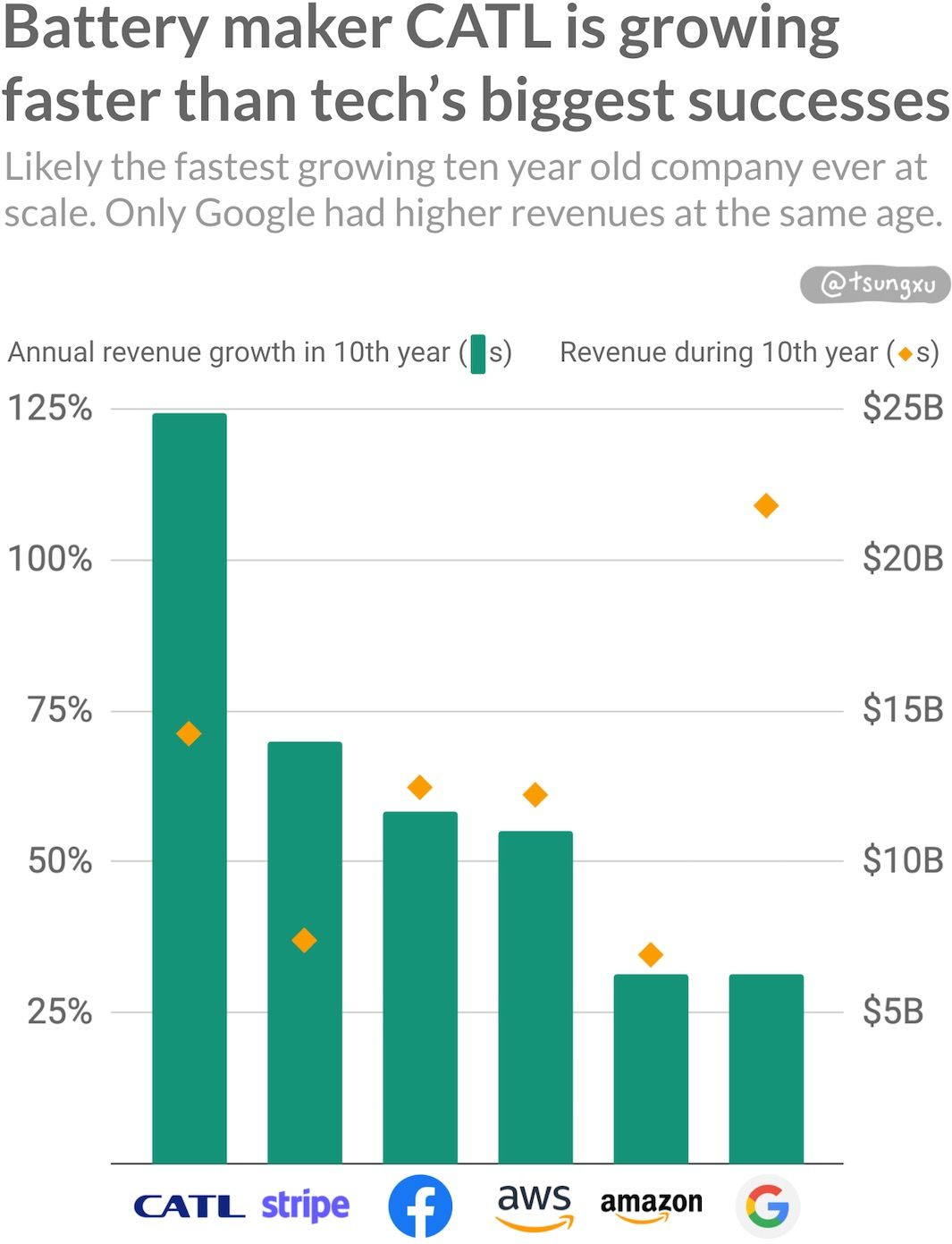

This emerging boom in lithium-ion battery demand has created some of the world’s fastest revenue-growing companies like Tesla, CATL and others.

Solar, wind and batteries are manufactured energy technologies, not mined and extracted ones. As a result, the rapid growth in their deployment enables cost declines and better performance more akin to computer chips or electronics than fossil fuels. Coal and gas simply cannot continue to stay competitive. Whilst coal and natural gas plants have become cheaper to build as more have been deployed (capex), the cost of the fuels themselves have actually gone up over decades of deployment, driving operating costs higher.

One note is that the production of solar, wind and batteries do require the mining and processing of minerals. But once produced, unlike fossil fuels, no further extraction is needed.

This self-reinforcing feedback loop is shown in the diagram below.

Whilst costs have plummeted, solar and battery characteristics continue improving. Solar photovoltaics (PV) technology has developed with many improvements across the supply chain. Battery characteristics like energy density, cycle count and safety have also rapidly improved.

3) Cheap, Clean Electricity Enables New Industries

Solar and wind now generate the cheapest electrons in history, and are only continuing to get cheaper. This will keep driving electricity costs lower, especially for commercial and industrial uses.

3As shown in the chart above, US heavy power users have strong incentives to purchase electricity from solar and wind power plants directly.

The pace of the cost reductions for solar-generated electrons is also historic. Falling electricity costs will create industries that are emerging now, as well as those yet to emerge.

For example, startups are betting on cheap electrons to power either CO2 capture and/or conversion. Direct air capture removes CO2 from the air. The CO2 can then be electrochemically converted into carbon-based materials, fuels and other products. Other industries are also set to take advantage of the lower cost of electrification.

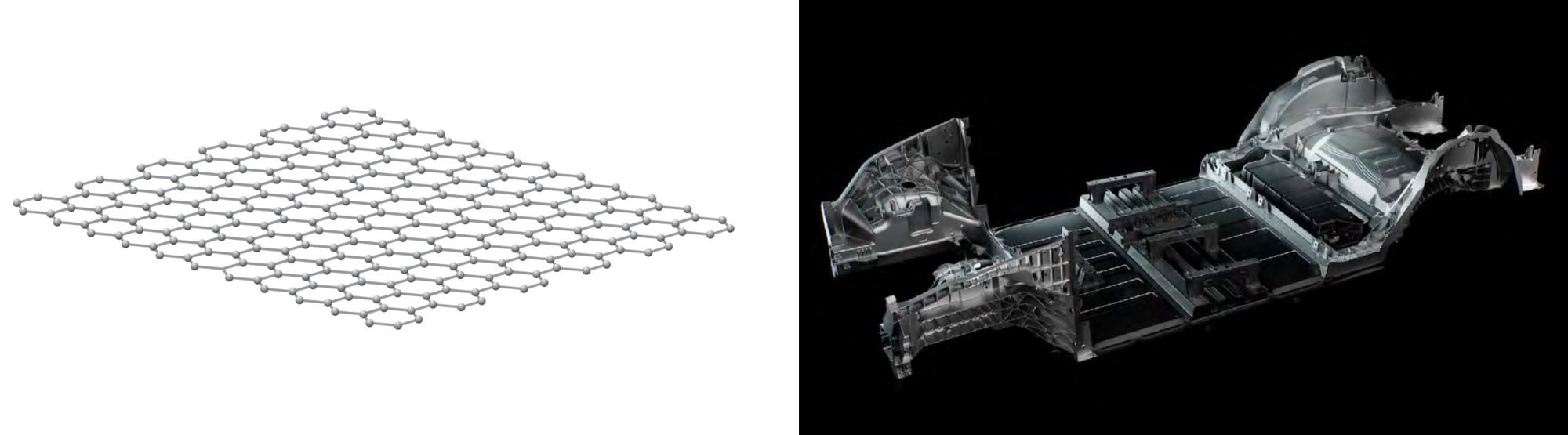

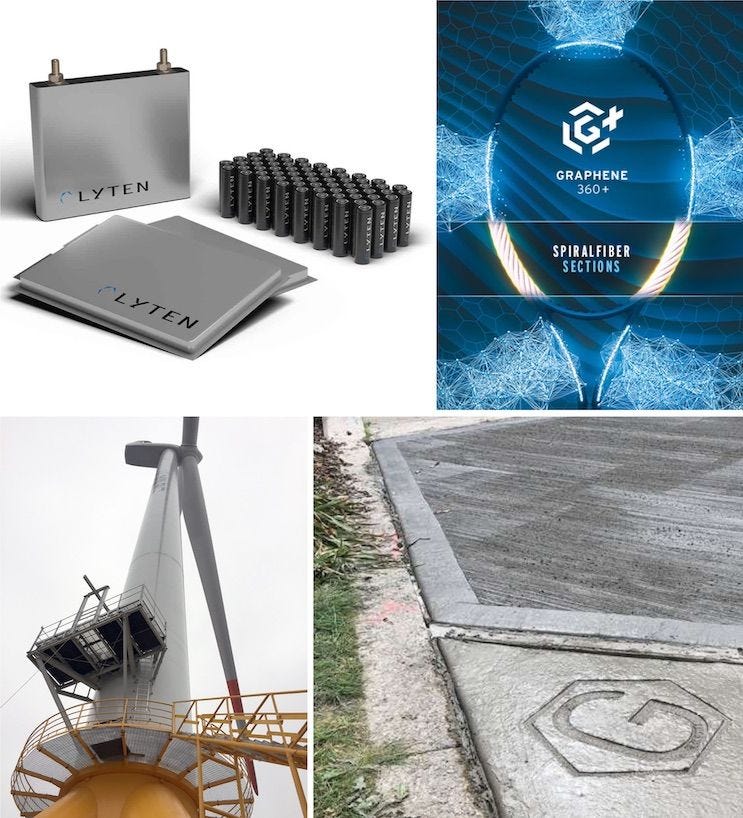

Graphene and single-layer materials had not been isolated and invented just twenty years ago. Today, these materials are growing in use in an increasing number of niche markets. Clean and cheap electrons could play a key role in accelerating adoption of emerging materials like graphene.

4) Emerging Energy Sources Scale Up Through Similar Phases

Before we dive into the clean energy transition, it’s very useful to gain a mental model of how analogous moments in history played out. Whilst there are many differences, there are also parallels between past energy transitions and this one.

We will explore the early rise of coal, oil and electricity and where they stand today. It’s easy to think that progress happens much faster today than it did in the past. This is true in some ways, but we’ll see that some energy-fueled technologies scale up surprisingly quickly, even by today’s standards.

Unless linked, stats and references in this section are from Richard Rhode’s Energy, A Human History.

1 Patterns in Previous Energy Transitions

When I first looked into the rise of coal, oil and electricity,4 I was surprised to find some patterns.

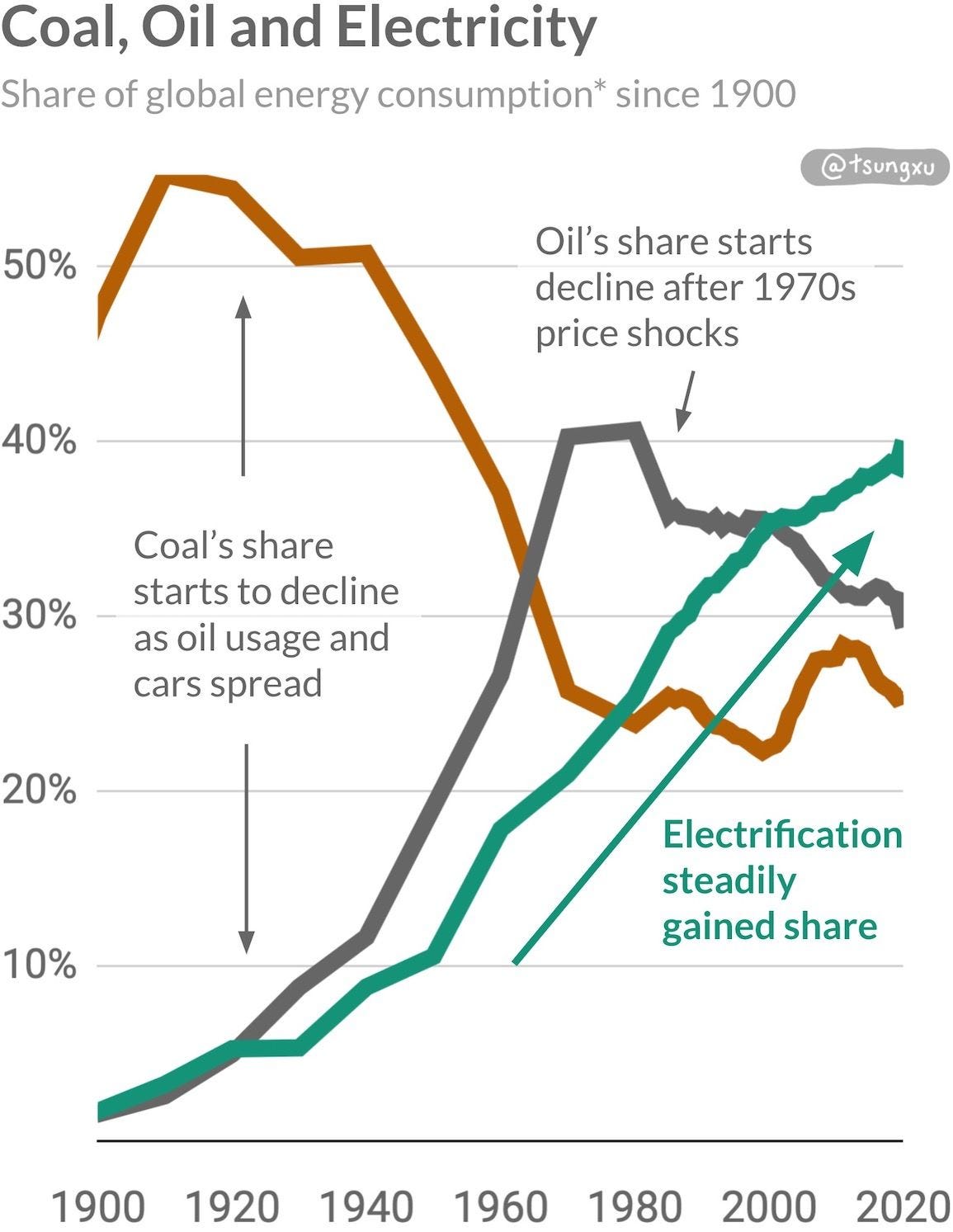

These key energy transitions in history all scale up through similar phases, as shown in the figure below.

After being discovered, the energy source (or carrier in the case of electricity) finds a foothold in niche markets where it outperforms the incumbents. Over time, as the technology matures, it can enter larger markets. Then, in the most transformative phase, new infrastructure emerges for the energy source, new materials are enabled, and new industries emerge.

Early on in an energy transition, there is often more attention on how well they can do existing things. Examples include how well coal could heat and oil and electricity could light. But the larger impact for any energy transition, like other new technologies, is to enable us to do brand new things.

Take a steam engine tinkerer in Britain in 1800, when steam engines were mostly limited to heating, improving coal mining and industrializing iron. Could they have conceived that within fifty years, these coal-powered machines would be driving people and supplies across tracks laid all over the country? Or that fifty years after that, skyscrapers made from steel (using coke — heated coal — furnaces) would start to pop up in major cities?

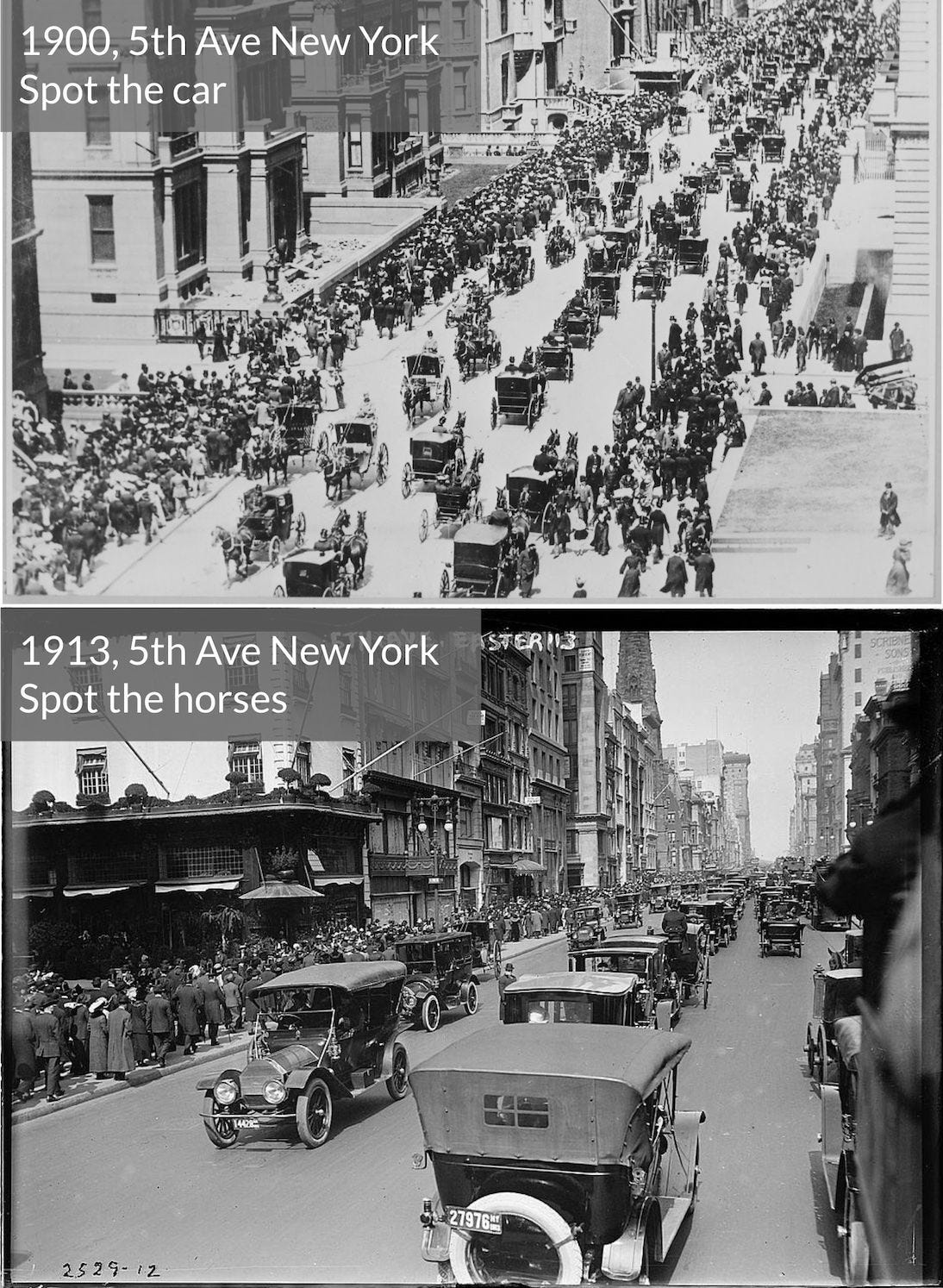

Or take a car hobbyist in New York, in 1900, when there were only a handful of gasoline-powered cars on horse-dominated roads. Would they have believed that only 13 years later, Manhattan’s streets would be filled with cars and few horses would be found? Or that thirty years after that, oil would start to be refined into polymers and plastics?

Finally take an electricity innovator in the US in 1890, when the first city-wide electricity grids had been in place for less than ten years, mostly used to power lights. Would they have thought that aluminum, which was more expensive than gold not long before, would soon be commercially produced using electricity? Or that by the end of the roaring 20s, more than two in three US homes would have access to electricity?

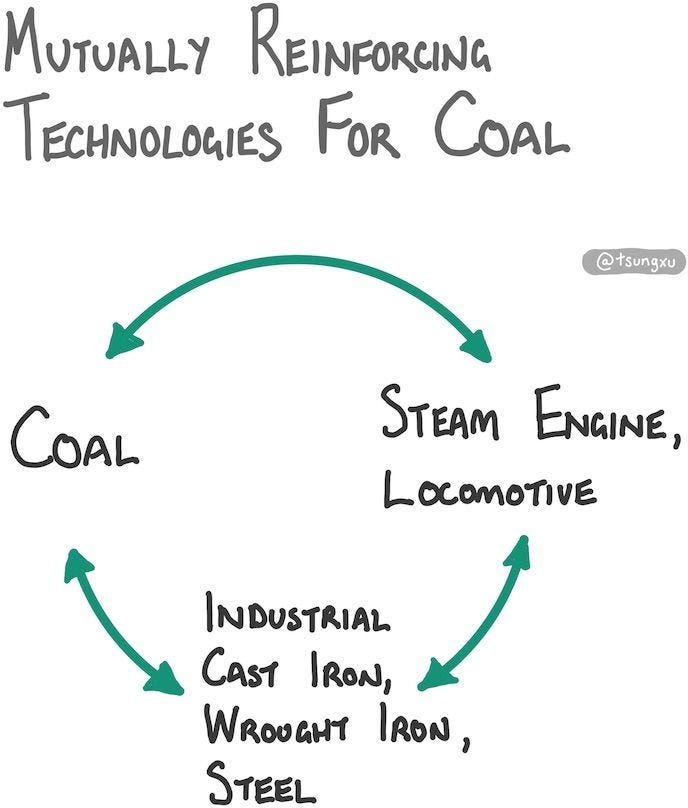

I found something else surprising about previous energy transitions. Each one later enabled new modes of transport and new materials which were very hard to conceive of during its early phases. In each of the past transitions, the energy source unlocked new distribution technologies and materials that helped drive more adoption for the energy source itself. As we’ll see later, the same is true for solar, wind and batteries.

Let’s take a closer look at each of these past transitions as a guide to what might be in store through the door of the clean energy transition.

1.1 Coal: Steam, Locomotives and Iron

Initial niche

In the 17th century, wood was scarce in England. Prices were soaring as London’s population 8x’d from 1500 to 1650, driving more demand for firewood. As more forests were cleared, wood had to be carted in on muddy roads further away from population centers. This created the opportunity for an alternative to serve the booming country.

Despite its somewhat toxic smoke, coal was cheaper and easier to get to market than wood. Back in the 17th century, coal mines were located near rivers. This way, the fuel could be sent on boats to London and other places for smelting iron or ship making. As London boomed, coal shipments to the city rose more than an order of magnitude during the century.

But early coal mines were dangerous, often flooding and killing miners. The first coal-powered steam engines, invented by Thomas Newcomen in 1712, mechanized the pumping of water out of mines. They were stationary, and as large as a small house, but good enough to prevent flooding. Their use saved the lives of many miners and enabled the early industrial scaling of coal mining.

Cast iron commercialized: larger markets

By the 1740s coal was already useful for more than space heating. Coalbrookdale Company was the first to use coked coal to smelt iron, enabling viable mass production of cast iron for the first time in history. The company also used Newcomen’s steam engines to replace horse driven pumps, reducing costs in the process. Less than 60 years later, iron had replaced wood in most manufacturing and construction uses in Britain.

Before the 19th century, coal mines were limited to being near waterways. Roads and horses were unsuitable, and so coal would be loaded onto boats. This meant coal still had to be carted from mine to the water, using wooden tracks at first.

Locomotives: distribution

Railways were developed to solve this problem. Higher-pressure steam engines were developed in the late 18th century, and by the early 19th century improved designs were being used to power steam locomotives. Railway tracks changed from being made using wood, to cast iron and then wrought iron in this period, allowing railways to start transporting coal, other cargo, and people. Coal mines could be increasingly built further and further away from rivers.

In other words, industrial iron production and steam engines, both reliant on coal, helped unshackle the fuel’s initial limitations in supply. These technologies became mutually reinforcing, and their impact would have been hard to fathom during the 17th century. They enabled brand new things to be done.

Once coal supply was unconstrained, production grew rapidly in the 19th century and spread from England to Europe and the US. It enabled iron production to double every 10 years from 1788 for decades. If instead of coal, charcoal had been used to make the iron railway tracks, there simply would not have been enough wood in England.

Steelmaking commercialized

A breakthrough in steelmaking in the late 1850s, the Bessemer process, would help the US to catapult steel output over 400x from 1867 to 1900. By then, the US was producing one third of the world’s output. Just as back then, to this day, steelmaking largely still uses coke made from coal.5

The transition from wood to coal for industrializing countries had been the fastest and most dramatic energy shift to that point in human history. Until then, we had been using wood-based biomass for heat and raw materials for millions of years.

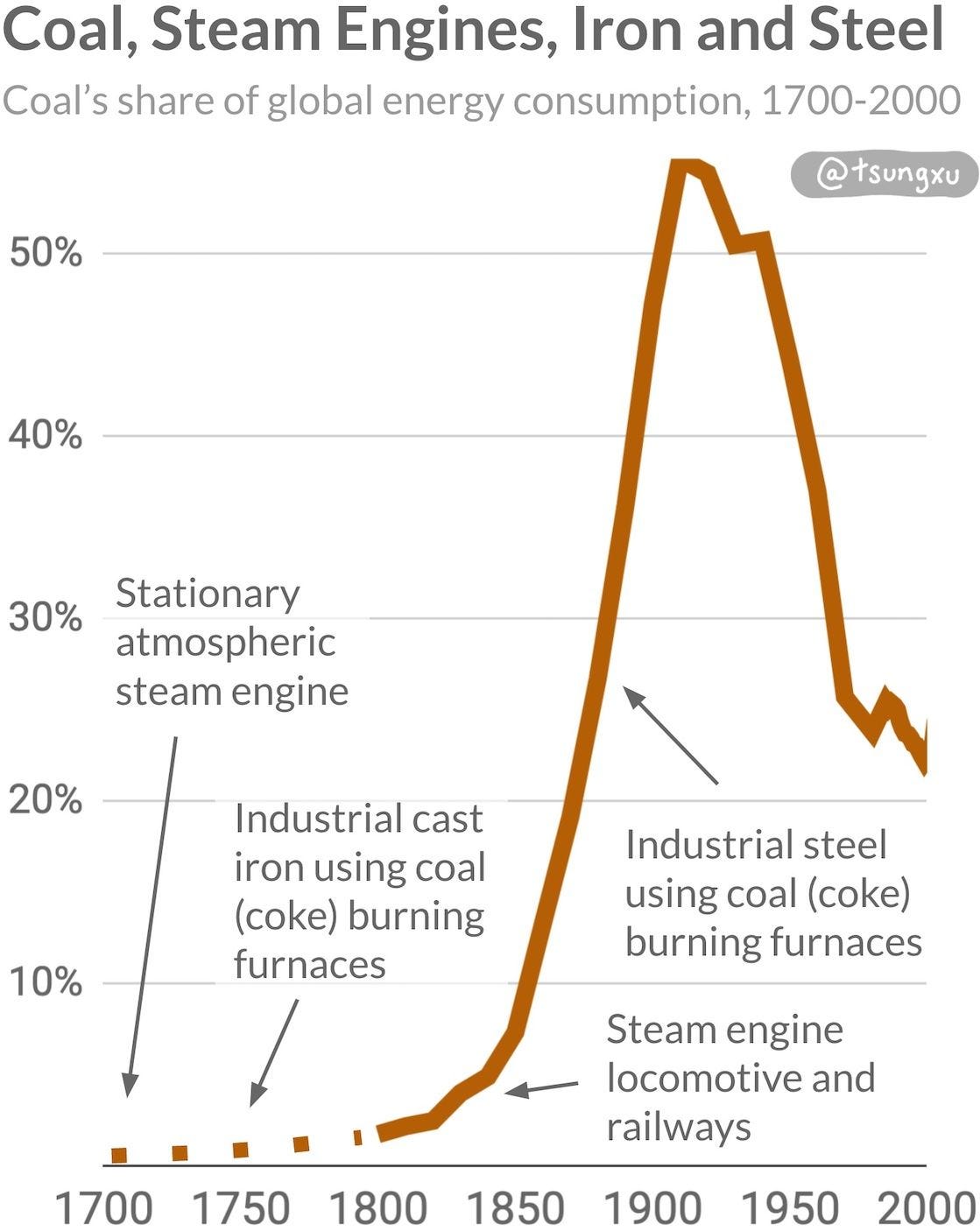

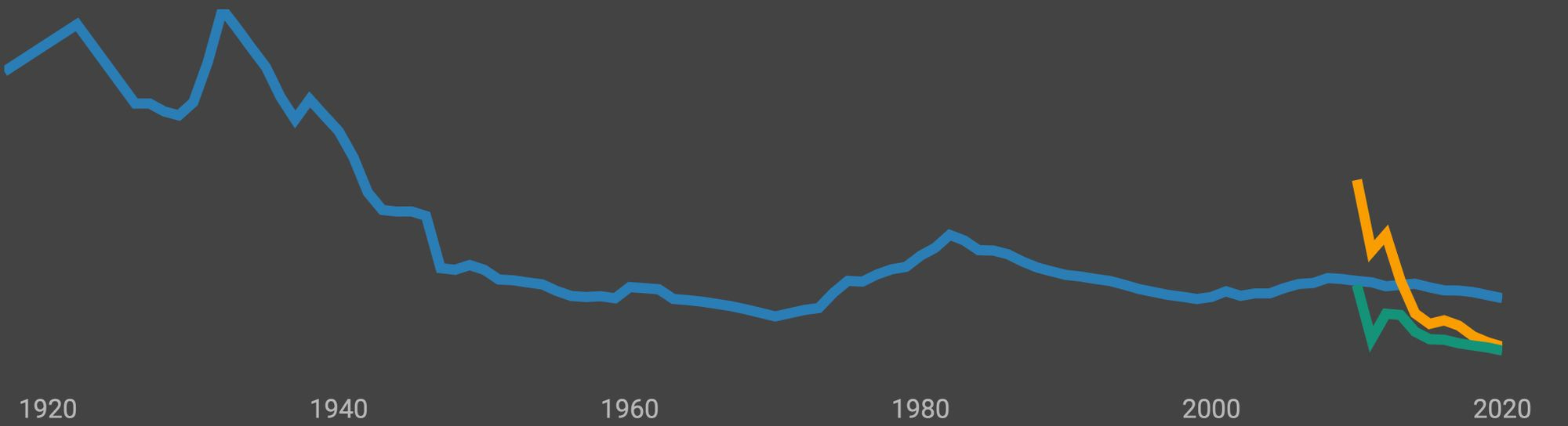

By 1900, coal was dominant, as shown in this chart. It supplied over 90% of the UK’s and 70% of US energy.

But only ten years later, coal’s energy use would peak, largely because oil was rapidly on the rise.

1.2 Oil, Internal Combustion Engines and Polymers

Initial niche

The initial product-market fit for oil was lighting. The search for oil was driven by finding a cheaper feedstock for kerosene, an oil for lighting that had been previously refined from coal. The first well in the US, drilled using a steam engine, started producing in 1859. Oil could be refined into kerosene and only 6 years the oil market for lighting had already 10x'd production.

The oil rush was on, initially in the US in Titusville, Pennsylvania. But, like coal, there were transport and storage problems to be overcome. It took 3 years for a rail connection for the town, and another year for the first rail-to-well oil pipeline.

John D. Rockefeller's Standard Oil was the emerging dominant oil refiner. He consolidated supply and made deals to reduce costs for kerosene by 55% from 1865 to 1870. Standard Oil drove efficiencies in refining, including using gasoline to help power refineries. Before gasoline found a market in internal combustion engines, other refiners were dumping it, often into rivers. Sounds incredible today, but then, they just wanted to make kerosene.

By 1870, cheaper oil-refined kerosene had cornered the US lighting market. But despite supplying almost 5 million barrels produced in Pennsylvania that year, lighting was still just an early wedge into bigger markets. There would be no bigger market for oil, and perhaps any other energy source until our time, than the internal combustion engine.

Engines and automobiles: distribution

The success of the internal combustion engine (ICE) would become the primary driver of oil demand for the 20th century.

Around 1900, steam engine powered cars and even electric battery cars were more popular than ICE cars in the US. In Europe, Porsche’s P1 (standing for Porsche number 1), was built in 1898 with a lead acid battery. However, the early lead of steam and electric car adoption would be short lived. Despite being a mature technology, steam engines were complicated to operate and appealed mostly to early-adopter hobbyists. Electric vehicles lacked charging infrastructure outside of cities, during a time when far more people lived in rural areas.

In the 1900s, ICE vehicles didn’t have the tech maturity of steam engines, nor the simplicity of electric cars. But thanks to the oil boom, ICE cars had refueling infrastructure distributed across the US. In the decades prior, gasoline derived from oil had found many uses outside of cities, used as a cleaning agent and solvent. Farmers had adopted stationary gasoline engines for “everything from washing machines to grain mills”.6 This meant general stores in rural and urban areas were stocked with gasoline.

Gasoline had superior distribution, and automobiles were increasingly cost effective. By 1914, there were nearly 1.7 million registered US motor vehicles, a market that grew at a CAGR of 46% over 14 years. See the photo taken in 1913 on 5th Avenue above. Only 13 years earlier, in 1900, there were almost no cars on the road. This was a remarkably quick transition, which, as we’ll discuss later, bodes well for electric vehicles in the 2020s.

Almost all vehicles sold by then were ICE powered. The Ford Model T had helped rapidly scale adoption of ICE vehicles by lowering costs dramatically. Henry Ford designed the car to have fewer parts (less than 100) which were interchangeable between cars, greatly increasing factory worker efficiency and streamlining the manufacturing process.

Polymers: a new class of material

Oil-derived polymers would become an entirely new class of materials. Bakelite, invented in 1907, was the first synthetic polymer and was actually made from coal. It was used as an electrical insulator for the rapidly electrifying US and in everything from radios, irons, combs as Time magazine praised in a 1924 cover. The success of Bakelite kicked off a race between chemical companies to discover new synthetic polymers, even if they did not have uses at first.

The R&D investment into synthetic polymers by many chemical companies started to pay off in the 1930s. Nylon was invented and used in WW2 (and to this day) for parachutes, ropes and stockings. Plexiglass was used in aircraft windows and polyethylene7 became used for packaging.

Just as with coal, the widespread use and distribution of oil enabled new materials to be developed and used at scale, as shown here. Entire new industries were created.

As remarkable as it was, one key thing limited oil’s rise. Cost. Oil has never been viably cheap enough to produce electricity, unlike coal, or later natural gas and now solar and wind.

Parallel to the rise of oil, electricity was also gaining traction. Despite its already huge impact in the 20th century, electrification is really just getting started.

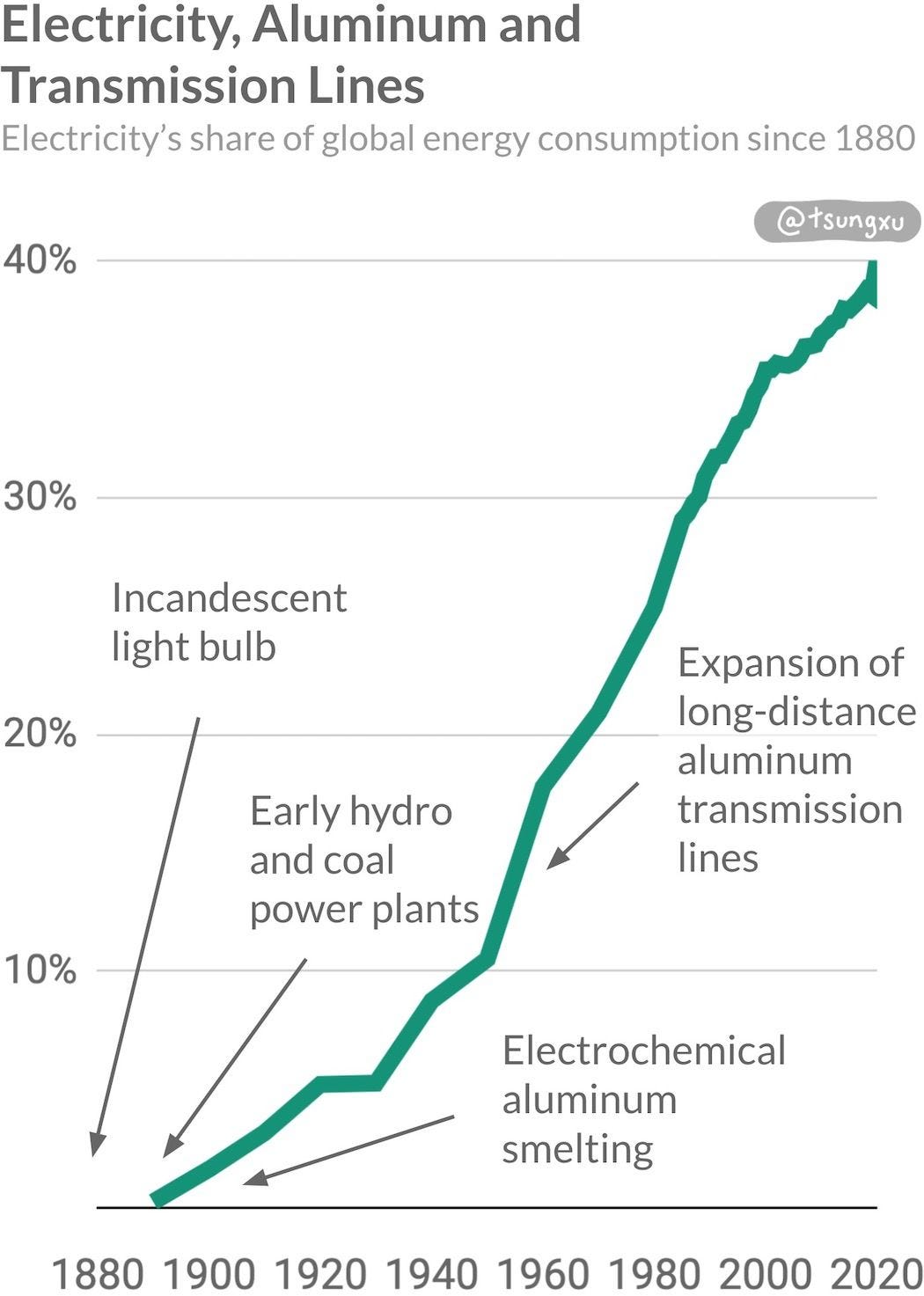

1.3 Electricity, Aluminum and Transmission Lines

Initial niches

After more than a century of research progress, electricity was still to be commercialized in the mid 19th century. Some early uses like the telegraph and telephone had already proved useful. However, at the time, there were no use cases that required more abundant sources of electrons.

Thomas Edison’s commercialization of the incandescent light bulb in 1879 was the early killer app. Light bulbs were brighter and lasted much longer than kerosene lamps. Ironically, oil had only started replacing coal in supplying kerosene twenty years before Edison’s invention.

Early electric light adoption was rapid. In 1882, only three years later, Edison had set up the US’s first commercial power plant in lower Manhattan, initially for 82 customers on a few blocks. Two years after that, Edison was supplying over 500 people with over 10,000 electric lights.

Early distribution wars

Electricity could only be transmitted very limited distances and used direct current (DC) infrastructure at the time. Edison backed DC but copper wires melted if transmitted over long distances. Plus, there were only so many polluting coal power plants that people could tolerate near cities.

It took a shift from DC to alternating current (AC) to distribute electricity much more widely than a few city blocks. Once developed and tested in the 1880s-90s, it could transmit electrons dozens of miles initially, with transmission range increasing with higher voltages.

Aluminum commercialized

The electricity generated was also cheap enough to enable materials like aluminum to be produced cost-effectively for the first time.

When opened in 1895, Niagara Falls hydropower was first used to power Alcoa’s third ever smelting plant. Before electrolysis of its oxide was possible with cheaper electrons, the metal was difficult and expensive to refine from ore. It had been more expensive than gold, and rare as a result.

Global aluminum production would 15x from 1900 to 1916 as electrolysis costs fell and the metal found more uses. The Wright Brothers used an aluminum alloy plane engine in 1903, and aluminum began being widely used in airplanes in WW2 and satellites during the space race.

Aluminum also replaced copper in transmission lines, allowing longer distance lines to be more economically feasible. It was cheaper, lighter and allowed for lighter (and also cheaper) transmission towers to be built, despite not being as conductive as copper.

Electrified appliances: growing markets

Homes and buildings became increasingly electrified, with about five in six households connected to the grid by the end of the 1920s. Electricity usage per household kept growing as more appliances became widespread, especially after WW2. Washers, fridges, TVs, air conditioners, dishwashers all made their way into homes in developed countries by the 70s.

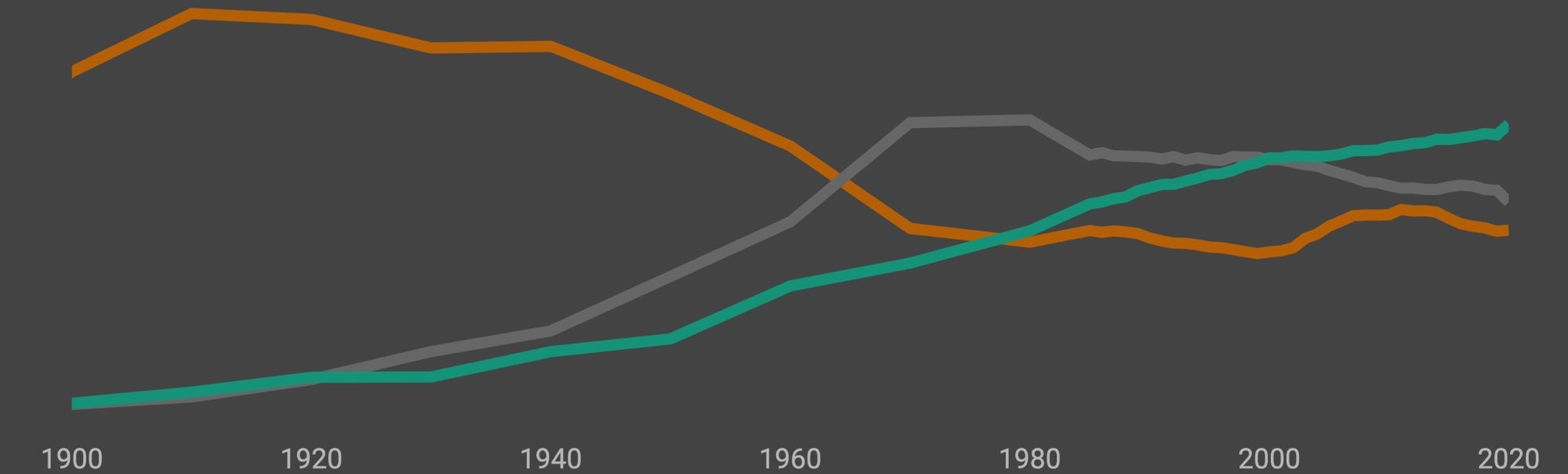

The increasing electrification of energy usage meant that a larger share of fossil fuels (coal and gas in particular) were producing electricity, and not for other end uses. As shown above, in 1900, less than 2% of the world’s fossil fuel production was converted into electrons, but by 2020, almost 40% was.

Fossil fuels are becoming less competitive with solar, wind and batteries, the new kids on the energy block. Now, another transition is well underway.

1.4 Clean Energy Now On The Rise

Despite all their vices and limitations, coal and oil fueled (no pun intended) the rapid progress in technological progress, and improved standards of living for billions. But the age of using prehistoric dead plants to power our economies is coming to an end.

Let’s look at energy transitions through the lens of innovation cycles, thinking back to how hard it is to understand non-linear growth.

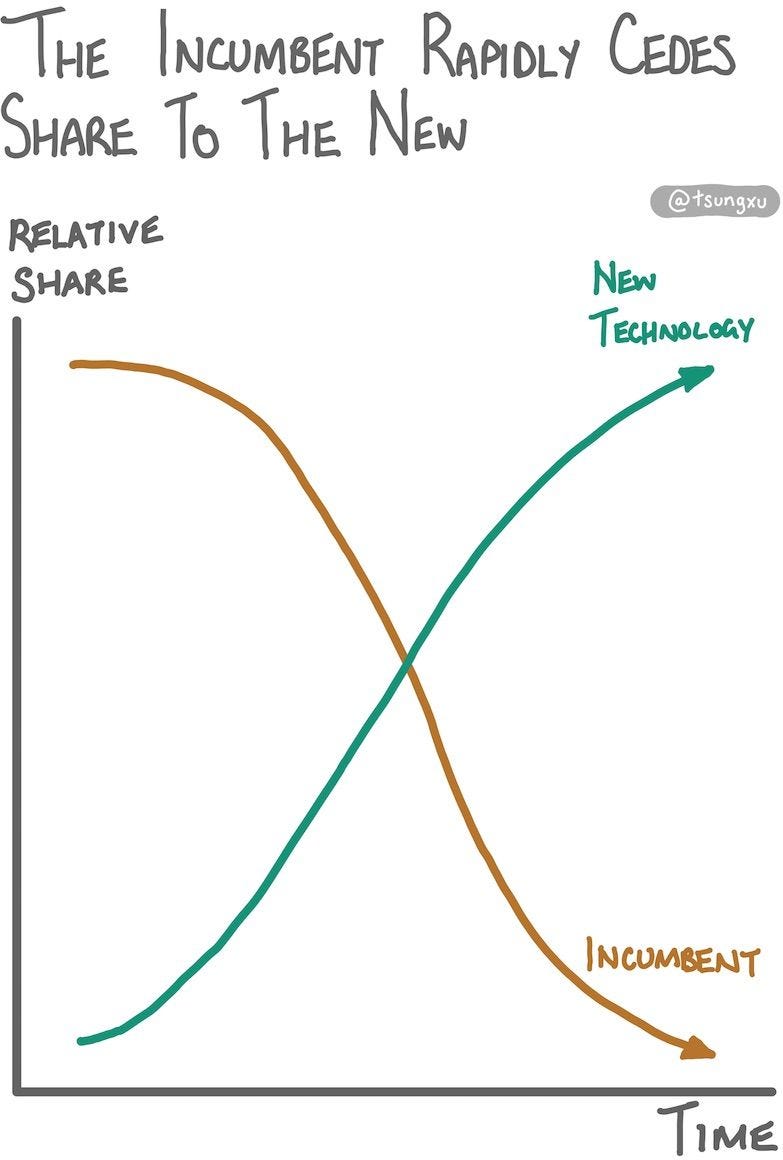

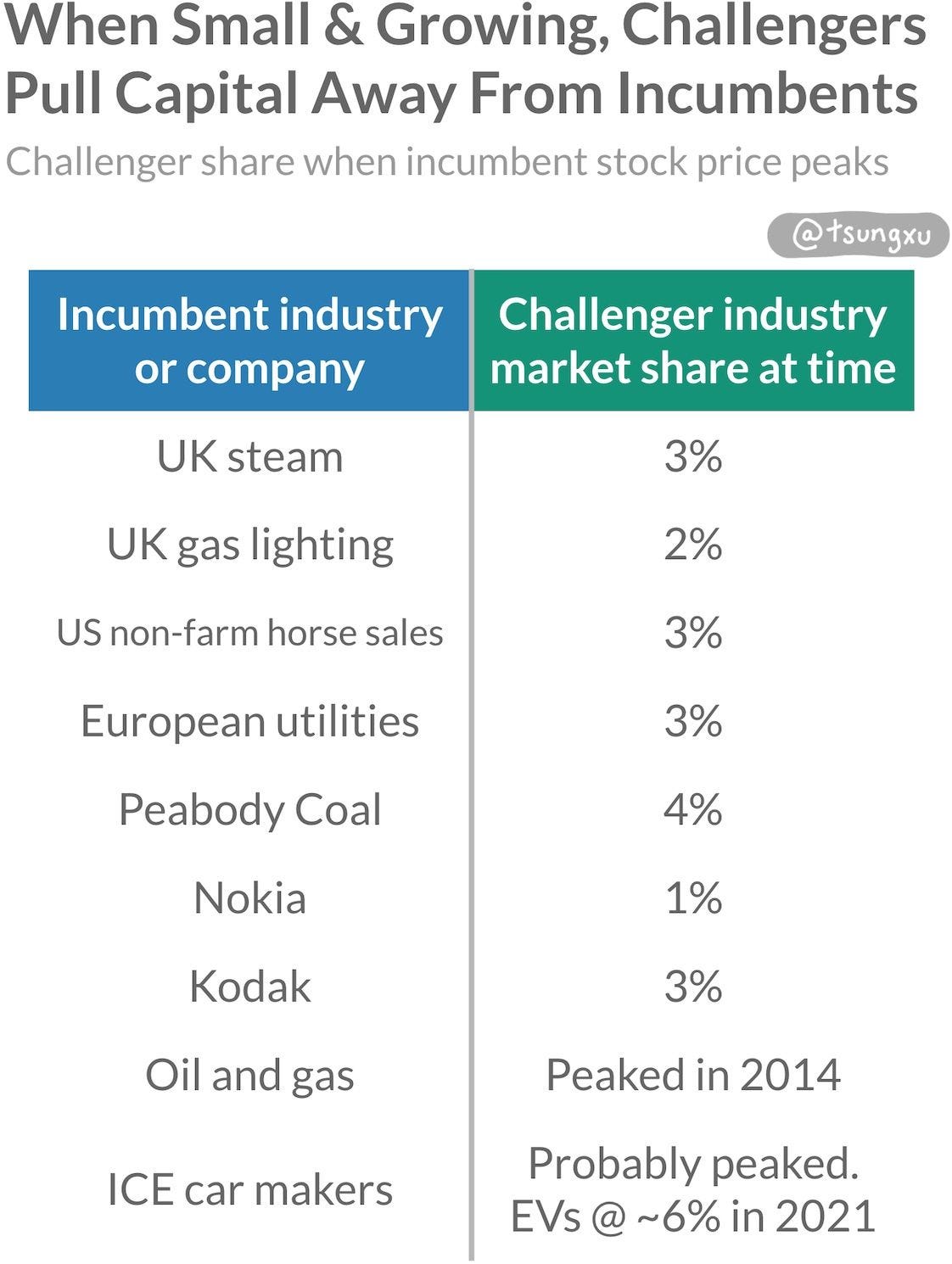

Early on in the figure above, the incumbent has a high relative share of the market. they seem to be maintaining the share well. However, the new technology is rising. It is growing at a non-linear rate to take market share every year from the incumbent. Before the incumbent can react, the new has already surpassed it in market share.8

This has happened over and over throughout history. Horses disappeared off roads as ICE cars took over; offline share of advertising dollars were replaced by online ads; Nokia did not respond to the rise of smartphones; Taxis have been mostly usurped by ridesharing.

Incumbent disruption also applies to the energy industry and energy transitions. Few people alive have lived long enough to be a part of one, unlike for many of the examples I just gave.

How the transitions are playing out

In the chart below, we see a high-level view of how energy transitions from coal to oil and electrification played out. I’ve only included these three as they are the most globally important and dominant energy sources (energy carrier in electricity’s case).9

10Coal’s share of global energy consumption had already peaked earlier in around 1910, when the growing adoption of ICE vehicles allowed oil to rapidly start to eat into coal's share.

By the 1970s, oil was the most important energy source, peaking at above 40% of global energy consumption during the oil crises of the 1970s. Natural gas use has only increased somewhat from 14% in 1985 to 24% in 2019 despite US production rising dramatically since 2005.

Electrification of energy has been playing an increasing role in the last 120 years. Around 40% of global energy usage is electrified, using the substitution method. Another lens on the rise of electricity is that over 30% of (mostly) coal and gas is converted into electricity globally, because that’s a very productive use of those fossil fuels today.

Clean energy is rising and accelerating

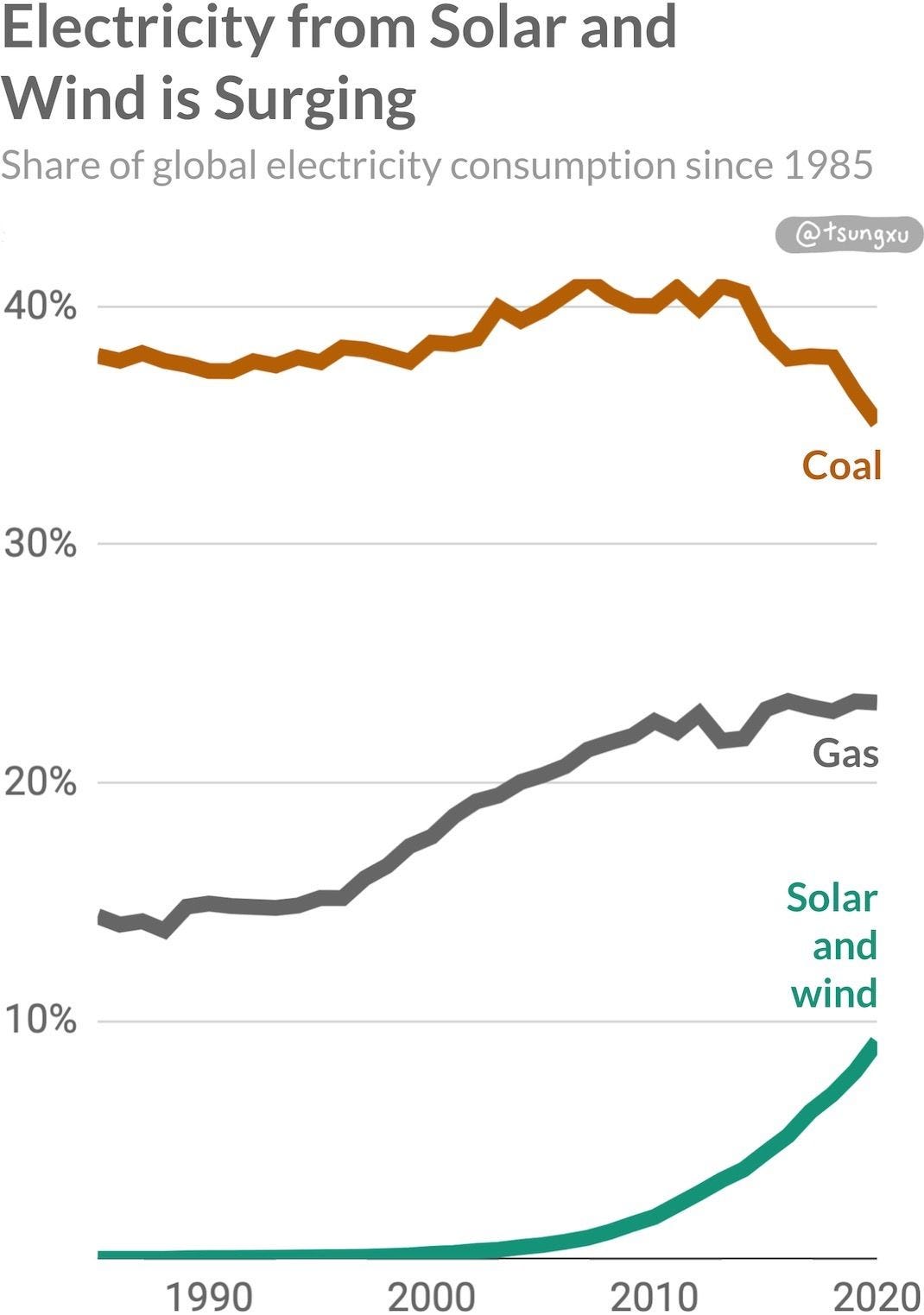

In the last 10 years, solar and wind have been eating into coal’s dominance in generating electricity. They generated 1% of global electricity in 2007 and were closing in on 10% in 2020.

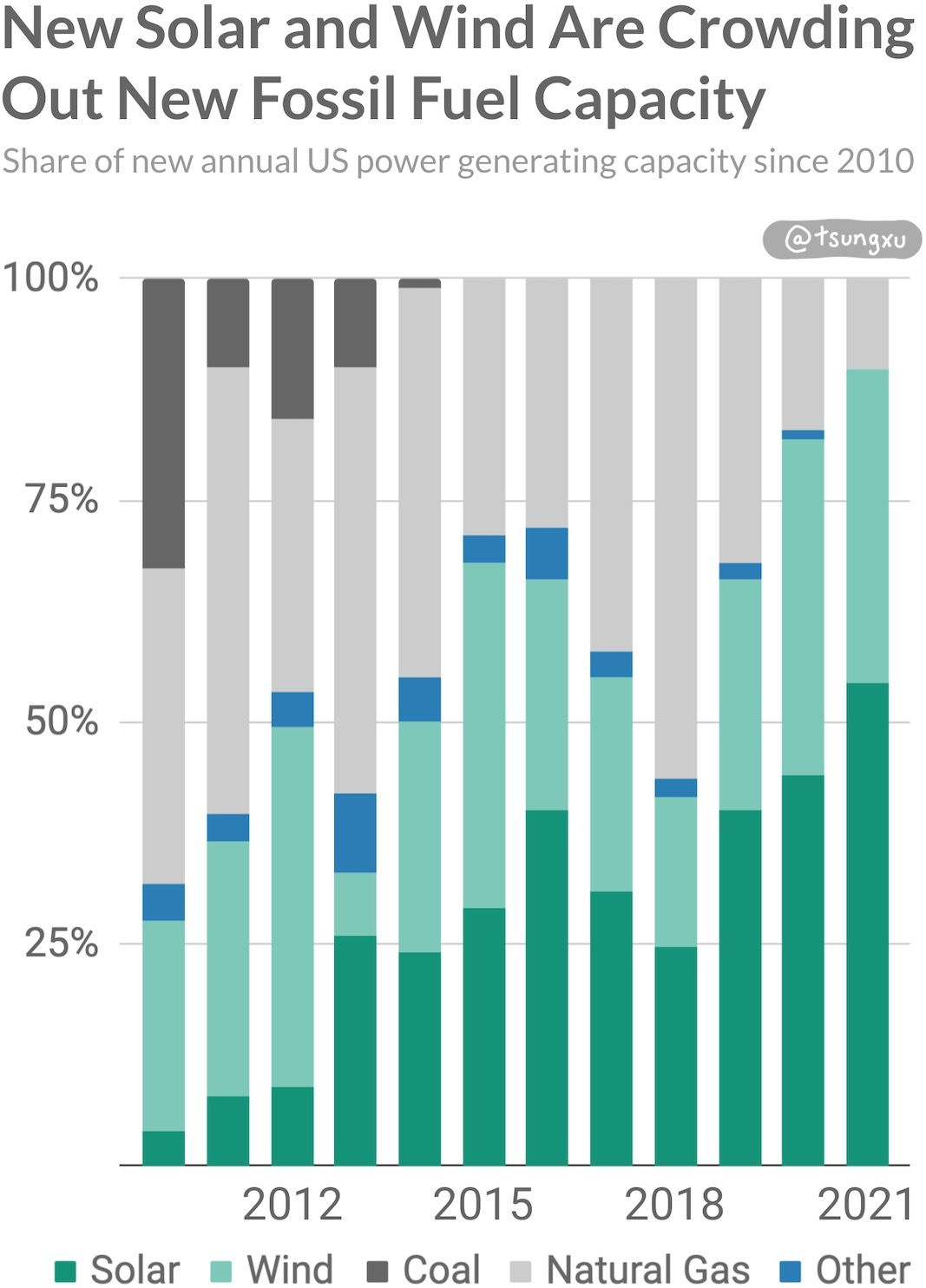

Fossil fuels are increasingly uncompetitive against solar and wind in generating electricity. New solar and wind power plants are cheaper to build than running existing coal and gas plants in almost half of the world. That has a lot to do with why over 80% of new electricity capacity in 2020 was from renewables, and the vast majority of that was from solar and wind.

It’s only a matter of years, not decades, before the world is building almost exclusively clean low-carbon power plants. Soon, there will be more coal and gas retirements than new solar and wind plants being added.

This trend is clearly visible in the chart above. The share of new electricity capacity from solar and wind topped 75% in 2020, having surged from around less than 6% in the mid 2000s. In that time, fossil fuels have shrunk from contributing over 80% of new capacity to less than 20%. This is a remarkable inversion in twenty years.

Despite rapid progress, solar and wind face growing pains. I’ll come back to the big challenges like intermittency, i.e. power only when the sun shines or wind blows, and the lack and slow speed of more transmission buildout.

Clearly, the clean energy transition is eating into the share of fossil fuels and at an accelerating rate.

A quick note about nuclear fission plant deployments, which had boomed during the 1960s and 70s. Meltdowns including at Three Mile Island, Chernobyl and Fukushima drove anti-nuclear sentiment, despite fission power being far safer than burning fossil fuels. That led to permitting and regulatory delays in fission plants being approved, with many projects being canceled and facing massive cost overruns.

Let’s next dive into the core of the clean energy transition to see how clean electrons (especially solar) are growing so quickly, why most pundits and industry insiders underestimated the growth and their foundational role in the clean energy transition.

2 Generation: Solar and Wind

We have never seen energy technologies like solar and wind before.

For the first time in history, we can manufacture the generation of energy. Once built, solar and wind equipment cost very little to operate. In other words, they are basically zero marginal cost electron sources.

Their fuel, either sunlight or wind, is free, and renewable. Solar in particular is modular and fractionalizable, meaning one panel can be installed on a rooftop or literally millions of panels at one site.

They have also gained traction fast. Historically fast so far, as the following chart shows. Of course, as deployments keep rising, the pace will likely slow down a little in the coming years.

11Solar and wind exhibit steep and consistent learning curves (also known as experience curves). That is, they become cheaper to build as more units are built and used. This trait of rapidly scaling technologies has never applied to fossil fuel energy sources.

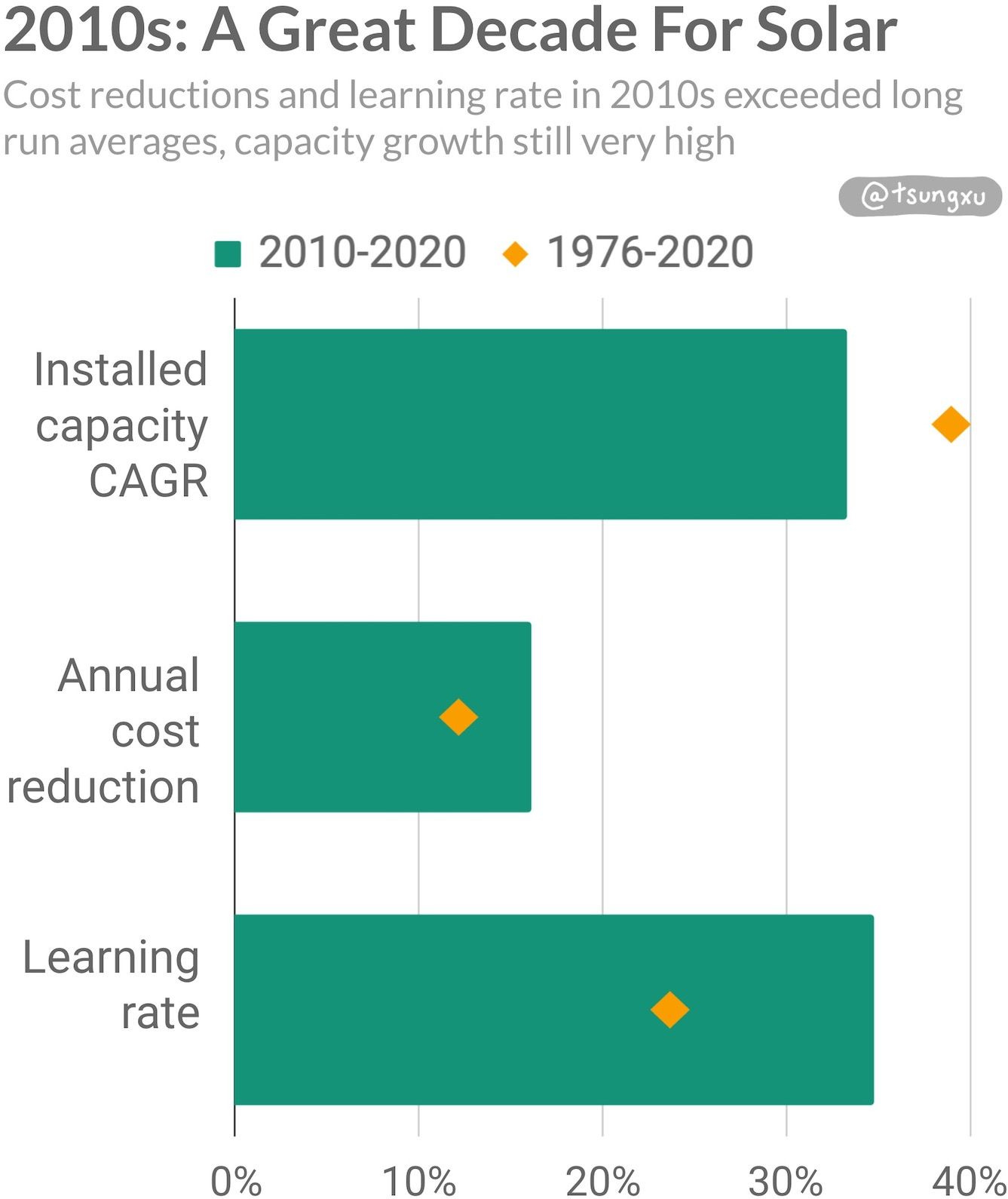

These clean energies show no signs of slowing down. The 2010’s were one of solar’s best decades, as shown in the chart below. Growth is strong, cost reductions drastic, and the industry is innovating and learning to further lower costs at speed.

Installed capacity grew at over 33% CAGR during the decade. This is a blistering pace considering hundreds of millions of modules are being produced every year at this scale. Cost reductions were strong too, with the yearly fall in cost per watt was over 16% during the 2010s vs 12% over the last 44 years.

Finally, the learning rate, which is the rate of cost reduction for every doubling of capacity, was also much better than overall. Solar’s long run learning rate is about 23.6% since 1976, but this soared to almost 35% in the 2010s.

As we’ll discuss, even for optimist industry insiders this growth was unexpected.

There are positive feedback loops from combining technologies, as we saw in past transitions. We’re starting to see more solar plants being paired with lithium-ion storage, helping resolve many of the limitations of variable renewables. These two technologies are mutually beneficial and help each other scale. Analogs include the past transitions above: coal, iron and the steam engine; oil, steel and the internal combustion engine; electricity, aluminum and transmission lines.

Lets first look at how solar in particular has taken off to set the table for diving into the clean energy transition.

2.1 Solar Adoption: Slow, Then All At Once

Unless otherwise stated, stats and references in this section are from Greg Nemet’s How Solar Energy Became So Cheap.

Solar photovoltaics (PV) modules started off solving problems in small niche markets. As production ramped, costs came down and performance of modules kept improving. Solar kept entering larger markets, like the rooftop and later utility-scale power, which has continued driving strong growth.

Visualizing 40 years of non-linear growth

An important point to re-emphasize is how hard it is to grasp non-linear trends. Take solar since 1976. On average, module deployed capacity grew almost 40% per year while costs have fallen over 12% per year.12

What does this look like?

Solar’s growth is an excellent demonstration of the positive feedback loop we’ve discussed for manufactured technologies. Because fossil fuels are not manufactured technologies, costs do not consistently fall over a long period of time. Coal and natural gas plants do exhibit learning rates but the cost of the fuels themselves have trended up over the decades as easy-to-extract resources become depleted, driving operating costs higher.

Now if someone had just glanced at this chart, they might have assumed that the capacity of solar installed was basically zero until 2000. They might also think that solar module prices have been close to zero since the early 2010s.

They’d be wrong on both counts. The compounding growth and cost reductions drive massive changes in scale that are hard to read on linear axes.

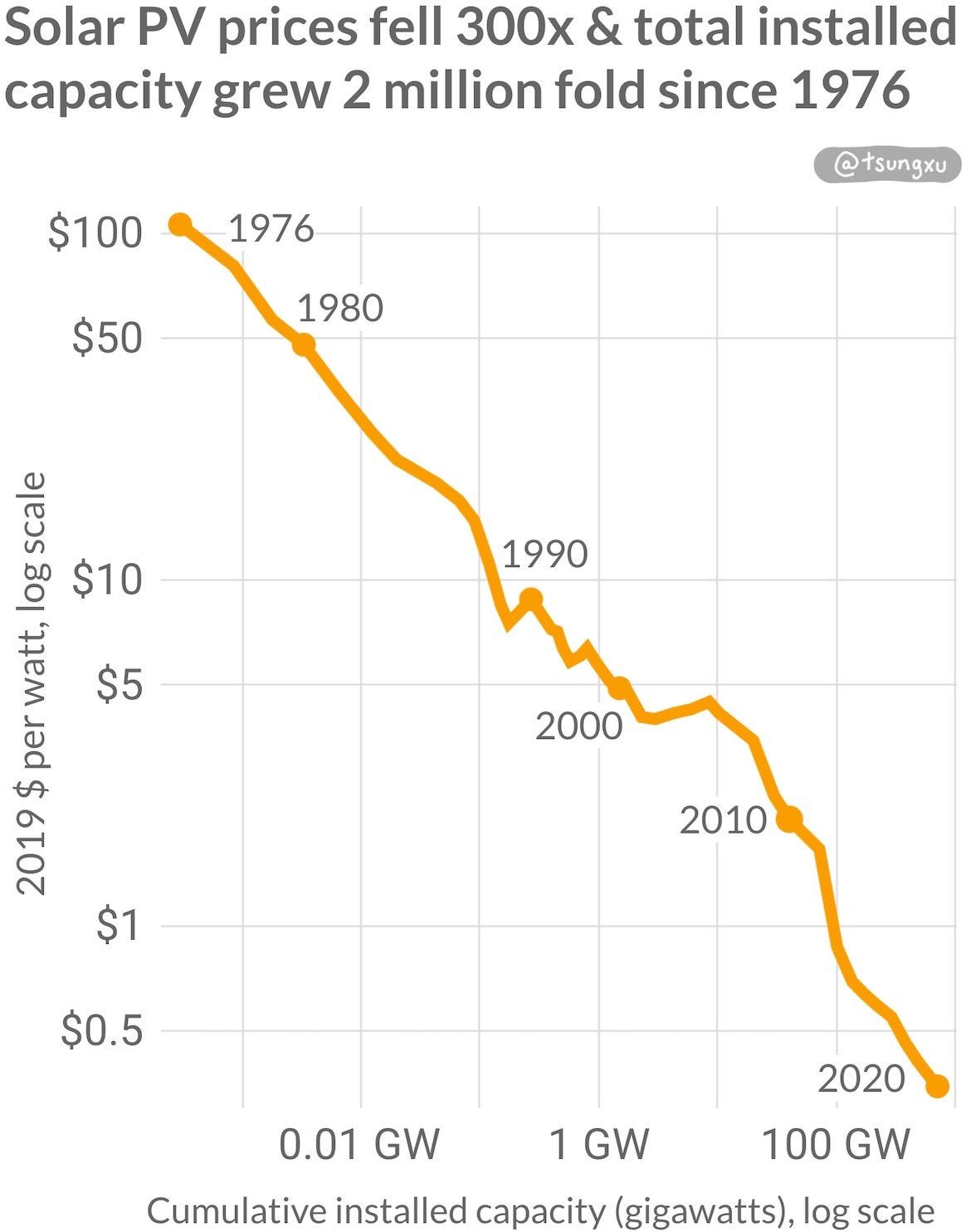

There’s an initially harder to read, but much more useful way to express such large changes, as shown in this chart. Use log axes, make the x-axis cumulative capacity and mark time on the data series itself.

As we can see, solar’s growth and cost reductions have been very consistent over multiple decades, with some bumps (lasting a few years) along the way. The last ten years have seen the largest relative cost reduction ever. As we’ll discuss later, it does not look like solar’s growth is slowing down.

A short history of solar’s growth

In 1954, Bell Labs developed the first silicon solar cells. By the late 50s, early solar PV modules were used to power radio transmitters on US Navy satellites.

During the 1960s, the US government procured $150M for 10 million solar cells, as well as glass and solar PV components. They would also invest into solar R&D during the 70s as a response to the oil crises.13 This helped to drive down solar costs an impressive 5x from 1974 to 1981, despite still being a small nascent market with US industry sales only at $100M in 1982.

Through the 70s and 80s, Japanese companies like Sharp continued to find more niche markets for solar, such as lighthouses and consumer electronics — remember solar-powered calculators? They overtook US producers by the early 80s but had stagnated by the 90s when there were no larger markets to sell into.

Meanwhile California was gearing up to play a catalytic role in both solar and wind scale-up. There was newly introduced clean energy legislation and expectations of continuing oil price rises after the 1979 energy crisis. These allowed around a billion dollars of both wind and solar thermal projects to be financed and built before oil prices reverted.

In the 90s and 2000s, Germany would grow to become the biggest market for solar PVs at the time by far. Policy played a huge role, subsidizing over €200B of rooftop solar and accounting for over half of global PV installations during 2004 to 2010. German manufacturers like Q-Cells scaled up to serve the market, but by the mid 2000s, Chinese startups were rapidly taking market share.

In the early 2000s, China’s emerging solar startups executed faster and benefited from timing to scale up with the German market. Most importantly, they had a relentless focus on good-enough quality and low cost, which their German competitors did not. German manufacturers also had to develop more bespoke manufacturing equipment (often adapted from the semiconductor industry). But when later purchased by Chinese companies, the equipment had become more standardized and cost less.

The Chinese are better at building [solar PVs] than anyone. The US, Japan, and Germany were simply not fast enough to recognize the market opportunity, much less meet it… [Chinese companies were] hiring quickly, producing quickly, and improving quickly.

— Prof. Greg Nemet, How Solar Energy Became Cheap, Pg 135

From 2000-2007, in the first 7 years of some of the first startups launching, more solar PVs were installed globally by Chinese companies than by any other country. They raised $7B in IPOs during 2005 to 2007. Beginning in 2009, the Chinese government became very supportive of the industry, giving tens of billions in tax credits to solar manufacturers to accelerate scale-up.

Other regions with plentiful sunlight started to offer policy incentives. Australia and California offered feed-in tariffs introduced in the late 2000s, helping accelerate global adoption.

In 2008, a shortage and price spike in polysilicon, the main material for PVs, bankrupted many solar manufacturers. It also motivated overbuilding of capacity in the solar supply chain which then helped fuel the 2010s boom.

Since 2005, global installation capacity has been growing at a blistering 44% CAGR. Over 60% of the solar modules are made in China, a point that policy makers and manufacturers in the US and EU are now looking to change.

2.2 Falling Costs Have Opened Up Larger Markets

Electricity from solar and wind power are very cheap today.

Cost over the lifetime of an electricity-generating asset is calculated with the levelized cost of electricity or LCOE. Recall at the start of the post I mentioned tipping points for the cost of electricity from solar and wind.

We can show this new tipping point in the chart below. New project LCOE is cheaper than new-build natural gas, and is competitive with existing gas plants in the US. These clean energies have been cheaper than newly built gas plants for years — a previous tipping point.

14In the chart above, the solar and wind LCOEs are unsubsidized. They are even more competitive with existing gas plants when taking current US incentives into account. With incentives, solar is five cents per kilowatt hour cheaper in 2021, at $0.023/kWh. Wind is incredibly cheap, falling fifteen cents per kWh to $0.009/kWh.

The LCOE of new solar and/or wind plants are competitive with, or even cheaper than, running existing coal or gas plants in many other countries. For example Australia, most of Western Europe, China, India and others. The cheapest fossil fuel plant is location dependent, and can be either coal or gas.

Reaching this cost tipping point has started to heavily discourage new coal or gas power plants from being built. In 2020 globally, 82% of new electricity capacity was from renewables.

In the US, no coal plants have been added since 2014 as shown in the chart below. Gas plants added only 10% of new electricity capacity in the first three quarters of 2021, compared to 57% only three years ago.

Learning curves for solar and wind are global, so that more deployments in early-adopting countries help bring down costs for others. This is great news for developing countries too, where solar’s growth is also accelerating.

India increased its solar capacity 600x between 2010 and 2020, and is currently only behind China, the US and Japan in total installed capacity. Vietnam added more solar capacity in 2020 than every country except the US and China, as foreign banks shun coal there (as they’ve done in many countries).

2.3 Solar’s Growth Keeps Being Underestimated

Solar PV has sustained high learning rates. Since 1976, every doubling of solar capacity has led to 20% reduction in cost, driving 300x price fall as capacity scaled 2 million times.

This is an example of Wright’s Law that describes a consistent fall in cost for every doubling of production. It’s been observed for making everything from airplanes, the Ford Model T, semiconductor RAM, and lithium ion batteries. Wright’s Law may even be better suited for predicting semiconductor production than Moore’s Law.

Almost no one has been optimistic enough about the speed of solar’s growth and cost reductions. This is despite Wright’s Law holding well for solar over more than four decades.

An Oxford team recently analyzed historical forecasts for solar PV, wind and other energy transition technologies. Not surprisingly, models consistently underestimated the growth of solar as well as the speed of continuing cost reductions. In their working paper, they wrote:

“Such models have consistently failed to produce results in line with past trends.”

They concluded, not surprisingly given solar’s rather consistent learning rate that:

“In contrast, forecasts based on trend extrapolation consistently performed much better.”

What about the predictions of industry founders, insiders, and experts?

Gregory Nemet, author of How Solar Energy Became Cheap, wanted to see. Between 2008 and 2011, he asked 65 leading solar business pioneers, policy makers and academics to predict the cost of solar in 2030.

In 2018, reality had already exceeded the expert forecasts twelve years early. The cost of solar-powered electricity was already lower than the median predictions for 2030. Remember, these were not pundits, but people who had built the industry.

The IEA, the world’s leading energy body, and leading energy experts have consistently underestimated solar’s growth for the last 20 years. What has happened to solar’s cost in the last 10 years was over a decade ahead of expert predictions.

Why have models and experts been so wrong?

I think in short, solar has expanded into larger markets faster than anyone thought possible. Alongside that, it has continued to drive cost reductions in the process, even accelerating in the last decade.

As the Oxford team discussed, forecasts used arbitrary limits to growth rates not consistent with historical patterns, and just as arbitrary “floor costs” that were baked into models.

The learning rates for solar have been faster since 2010 than in previous decades. As discussed earlier, learning rates in the last decade were almost 35%, above the long-term average of 24% since 1976.

There are several reasons why the LCOE of solar has been falling even faster than the historical average. Solar PV technology keeps improving as production ramps.

One group who clearly did not get the forecasters’ slow-growth memos were the solar manufacturers. They increasingly benefit from economies of scale and standardization in manufacturing. Solar projects are increasingly being built at utility scale, which are now up to multiple gigawatts in size. This has enabled even more cost reductions with lower non-module costs for utility scale solar projects. Finally, solar PVs are becoming more durable with longer warranties being offered over time, with one large manufacturer now offering 40 years.

2.4 Intermittency

Intermittency is the problem of the sun not always shining, and the wind not always blowing.

As more solar has been added to grids like California’s CAISO and South Australia, there can be sunny days with too much solar for the grid to handle (the duck curve phenomena). In grids with high solar penetration like the two mentioned, it creates a need for resolving daily intermittency.

There is also the problem of longer-duration intermittency which can be for several days or seasonal mismatches. In an area where one winter is particularly cloudy, solar capacity can fall by half or more over a month vs the yearly average.

Solutions are at hand though. For shorter durations, big lithium ion storage projects provide up to four hours of viable storage for renewables with current unit economics. Eight hour storage projects are starting to appear. The first grid-scale deployment was by Tesla in South Australia in 2017, with the state having not endured a blackout nor needing to “shed” any clean energy since then.

Storage paired with solar can add more value to high-renewable grids than storage alone, especially during peak evening hours. Also, as battery prices continue to fall, longer duration storage, perhaps 12 hours will be possible. We will talk more about batteries and the storage market in the next section.

Longer duration storage has many clean energy solutions like pumped hydro, mechanical and various electrochemical solutions like iron-air batteries. There’s no shortage of funding for these emerging technologies. It’s still too early to tell which technologies will scale, but likely those that use low cost materials and have high learning rates.

Finally, the grid might not need as much storage as you’d think, though we will need a lot.

A recent paper published in Nature models that if solar and wind provide 1.5x of all electricity capacity, only 3 hours of paired battery storage would perform well. It would result in electricity shortages during less than 200 hours per year. Likely even less shortages would have been modeled if distributed batteries (say in electric vehicles) were included in the analysis.

2.5 Transmission upgrades

Transmitting utility-scale clean energy from solar or wind-rich areas requires more high voltage transmission lines to be built. These lines are often expensive, and get bogged down in permitting red-tape that can take 10 years for approval and deployment.

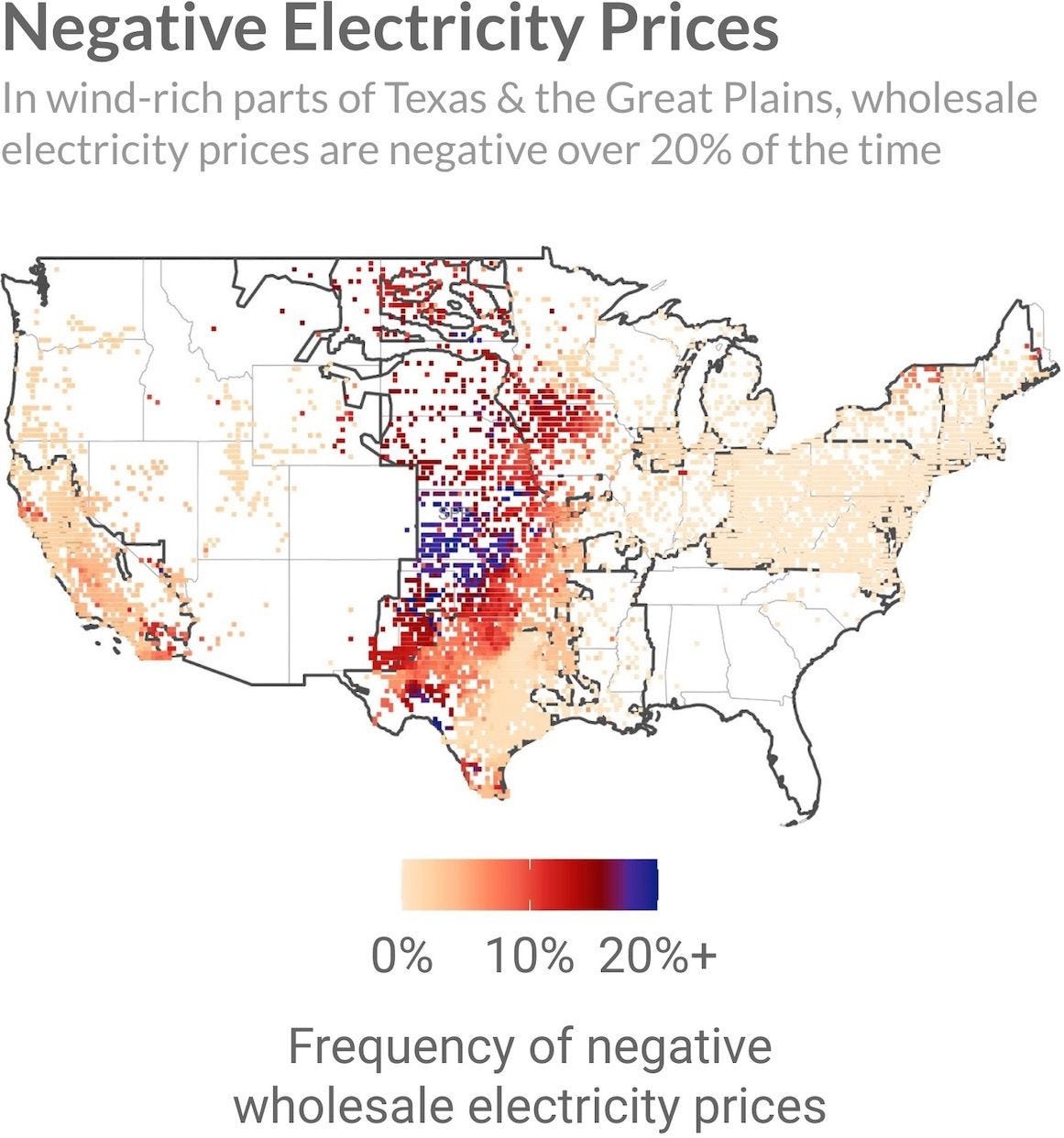

Of course, we only need transmission lines in cases where clean electrons are generated far away from where they are used, like urban centers and manufacturing hubs.

To move faster and get access to cheap, clean electrons directly, electricity-hungry industries are increasingly co-locating next to solar and wind plants. This way, renewables developers avoid paying interconnection fees whilst new industries powered on ultra-cheap electrons can get the cheapest juice possible without a utility acting as middleman. We’ll talk more about this later.

The other side of this is of course, installing smaller-scale solar projects in areas where energy is already used. Rooftop solar, microgrids and energy storage for homes and industry are growing. These distributed energy resources (DERs in energy-speak) can keep the lights on during extreme weather events even if all power lines into a city go down.

In many scenarios, more transmission does need to be built. To enable more utility-scale solar and wind power requires reform and infrastructure upgrades. This space has seen promising activity by US regulators recently and bills that allow for faster transmission buildout along roads and railways. There are also startups working on increasing the capacity of existing lines and optimizing them.

In reality, most countries are scaling both distributed and utility-scale clean energy as both types offer value in addition to being low carbon.

2.6 Strong Growth Ahead Is Likely

Solar and wind power are likely still very early in their adoption and will continue to see strong growth. The following points make my case.

Solar and wind keep driving down costs as deployment scales

The cost of solar-powered electricity has declined 35% per industry doubling in the last decade. The learning rate is faster than the 24% rate seen since 1976, but makes sense given the rapid growth and competition of Chinese manufacturers since the mid-2000s discussed earlier.

No physical cost constraints for at least the next decade

There is plenty of land and materials like silicon for scaling up solar PV production. Newer panels are built to last longer. Solar PV technologies are still maturing, with room to drive down costs further. Examples include increasingly standardized manufacturing, better materials that improve cell efficiency and designs such as bifacial or double layer with higher efficiencies, and even anchoring panels directly to the ground to save on system and labor costs.

Looking at the last decade, the CAGR of solar-generated electricity was almost 40%, which outpaced the growth in annual capacity additions of just over 33%.15 This likely was helped by improving solar capacity factor from an increasing number of utility-scale projects using sun trackers as well as more efficient solar cells and otherwise improved manufacturing processes.

Solar and wind outcompete fossil fuels in many places

New utility-scale solar or wind projects are already cheaper than running existing coal and natural gas plants in countries making up 46% of the world’s population. As shown in the chart below, solar is cheapest for China, India and most of Western Europe; wind in Denmark, Brazil, UK, Morocco and others. In the US, 61% of existing coal plants are more expensive than renewables. Solar and wind are competitive with running existing natural gas plants.

As mentioned before, 82% of new electricity generation globally was from renewables in 2020. Coal is in near terminal decline, with proposed plants being canceled at a historic rate. Natural gas use for all uses including electricity, fuel and heat may have peaked in the US in 2019. The decline of gas for electricity generation likely will be accelerated by the late 2021 global spike in prices. As solar and wind become the cheapest source of electrons in even more countries, expect an increasing amount of stranded existing fossil assets.

The case to shut down and replace existing fossil plants becomes more and more compelling every year.

Distributed solar and offshore wind reduce need for transmission lines

As mentioned in 2.4, transmission upgrades are costly and take many years to even approve new utility-scale solar plants.

Distributed solar can complement utility-scale renewables. Types include residential rooftops, commercial and industrial, microgrids and offsite community solar installations.

Distributed solar, batteries and other resources can actually reduce grid electricity costs and even enable more utility-scale renewables to be built.

Solar PVs, by design, are small and modular enough to be deployed near or where it is used. Rooftop solar has boomed in countries where solar resources are great, system costs are cheap, net metering policies means high ROI, and permitting processes are fast. For example, 30% of Australian homes have already installed rooftop solar, and by 2025, solar will supply all the needed electrons at times.16

The US is a country in which rooftop solar is unnecessarily expensive. A combination of permitting costs and city-level red tape, arcane code restrictions and very high customer acquisition costs have made rooftop solar in the US far less affordable. Which of course means far less adoption. In contrast, Australia has streamlined permitting, simplified codes and lowered customer acquisition and labor installation costs. The result? Rooftop solar is almost three times more expensive in the US. The US does seem to be making inroads to reduce costs and friction though, with the SolarAPP public/private initiative to automate permitting, and California looking to pass its own bill to build on SolarAPP.

There are more rooftops being added just to enable more solar-generated electrons. EV charging stations are starting to add covered carports with solar PV rooftops, and stationary batteries. This makes EV charging sites more economical by allowing businesses to avoid demand charges, which can make up half of an energy-intensive business’s utility bill. It also allows restaurants and other commercial spaces to adopt microgrids, saving on electricity costs and having backup energy during outages.

Community solar is another promising type of distributed energy. It covers a broad umbrella of solar installations that allow the financial benefits to be distributed amongst many people. These projects could allow two third of Americans and billions globally who can’t install rooftop solar to access local clean energy. A huge benefit is community solar does not usually require transmission upgrades. US community solar capacity grew at 130% CAGR during 2010-2020, far outpacing even the overall stellar rise in solar.

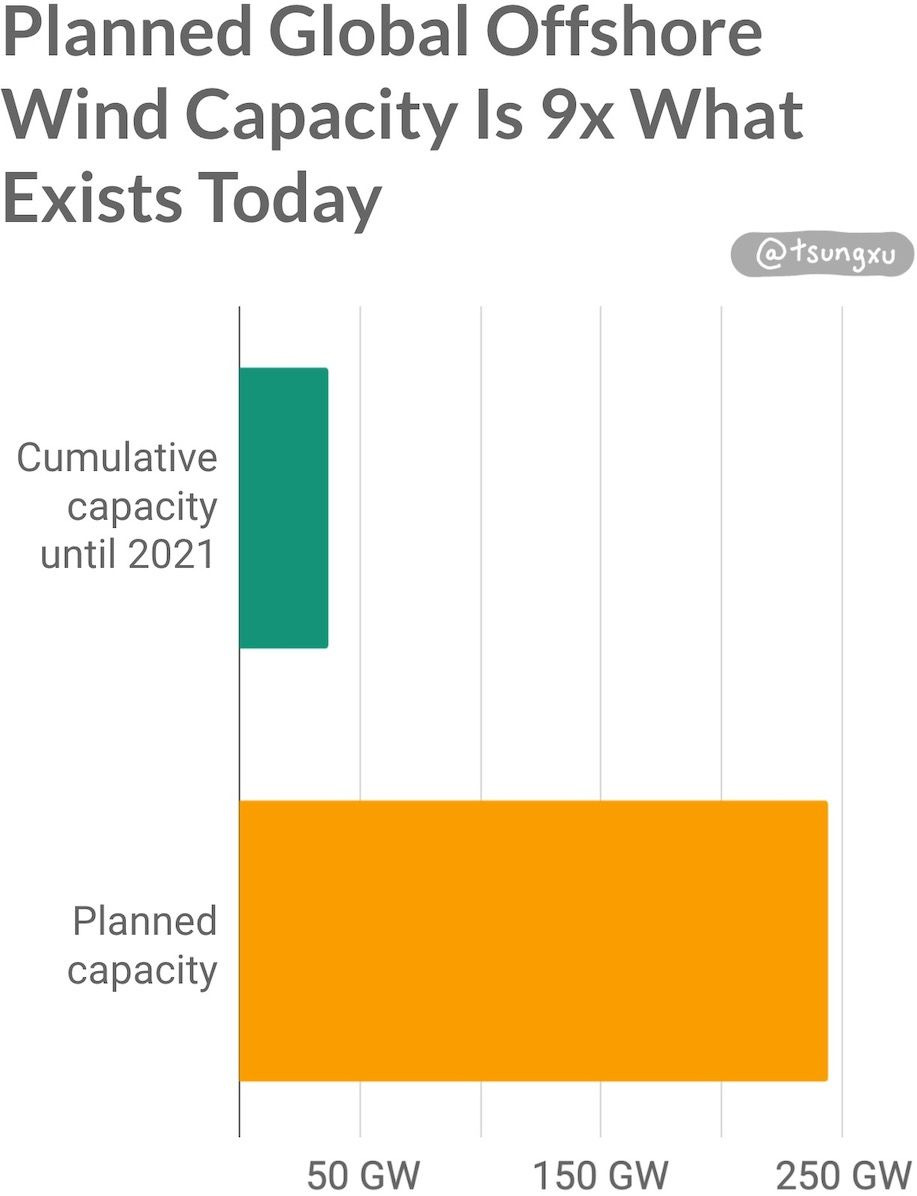

Offshore wind turbines can also help alleviate transmission challenges, being located near energy-hungry coastal population hubs. Capacity of global offshore wind farms rose 11x from 2010-2020 (27% CAGR). Even more growth is ahead, with nine times the amount of current capacity in the pipeline, as shown below. Wind speeds at sea are higher, more consistent and often peak when most needed during afternoons and evenings.

Wind power will continue getting cheaper. Electricity costs from offshore wind globally have fallen by nearly half in 10 years, with a 9% fall in 2020 alone and auction results suggest another 40% fall by 2023. In the US, the booming queues of offshore wind projects are very promising, but require some transmission issues to be resolved. Finally, offshore wind resources are especially abundant closer to Earth’s poles, making them very complementary for equator-favoring solar power.

Not to be outdone, onshore wind turbines at end-of-life can be repowered. This means much of the structure can be reused and new turbines be installed, saving on costs and eliminating lengthly interconnection delays and costs. This has already been happening in Denmark for example.

New uses for solar PV will continue to be found. We tend to think solar PVs will only be used to produce electricity. But we will likely see more novel uses and integrations as solar keeps getting cheaper.

One example is the growing momentum for building-integrated PV (BIPV) systems. These systems can replace existing facades, like for the Swiss building in the photo below, or replace rooftop tiles/shingles (think Tesla’s solar roof).

Another example is solar PV that can produce water. Source Global deploys “hydropanels” that make clean drinking water using solar PVs to condense water vapor. It is being used for remote communities and for water conservation in drought-stricken areas like California’s Central Valley.

2.7 What About Nuclear Fission and Fusion?

Nuclear power has tremendous potential, and the promise of abundant fusion power is worth accelerating R&D into.

There’s a lot of chatter amongst some Silicon Valley engineers and Twitterati about the promise of nuclear energy, which I in part agree with. Yet they have, like most everyone else, vastly underestimated the growth of solar and wind and some have acknowledged this more recently.

Around 10% of the world’s electricity is generated by large (gigawatt scale) nuclear fission plants. That sounds like a lot, but it has fallen from a high of over 17% in the mid 90s, mostly because of increasing public safety concerns over meltdowns like Fukushima, Chernobyl and Three Mile Island. Cost blowouts and cancellations have made large nuclear plants uncompetitive with solar or wind energy.

Despite these accidents, current generation nuclear power is very safe. In fact a hundred times more so than fossil fuels. Small modular reactors (SMRs) and next generation designs are likely to be even safer. However, these emerging technologies still face long project delays and cost concerns for buyers especially in developed countries. Other countries show some more promise, with NuScale, a leading SMR company, having plans to build an SMR plant in Romania by the late 2020s.

A promising strategy may be to carve out a compelling niche, avoiding competing on price with low cost renewables. Micro-reactors like Oklo are targeting remote communities that rely on diesel whilst NDB is developing tiny nuclear waste-powered batteries for consumer electronics that never need charging.

As for fusion, more R&D is a no-brainer. Rather than using a tiny fraction of sunlight emitted by the sun’s continuous fusion reaction, we should be building our own safe mini-star fusion reactors. A key step to progress fusion is a demonstration plant producing more energy than it uses. As dozens of well funded companies and public consortia resolve the early technical hurdles, progress has been promising.

Despite the R&D progress, the technology is still likely still at least two decades away from commercialization. By then, as we’ve shown, it is likely solar, wind and batteries will be so cheap as to make it very hard for early commercial fusion designs to be cost competitive in generating electrons. A possible path for fusion in the 2040s or 2050s would also be to scale up in niche markets, perhaps where heat can be directly harnessed.

It is inevitable that fusion, next-gen fission and/or other clean energy technologies will largely replace solar, wind and batteries one day. That’s the nature of energy transitions as we’ve seen.

3 Storage: Batteries, EVs and More

Lithium-ion batteries (LIBs) may be the most underrated technology today.

For years, LIBs have powered our phones, electronics, power tools and even pacemakers and hearing aids.

They run quietly and reliably in the background but it’s hard to imagine living in a world without them. Since they were commercialized only thirty years ago, these batteries have become something we take for granted,17 but already power so many tools we depend on.

LIBs are still in the early days of growth. Prices have tumbled over 97% since 1991, and continue to fall. Battery capacity has risen by over 6 orders of magnitude in that time, with the learning rate being about 18.9%. I.e. prices falling that much for every doubling of production. Sounds like solar’s growth right?

Many developments in technology and processes have continued to improve energy density and cycle count. Gravimetric energy density is up over 3x from ~80 Wh/kg in Sony’s original 1991 design to now almost 300 Wh/kg. This allows battery makers to offer 6 year and 600,000 km (370,000 mile) warranties on their batteries, and Tesla has said their Model S/X batteries still average 90% capacity after 200,000 miles.

Enabled by these improvements, growth is accelerating for these large, linchpin LIB markets. In 2021, EV sales more than doubled in just one year. US storage deployment is set to more than quadruple in 2021, after tripling in 2020!

In both battery markets, the rapidly falling cost of batteries have reached tipping points. They are increasingly allowing ICE car cost-competitiveness for EVs. Also, the cost reductions enable more economically viable deployment of grid storage either as standalone sites or (increasingly) paired with solar.

3.1 LIB Adoption Is Even Faster Than Solar

The rise of LIBs has been simply extraordinary so far.

John Goodenough, then at Oxford, developed a proof-of-concept in his 1980 research with cobalt oxide as a stable cathode. Five years later, Akira Yoshino developed a commercially viable battery based on the work of Goodenough and others. His employer and Sony would commercialize in 1991, initially in a bestselling camcorder, which its competitors like Panasonic quickly copied.

In the 90s and early 2000s, LIBs cornered the market for portable electronics, expanding into laptops, mobile phones, iPods and more. Costs plummeted, as you can see in the chart below. This market continued to grow as battery energy density improved. Not long after, lighter and more power-hungry devices like drones started hitting shelves and battlefields.

By the mid-2000s, cost reductions slowed as saturation in the consumer electronics market slowed growth. People were not buying new tech gadgets as quickly as they used to. Also, the small size of each device’s battery was contributing less and less to LIB deployment over time.

This changed with the rise of electric vehicles (EVs). The first LIB powered EV was Tesla’s Roadster. It launched in 2008 using existing reliable existing 18650 sized battery cells. These cells, assembled into custom battery packs, were actually designed for laptops — no batteries were built for EVs specifically at the time.18 Portable electronics literally provided the first batteries for commercializing EVs. Now, a Tesla Model 3 has the capacity of about 4000 iPhones.

The equally interesting, but less often discussed side of LIBs is how production scaled. Chinese battery cell manufacturers achieved 73% of global production in 2019. By then, the Chinese had rapidly surpassed Japanese (remember Sony?) and South Korean manufacturers who had previously led. They did this by focusing on the booming EVs and storage markets, and not electronics. Generous government incentives and policies dating back to 2009 also helped tremendously. Unlike the scale-up of solar manufacturing there, the public sector took more initiative in developing the battery supply chain before winners emerged.

No surprise: this growth has been underestimated

Much like solar, LIB prices have fallen twice as quickly as “optimistic” forecasters like BNEF and Navigant predicted. This has driven underwhelming estimates in the adoption of EVs and energy storage.

Let’s first look at EV forecasts. In 2015, the US Energy Information Administration (EIA) predicted that only 20,000 EVs with 200+ miles of range will be sold per year by 2040. In September 2021, the US sold almost 30,000 EVs in one month. In the last 5 years, BNEF and others just keep raising their projections for EV sales. Not surprising.

For energy storage, Wood Mackenzie, a leading energy consultancy, made a forecast in 2018 for US sales in 2023 to be $4.6B. Only three years later in H2 2021, they had to raise it by two thirds to $7.6B.19

It’s really hard for people to grasp how quickly high learning rate technologies like solar and LIBs can grow. Even Tesla has been surprised by the recent growth in demand for EVs.

3.2 EVs Are Rapidly Replacing ICE Cars

“There appears to just be quite a profound awakening of the desirability for electric vehicles. And to be totally frank, it’s caught us a little bit off guard… we’re not able to increase production capacity fast enough.”

— Zachary Kirkhorn, Tesla CFO (aka “Master of Coin”)

EV market growth is exceeding most expectations.

In 2021, people buying EVs are no longer just eco-warriors or Tesla fanboys. There are more and more reasons to buy an EV car like price, performance, cheaper cost of ownership, range, improving charging infrastructure and more EV models every year.

As you can see from the chart below, global EV sales keep growing, with 2021 being an inflection point.

Light electric vehicle sales globally have grown 57% every year from 2013 through 2021. There’s around 12 million purely electric passenger cars on the road in 2021. Around 4.3% of global car sales in the first half of 2021 were fully electric.

Growth is so rapid that every month, EVs are taking share from ICE cars. Leading the way in December 2021 were Western Europe with 20% and China with 17%. These markets led with far more vehicle selection and policy support vs the US other markets. The US is a few years behind at current growth rates, with EV’s making up less than 3% of 2021 passenger vehicle sales.

We’ve already talked about the dramatic fall in LIB prices. However, they do still account for about 30 percent of the cost of an EV, and have plenty of room to come down as learning rates continue. Upfront purchase cost is already competitive with ICE vehicles, with government incentives, particularly in China where EV market competition is fiercest.

Within a few years, EVs will reach price parity without incentives as battery prices keep falling. Even now, plenty of research has shown that lifetime cost including maintenance is lower for EVs.

EVs design affords less constraints and more interesting models. Removing a bulking engine means storage in the frunk. The best selling EV in China weighs only 1466 lbs (665 kg) and is less than 3 meters long. The first electric pickup truck, the Rivian R1T, has very high ground clearance for better offroading. The Rivian model even has an optional camp kitchen set built into their “gear tunnel” under the back seats. This is an early example of how EVs free from engine and exhaust requirements can be designed with novel features.

The fastest production cars in a straight line are already EVs. The 5 seater Tesla Model S Plaid is faster than the $3M Bugatti Chiron and every other million dollar hypercar.20 Its battery pack weighs about the same as the engine of the Chiron, and that’s not factoring in a full tank of gasoline.

The Model 3 is the best-selling vehicle in its class in the world, despite being cheaper21 than competing Audi, BMW and Mercedes models.

We are at or close to tipping points for price, in which EVs outperform an increasing range of comparable gasoline vehicles.

As battery energy density keeps improving, EV makers can improve range or reduce battery size and cost. Range is getting closer to parity with ICE vehicles, rising on average globally from 211 km in 2015 to 338 km in 2020. Most of the best selling models sold outside of China have much more range — the 2021 Tesla Model 3 Long Range has 334 miles (537 kms), and the Mustang Mach-E RWD has 305 miles (491 kms).

Charging infrastructure is getting better all the time, though it tends to be better in areas with higher EV adoption like California, Norway or Germany. For people who can, charging at home is like plugging in any device and a much better experience than waiting at a gas station.

For apartment dwellers, charging is much harder for now. Public charging should become much easier as more charging infrastructure gets built or opened up. For example, Tesla’s global network of 25,000 charging locations is being opened up for use by cars by other EV makers.

Perhaps most importantly, there is an ever expanding selection of EVs, especially in China and Europe. There were 235 EV models in 2020, mostly in China and Europe, up from only 55 in 2015. In 2021-2022 in the US, selection is also ramping fast.

3.3 LIB and EV Producers Outpacing Tech Giants’ Growth

Internet companies have set the standard for the rapid speed of growth. Since the 90s, we’ve seen the meteoric rise of Amazon, Google, Facebook and many more since.

That made the following even more of a surprise when I ran the numbers.

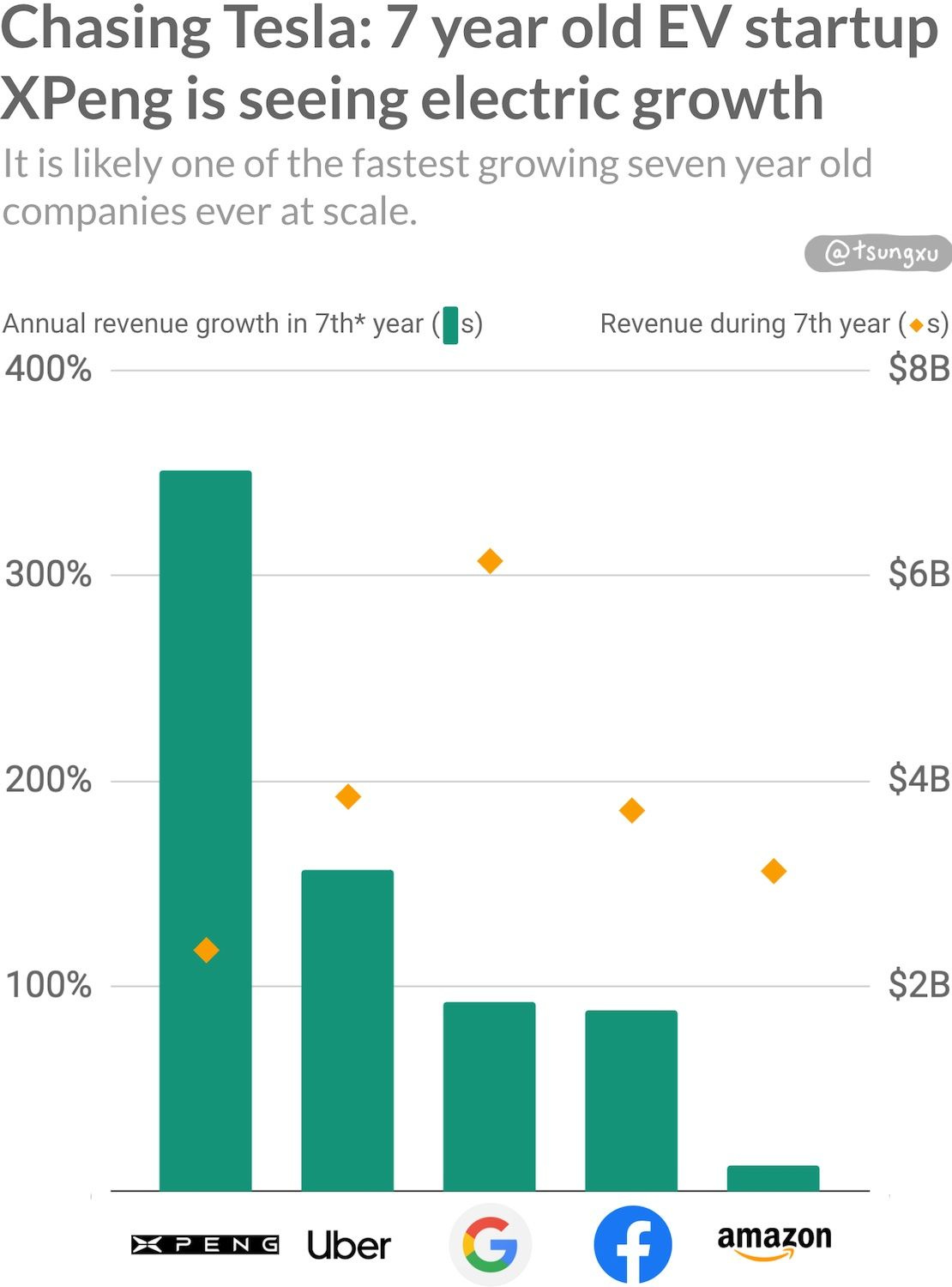

I realized that an LIB manufacturer and two EV companies have outgrown the internet giants at the same age. Growth rates are far beyond the tech companies, whilst revenues are comparable. Let’s look at these companies in turn — CATL, Tesla and XPeng.

CATL: Battery Powerhouse

So far, LIB manufacturer CATL is the largest winner from the boom in LIB production. It is ten years old, having been founded in 2011. In 2021, it was the top producer of LIBs globally with over 30% market share and growing, and has been for several years. Sales had grown to over $14B USD22 during the latest 12 months reported.

The pace of CATL’s growth is historic, as shown above. Its trailing 12 month revenue and net income skyrocketed more than 120% vs the previous 12 months. After ten years of operation, none of the tech giants were growing anywhere near as fast. Google was the only tech company that had more revenues after ten years but was growing at a relatively sluggish 31% year on year.

CATL is likely the fastest growing ten year old company ever, as measured by revenue growth. Oh, and it is already highly profitable.

Tesla: Pioneer and Leader

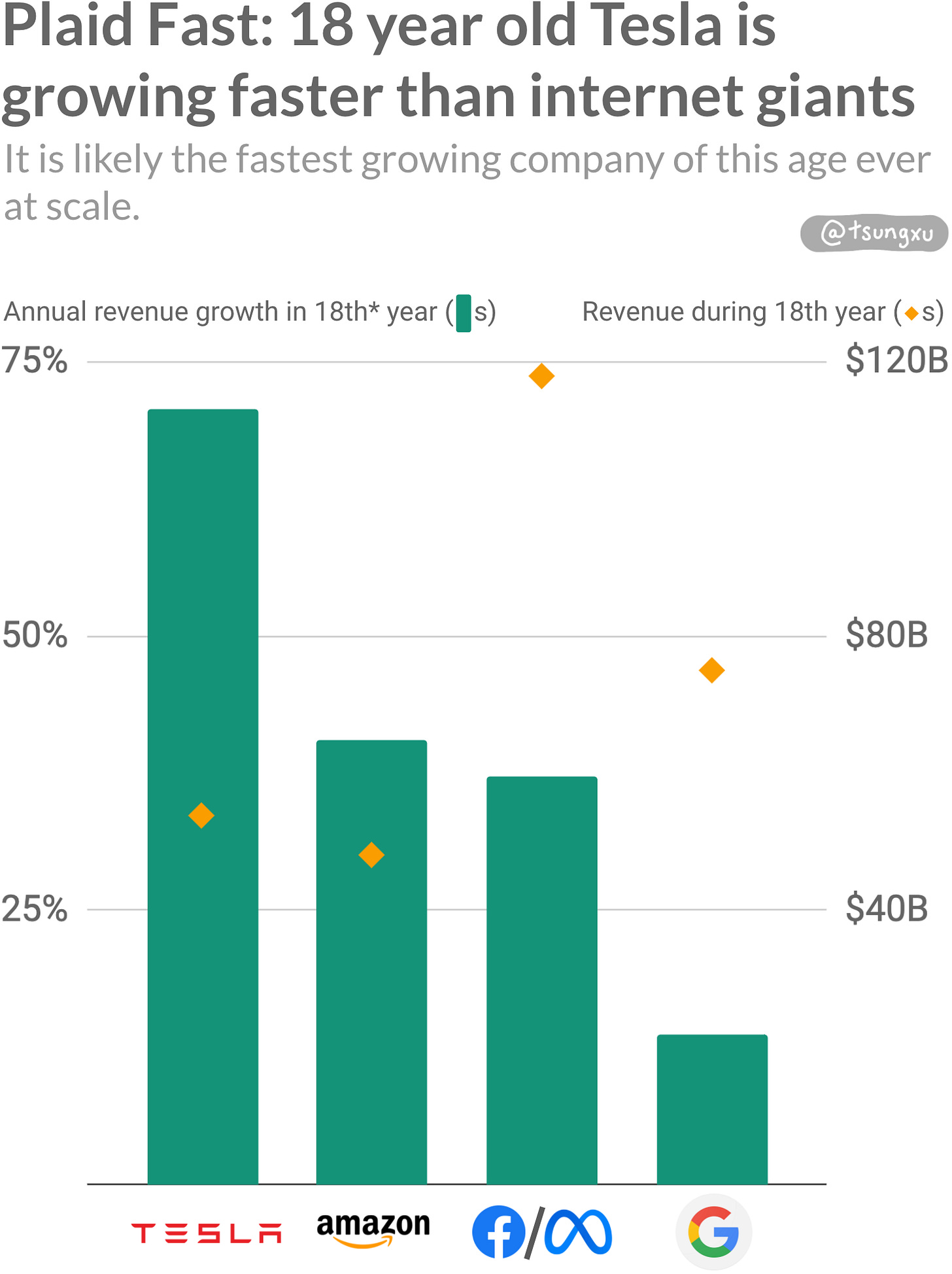

At eighteen years old, the pioneering EV company is also no slouch.

Tesla’s revenue growth also hold up very well vs tech giants, as shown below. In 2021, revenues were growing at 71% year-on-year, far faster than the tech titans at the same point in their histories, as you can see below. Facebook had much higher revenues in it's (latest) 17th year, but was not growing as fast.

Let's put Tesla's astounding growth in perspective. Neither Google nor Amazon have grown this fast for at least 15 years, going back to their earlier days at much smaller scale. Facebook has not grown this fast since 2011, again when they were much smaller.

Tesla is growing this fast, when it is already this big.

XPeng: EV Challenger

Finally, there’s the next generation of EV startups with their sights set on Tesla.

The furthest along are the booming Chinese startups. Amongst those, none have arguably have gained more traction than seven year old XPeng. They’re the first EV startup since Tesla to sell more than 15,000 vehicles in a month, and almost 100,000 in a year.

XPeng’s traction is remarkable for a seven year old manufacturer of complex hardware, software and machinery, as shown below. In the twelve months ending September 2021, revenues soared over 350% from the previous twelve months, an industry standout during China’s record. This is more than double the growth rate of Uber during 2016. Google and Facebook in their seventh years both grew revenue at around 90% CAGR, whereas Amazon had a tough seventh year with low growth.

What About Profitability?

You might think that this looks great for Tesla, CATL and XPeng when considering top line revenue, but what about profitability?

Well, even here, their numbers are quite favorable. A good metric to compare profitability is EBITDA margin, which measures operating profit as a share of revenue.

Tesla's was 21.6% in 2021, up from 5.5% in 2017 during Model 3 "production hell". Auto OEMs averaged far less, at 6.8%. CATL's EBITDA margin was 22% in 2020, and fell a little to 19.5% in 2021 when it made massive investments in new capacity to meet surging LIB demand. XPeng, investing heavily to keep up with extreme growth, had a respectable -7.9% for the most recent quarter.

Amazon had less than 10% EBITDA margin until 2018, and is still "only" at around 13%. For Q4 2021, Uber's for rides and deliveries combined was 0.3%. With less capital expenses, pure software companies like Google and Facebook do have better EBIDTA margins vs CATL. Google's/Alphabet's has been between 25-40% whilst Facebook/Meta has usually been between 42-57%.

In short, Tesla, CATL and XPeng have profitability margins that looks more like tech companies with real-world operations like Amazon than like automakers.

Unpacking this narrative violation

Ten years ago, if I had said Tesla would be growing faster than tech companies in 2021, I would have been laughed at. People would have dismissed the possibility of a lithium-ion battery maker doing the same.

Yet, today we can no longer think of internet startups as the preeminent hyper-growth companies of the world.

The incredible growth of clean energy companies is most visible today in LIB and EV makers. Solar manufacturers for panels and inverters are also large and still fast growing companies in their own right.

It’s hard to see today’s use-cases that will become tomorrow’s leading industries, but many are very likely to be riding the clean energy transition.

With such incredible recent growth in LIBs and EVs, it’s not surprising US and European policymakers have big ambitions to rapidly scale up LIB manufacturing and mining.

Redwood Materials in the US and Northvolt in Europe have raised billions to build out battery gigafactories — founders from both companies are ex-Tesla executives. Diversifying global manufacturing could not only reduce reliance on a single country, it could also accelerate battery breakthroughs and progress down the learning curve.

The rapid growth of a manufacturing and mining-intensive industry has also raised questions about sustainability and reuse. Both battery module and EV manufacturers are increasingly recycling their batteries. Tesla works with third parties and recycles batteries themselves at their Nevada cell factory. BYD, one of the world's largest EV and LIB manufacturers, designs their cells to be easily removed for reuse. Redwood Materials works with EV makers to reuse depleted cells whilst Northvolt also plans to recycle 95% of the batteries they will produce.

3.4 Storage For Grids Is Booming

The energy storage market is booming.

Stationary battery storage has historically mostly been deployed standalone. These earn revenue by helping the grid in a growing number of ways. LIBs have become cheaper, battery storage has excelled in high-renewable grids like California, Texas and Australia. They can now economically offer 4 or more hours of electron storage (and growing).