Biomanufactured materials are coming

Twenty milligrams, about the weight of a feather. Spiber's founders had only made this much spider silk protein in three months in 2008. For their first year operating, it was an inconspicuous amount and very humble beginnings.

Since then, spider silk protein startups have managed to almost double production on average every six months since 2008. These startups are closing in on about eight tons of production this year, over eight orders of magnitude more than in 2008. Spiber and others have too much demand and are hastily scaling to keep up.

This article is Part Two in a two part series about materials. Part One outlined a case on why we need a new materials paradigm. This piece dives into amazing new performance materials leading this seismic shift, how many of them have underpinnings in synthetic biology and how startups can use these materials to engineer products we've never had before.

In writing these articles, I have been learning as I go and do not have all the answers. That said, I now have conviction that emerging materials with better properties will create a new normal. As I wrote in Part One, synthetic polymers became a new class of materials that changed the world during the 20th century, enabled by fossil fuels. In the coming decades, I believe new materials will replace synthetic polymers and other materials as well as being used in completely new ways. A ton of opportunities will open up for new startups, which is my interest as a founder.

We will summarize some key takeaways before diving in.

tl;dr

The rapidly evolving synbio stack is allowing startups to be faster, better and cheaper. The technologies underpinning synthetic biology and by extension, performance biomaterials, have rapidly improved over the last two decades. A core enabler driving this is that costs of DNA sequencing and synthesis have fallen orders of magnitude, and productivity has increased similarly.

Companies making chemicals using engineered microbes, like Amyris, Geno and Lanzatech, have leveraged these improvements. Amyris and Geno have drastically reduced development times of their molecules from 2-4 years to 6-10 months or less. Amyris lowered the cost of farnesene, their first commercial molecule, fourfold in four years while Lanzatech's ethanol is cost competitive with incumbents today.

These three companies are all scaling rapidly. Amyris is at thousands of tons of production volume for squalene alone, while seeing blistering revenue growth of their consumer products. Geno is at 30,000 tons of 1,4 butanediol and Lanzatech 60,000 tons of ethanol production. Both are building new plants that aim to increase scale threefold in Geno's case and tenfold for Lanzatech in the next few years.

Biomaterials like spider silk and mycelium are scaling up at historic speeds, yet are not being talking about. Spider silk protein made by Spiber and AMSilk, the industry leaders, has grown production at an incredible ~273% compounded annual growth rate (CAGR) since 2008 (see below). They are currently at about eight tons, but are scaling up to over ten thousand tons in the coming years. At that scale and even as growth slows, it should still close in on the production volume of global 3D printed polymers. How many people would have predicted that could happen by the mid 2020s back when milligrams of spider silk protein were made in 2008?

Mycelium production is also rapidly scaling. Last year, Ecovative produced about 45 tons for a variety of uses. Their spin-off, MyForest Foods, uses AirMycelium, Ecovative's patented tech that grows mycelium in open-air racks. MyForest Foods has just opened a new commercial plant that alone aims to scale to over 13,000 tons by 2024, which will accelerate their 212% CAGR growth over the last two years. Though that plant is being used to produce fungi-based bacon, other plants that make leather and foams would be largely the same except for the strain, mycelium growth substrate (e.g. woodchips and hulls of seeds) and control algorithms.

Performance biomaterials have novel properties that surpass existing materials. Spider silk protein, algal oil polymers and squid-inspired protein are some examples of performance biomaterials we'll discuss.

Spider silk protein (AMSilk and Spiber) is lightweight, has incredible toughness, high tensile strength and is highly elastic. It's being used in cosmetics, medtech, apparel and watch straps, and is being tested by Airbus for replacing carbon fiber in composite parts on airplanes, Mercedes in interior car parts and more.

Checkerspot's polyurethanes made from an algal fermentation process are used in their direct to consumer skis and snowboards. These performance materials offer excellent damping and great low-temperature tensile strength.

Tandem Repeat's squid-inspired protein heals in seconds by applying 50°C/122°F heat and also has thermal properties for helping keep clothing cool. In a recent Nature paper co-authored by one of Tandem Repeat's cofounders, squid-inspired proteins have been demonstrated as a strong artificial muscle with possible soft robotics applications.

Though not a biomaterial, graphene has exceptional properties and is finally hitting its stride. It's being used in a wide array of industries, surging 61% CAGR from three thousand tons in 2018 to twelve thousand tons of global production in 2021. At this scale, like with spider silk protein, it may also overtake the global production volume of 3D printed polymers by 2025.

Startups that source performance biomaterials and integrate them into products are a largely untapped pathway to market.

Almost all performance biomaterials producers today partner with incumbents that make end products and distribute them. Two of the only exceptions I know of are Spiber partnering with sustainable fashion startup Pangaia and Checkerspot's own brand WNDR Alpine making skis and selling them direct to consumer.

Two benefits of biomaterials working with consumer product startups are worth calling out.

The potential to offer more differentiated products free of constraints of larger incumbents that customers can be really excited about.

These products can help pull demand forward for biomaterials producers.

Incumbents did not build the iPhone, any Tesla EV, Fitbit wearables or even Allbirds shoes. Just like in those and countless other examples, the upstarts will push the boundaries of performance materials more than any established players.

In the years ahead, I believe sustainable materials will be the norm as more producers scale up. They will become table stakes for tomorrow's products and no longer be a differentiator. Ambitious consumer startups will need to push performance boundaries to drive more adoption.

The future potential of these materials is enormous, and hard to fathom this early in their ramp up.

The novel properties of biomaterials and scalability will improve existing products and unlock new products that do not exist today. Using multiple performance biomaterials in one product will become more common and enhance the product's benefits. Engineering them together with other technologies will also increasingly happen.

Possible applications will include self-repairing smart clothing, biocompatible human-computer interfaces, electric propulsion vehicles (especially next-generation aircraft), and in humanoid robots as artificial skin and muscles.

That's a summary of what to expect in this piece. Now let's dive deeper into each of these ideas starting with the synbio tech stack. We'll see how it has enabled companies like Amyris, Geno and Lanzatech to build better, faster and cheaper and how that bodes well for performance biomaterials as they scale up.

The synbio stack is a key enabler

Let's cover some brief definitions to level set.

Biomanufacturing is the use of biological systems that have been engineered, or that are used outside their natural context, to make a product. It is enabled by synthetic biology (synbio), an interdisciplinary domain that involves the application of engineering principles to biology.

From this, biomanufactured materials refers to materials produced using engineered biological systems. Examples of biological systems include submerged, solid state or gas fermentation using engineered microbes, cell-free systems using enzymes as catalysts and finally mammalian cell cultures. Note: when I mention fermentation or microbial fermentation in this piece, it means submerged unless stated otherwise.

Biomanufactured materials is a mouthful, so I use ‘biomaterials’ for short. Just be warned that this term is also used to describe any material that can interact with biology, like prosthetics or other material therapeutics.

So biomaterials it is. Let’s now build towards the case for biomaterials by looking at some important developments in biomanufacturing and synbio in the last few decades. These developments underpin what is happening now with biomaterials and are ongoing tailwinds for the future of the space. I’ll focus more on microbial fermentation, but there’s also rapid progress in improving solid state and gas fermentation, as well as cell-free systems.

Biomanufacturing has been quietly ramping up

The origins of synbio go back just over four decades to Genentech’s synthetic insulin, first produced in 1978. Genentech's breakthrough was the first microbe-produced biopharmaceutical drug, aka biologic.

Synbio has gone on to disrupt pharmaceuticals with biologics having grown to contribute over 32% of total industry revenues in 2018 in the US. Six of the top eight drugs by revenue in 2016 were biologics, though perhaps helped by market distortions. Fun fact: many biologics are so valuable they can be more valuable than gold on a weight basis. This super-high value product shows two interesting points. First, a $300B+ global biologics market is not niche in a monetary sense, but in terms of the quantity of biomanufactured goods, this is still a relatively low volume market. This is a classic example of high value, low volume which often serve as beachheads for nascent technologies. Second, the stratospheric price means biologic developers did not have to worry about optimizing product titers (concentration) in their process.

Companies making lower value products (basically everything else) did have to focus on titers and costs.

As titers improved for fermentation, startups began focusing on lower value products. Around twenty years ago, companies like Amyris, Genomatica and Lanzatech were founded to use fermentation to produce various chemicals. Encouraged by high oil prices, many of these Cleantech 1.0 companies focused on making biofuels and raised a boatload of capital during the late 2000s. Unlike the three companies above, most did not survive. Many that died did not pivot away from trying to make biofuel unit economics work.

Amyris, Genomatica and Lanzatech are amongst the survivors. They have started gaining strong traction in markets where petrochemicals or corn starch have been incumbents for decades.

Amyris survived a costly biodiesel foray and pivoted to becoming a vertically integrated health and cosmetics company. Their fermentation process first produced high-purity squalene at a far lower cost than can be extracted naturally, and has come to dominate the global market with 70% share or over 1500 tons per year. Amyris has also expanded to produce 12 other higher value ingredients using fermentation of engineered yeast. Further, they have found exceptional product market fit for their consumer products with direct to consumer (DTC) being a core driver of growth for new product launches. Aided by DTC success, their consumer business has grown at 133% CAGR since 2019 to $77M in the first half of 2022. Their consumer business now accounts for the majority of their revenues.

Genomatica (now Geno) has been slower growing in recent years than Amyris, but by targeting lower value commodity chemicals, has scaled fermentation capacity even more. Their first target molecule was 1,4 butanediol (BDO), a chemical intermediate used for various polymers like spandex with annual global capacity at 2.5 million tons. More recently, they've expanded to make nylon intermediaries and personal care ingredients. Rebranded as Geno, they are more than 3x'ing their BDO capacity in two years from 30,000 tons to over 100,000 tons per year in 2024. By then, they will have about 4% the global market. It's worth noting they sell their ingredients B2B, and have grown annual revenues at 37% CAGR from 2016 to 2021 to $48M.

Lanzatech produces ethanol and more recently, sustainable aviation fuel (SAF), ethylene and other commodity chemicals. Unlike Amyris and Geno, they use gas fermentation technology, which is less established than using crop-derived sugars. Their process feed syngas, a mix of carbon monoxide and hydrogen, instead of sugars to their microbes. Lanzatech's demo-scale plant in Georgia and first commercial plant produce about 60,000 tons per year combined and their product is already cost competitive, even with first generation plants. They are building seven new plants and another seven are in engineering. These plants will allow them to ramp capacity about 10x to 600,000 tons per year of ethanol, SAF and other chemicals.

These low value chemicals are multiple orders of magnitude cheaper than biologics to make. To viably produce these molecules, the underlying tech stack of synthetic biology had to improve exponentially in the last two decades. Strain and metabolic engineering had to improve. Iteration cycles had to accelerate. All of this happened.

Synbio stack: faster, better, cheaper

We can see just how quickly synbio has improved by thinking of synbio as layers in a stack. As we'll see shortly, these improvements have enabled Amyris, Geno and Lanzatech to accelerate their progress. Biomaterials companies have also benefitted a ton (yes, a pun).

This image above gives a good high level example of a synbio stack. See Amyris featured in the application layer, as well as a couple of biomaterials companies we'll touch on later. A couple of other frameworks are worth pointing out. Drew Endy at Stanford articulates abstraction layers for synbio clearly and simply in many publicly available speeches. Elliot Hershberg has laid out a more recent outline of the synbio stack on his Substack.

The notion of a stack comes from software. For example many teams that built a v1 of a web applications historically (e.g. Wordpress blogs) used a LAMP stack consisting of Linux, Apache, MySQL and PHP software layers. Cloud, containerization and other more recent developments have abstracted away or simplified more layers of the tech stack. This has, among other things, allowed founders to build faster and more cost effectively and software engineers to focus more on development rather than worrying about provisioning and maintaining servers.

The most surprising thing about the synbio stack was just how fast the whole synbio stack was improving.

DNA sequencing and synthesis costs have been falling at a super exponential rate for decades, as shown here and known as the Carlson Curve. Meanwhile the speed of DNA sequencing and synthesis has similarly increased at a super exponential rate, as shown below. Note the vertical axis is log scale for both charts. The cost of sequencing a human genome has fallen from $100 million dollars in 2001, with the first ever human genome taking 13 years to sequence. Today, they are as cheap as $100 in as little as five hours. The workhorse microbes used for most fermentation processes today, S. cerevisiae and E. coli, have four and three orders of magnitude less base pairs in their genomes vs humans.

Engineering of microbial strains have also been rapidly improving. Strain engineering really helps startups that are looking for an optimal strain, usually of e. coli bacteria or s. cerevisiae yeast, to produce a molecule with specific traits. One startup, Inscripta, offers a gene editor in-a-box that allows companies to test hundreds of thousands of genetic variants in days. For example, Ginkgo used Inscripta's product to develop strains 10x faster and halve their Design-Build-Test-Learn cycle time.

There are many more examples of the synbio stack helping make development and early stage biomanufacturing faster, better and/or cheaper. Want to run more experiments but don’t have lab space? Cloud labs have got you. Too much pain using software not designed for bio to run experiments? Benchling can help. How about abstracting away cloud compute infrastructure for bio? Latch will do it. Need fermentation capacity? You can do it in the cloud with Culture, or use various contract manufacturing organizations (CMO). Strain development not core to your startup's value? Ginkgo or a contract research organization (CRO) has you covered. Most of these companies were founded in the last ten years.

That’s just a brief sampling, but the picture is clear. The synbio stack makes biomanufacturing better, faster and cheaper. Amyris, Geno and Lanzatech are amongst the many companies to have taken advantage of these trends. Let's have a look at how they've done it. This will be instructive in how biomaterials startups are starting to do this as well.

Amyris has accelerated time for molecules to go to market by 80%, and are gaining traction in markets faster. Meanwhile, development time has fallen six fold from over 36 months for their squalene molecule in 2012 to about 6 months years for molecules launched a few years ago. Geno's BDO took 27 months to reach a commercializable titer (50 g/L), whereas their second molecule only took 10 months, and is probably faster today as this was back in 2014. To be fair, both Amyris and Geno have developed platform molecules which they can use as building blocks for chemicals and other products. Amyris’s farnesene is a good example, as it can be made into squalene, hemixsqualene and other fragrances which are used in several of their brands.

Costs to biomanufacture have come down too. In 2011, farnesene cost Amyris $7.8/L to manufacture, but they had lowered costs more than 4x to $1.75/kg by 2015. Lanzatech’s ethanol is at cost parity and Geno’s BDO is approaching it as they scale towards 4% share of a $17B market.

Further, better metabolic engineering and other improvements have upped titers, helping these companies and the synbio industry come down the cost curve. Geno’s BDO titer improved from around 10 g/L in 2009 to 80 g/L in 2011, reaching 140 g/L by 2016. See the chart below.

These gains have helped enable these three businesses to be amongst the first synbio companies to be closing in on industrial-scale capacity. Amongst other products, Amyris is producing 1500 tons of squalene and selling DTC in their cosmetics brands, Geno is making 30,000 tons of BDO and Lanzatech is cranking out 60,000 tons of ethanol. All have plans to ramp capacity fast and extend their platforms as discussed above.

Synbio products like these are closing in on over a million of tons of molecules capacity per year. It is ready to scale.

Biomaterials are at an inflection point

Like the companies above, biomaterials startups have employed advances in synbio technology to accelerate their progress. I’ve tracked at least two biomaterial products which have scaled capacity at stunning growth rates.

Spiber and AMSilk are leading companies producing biomaterials processed from spider silk protein. AMSilk initially focused on high value cosmetics and medical applications, whereas Spiber developed fibers for apparel. They are also targeting aerospace, mobility and other industries. In the first paragraph, recall Spiber made only 20 milligrams of spider silk protein in solution in 2008. It took three months to make this amount, as shown in this image from a talk by the founder Kazuhide Sekiyama. At that point, Spiber had not even began honing the fabrication steps needed to turn the protein into a usable material. According to C&EN, Spiber's capacity in 2021 was "several" tons per year. Let's call it two tons per year to be conservative.

Being founded in 2008, one year after Spiber, AMSilk would have also made a negligible amount around that time. They have managed to scale up though, with their protein used as a cosmetics ingredient in twenty products by 2017 to help come down the cost curve. More on that later. This year, AMSilk is on track to contract manufacture six tons of their protein in Europe alone, up sixfold from last year.

Based on Spiber's 20 mg in three months in 2008 together with their current capacity combined with AMSilk's, spider silk protein production volume has approximately grown at a stunning 273% CAGR on average since 2008. This growth rate is even comparable to the very successful early synthetic polymers like Bakelite or nylon when they were at similar production volumes. As I wrote about in Part One, these plastics helped kickstart the last materials paradigm.

The capacity growth is set to continue apace. Spiber and AMSilk are in the middle of aggressive scale-up to commercial production. In the next few years, Spiber aims to ramp production to thousands of tons. Firstly at a demo scale plant in Thailand with hundreds of tons of capacity, and then at a commercial scale plant in the US in Iowa with about 10x capacity of the Thailand plant. To be fair, Spiber has overpromised on milestones in the past, so I am not using their best-case timelines for plant openings. AMSilk is aiming for several thousands of tons of capacity by expanding its range of CMOs beyond Europe.

Mycelium, the “root structures” of certain species of mushrooms and other fungi, is another biomaterial scaling up fast. In particular, the startup Ecovative produced 45 tons per year in 2021 for a growing range of uses and can double capacity. When Ecovative was first founded in 2007, Eben Bayer made a small palm-sized piece of mycelium composite grown under his bed in his dorm room, shown here.

If that piece conservatively weighs 1kg (2.2 pounds), Ecovative has more than doubled their mycelium capacity every year on average. MyForest Foods, a spin-off from Ecovative, has just opened a plant that will scale up to over 13 thousand tons of mycelium per year by about 2024. Bayer is also CEO of MyForest Foods, and this plant is focused on making mycelium bacon and other alternative proteins. Ecovative is also scaling up mycelium production for their own Forager brand, as well as providing technology for products like Bolt Threads' Mylo leather and more.

Of course, even tens of thousands of tons of capacity is still peanuts vs the tens of millions of tons of capacity for the highest volume synthetic polymers today. That said, those materials have had several generations to scale-up and it would be unwise to bet against sustained non-linear growth. Ten or twenty years ago, few people anticipated solar PV at the scale it is today. Just as few people, ten or even five years ago, expected lithium ion battery packs to power 12% of all cars sold globally now as pure EVs. Growth rates matter and most people (especially analysts) underestimate their compounding effect. Inflection points only accelerate this growth.

I think we are close to an inflection point for these biomaterials. It does seem that with scale-up plans and very strong demand, scale-up of spider silk protein, mycelium will continue. Production growth can probably be sustained but there will be other challenges in addition to improving titers, lowering costs and accelerating cycle times discussed above.

The proteins being made in fermentation bioreactors are long and complex carbon molecules. This often makes the downstream processing much more complex. Once the molecules are isolated and purified from the fermentation medium, biomaterials startups face the challenge of fabrication, ie turning these molecules into materials. R&D in this stage of the biomanufacturing process has involved deep technical risk, as much of the materials science and engineering to commercially formulate biomaterials is still new.

We can now see how Spiber, AMSilk and Ecovative have begun scaling up production to commercial scale. Let's look into biomaterials that are aiming to mimic the performance, look and feel of existing materials before diving in to the case for performance biomaterials.

Drop-in biomaterials

Many startups producing biomaterials are focused on largely being drop-in replacements for existing materials in products. Many more are focused on replicating performance characteristics, but, at least for now, not aiming to go beyond.

Companies working on mycelium or collagen-based leather and other materials are making good progress selling to incumbent brands — especially in apparel. These materials are more sustainable, and usually easier to process at end of life vs synthetic or natural options. They also will reduce resource consumption and manufacturing emissions, in part because fermentation takes days to produce materials instead of months. At or close to price parity with legacy fabrics like leather, they could take large shares of these existing markets.

That said, as biomaterials keep ramping, sustainability will become table stakes. I am more excited personally about biomaterials that can deliver better performance than incumbents. Making better products is how technologies we take for granted became so widespread. iPhones > Nokias, LEDs > incandescents, computers > electronic word processors, EVs > gas-powered cars, etc. Early in the s-curve, a new technology is better at replacing existing use cases. For example, nylon stockings was a replacement for silk stockings. As the technology matures, it starts to solve new problems and creates entirely new product categories because of novel properties. Lithium-ion batteries enabled drones, solar PV enabled human-scale power generation and synthetic polymers enabled all kinds of products to be better and cheaper. Better performing materials also matter for speed of adoption. All of these examples of technologies gained adoption very quickly because of their tech-driven differentiation.

It's fundamentally hard and pioneering work to develop to bring novel materials to market, whether they are drop-ins or performance-orientated. Yet mimicking the properties of a synthetic polymer plays to its strengths and not to those of biomaterials. One of the key differentiators of using engineered biology is enabling performance properties not possible with materials derived from fossil fuel feedstocks. Why can't we make synthetic polymers that have these properties? In short, they rely on a limited range of fossil feedstocks and there are only so many ways to economically process them. I wrote about this in Part One of this series. Engineering with biology allows more control over end products with bespoke properties using the nanomachinery of cells and enzymes. Drop-ins do not take advantage of this.

Drop-in materials are good. I understand some startups need brand interest to secure funding and/or recruit talent in their early years and to help move biomaterials forward. Yet as we’ve covered, I think the bigger breakthroughs and step changes in scale will be unlocked by leveraging superior properties.

Performance biomaterials

When we have some control of the arrangement of things on a small scale we will get an enormously greater range of possible properties that substances can have, and of different things that we can do.— Richard Feynman

Let’s look a little closer at examples of performance materials and startups that are making them.

By performance, I mean higher performing along any dimension or property of the material. Performance biomaterials will unlock products that synthetic polymers and other materials simply could not be used in. Plastics themselves disrupted natural fibers, wood, metals and other materials during the 20th century because of their novel properties and production scalability.

Spider silk protein from AMSilk and Spiber

We are talking specifically about spider silk protein made from microbial fermentation. One of the appeals of this protein as a biomaterial is the exceptional properties, even straight from nature. Incredible toughness, high tensile strength, lightweight and compatibility with biology is quite the list. Also, being made from engineered microbial "factories" allows tuneable properties, no matter if the protein is spun into a fiber or made into a gel, coating or composite material.

Of the numerous startups developing spider silk protein into materials, AMSilk and Spiber have the most traction. We've discussed the growth of these companies above, and will focus more on material properties and commercialization here.

AMSilk is perhaps the most under the radar biomaterial startup I’ve come across given its age and relative traction. Founded and based in Munich, Germany, their beachhead market was as high value, low volume gels for cosmetics products. By 2017, their gel was already in 20 speciality cosmetics products. Early on, they also developed Medtech applications including a coating for breast implants, tested in vivo in preclinical trials, where the spider silk gel’s biocompatibility lowered inflammation and other post-procedure problems. Their fiber can be used for biosensors and even in 3D printable structures. By focusing on non-fiber applications, they avoided the challenges of material fabrication we spoke about earlier.

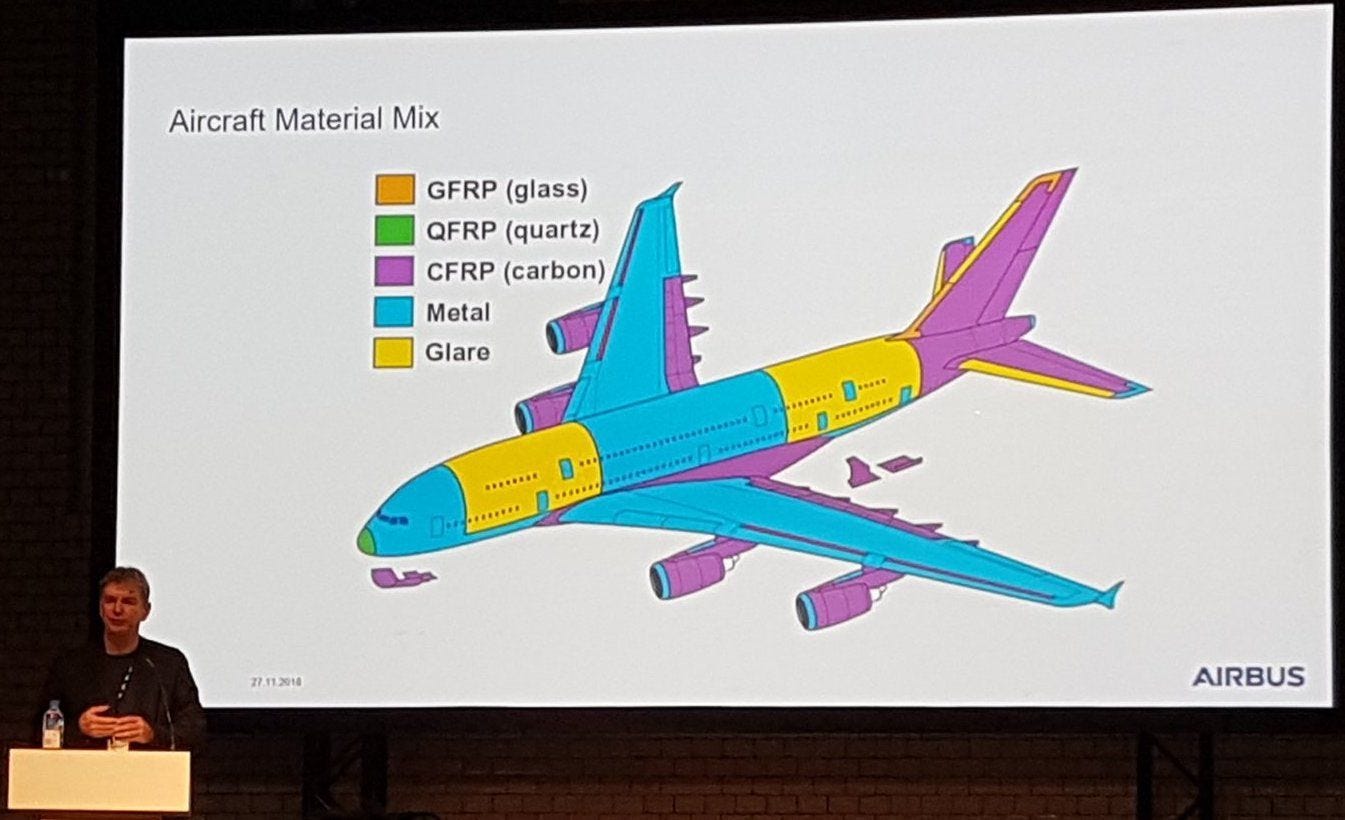

In 2015, AMSilk made their first fiber, branded as Biosteel. In the past few years, they’ve started partnering with several large companies and have multiple products in the market. Airbus is researching how to replace carbon fiber with AMSilk's fiber in composite parts on their airplanes. This would allow for planes to better withstand impacts and help with light-weighting and is a great example of how innovation in performance biomaterials will extend far beyond fabrics. Airbus's Innovation Manager for Emerging Technologies and Concepts, Detlev Konigorski, had this to say about spider silk:

We haven’t even begun to scratch the surface here. Ultimately, this material could enable us to approach design and construction in an entirely new fashion.

It bends without losing strength. So, it could be integrated on parts away from the fuselage that are prone to debris impact or bird strikes. It could help protect space equipment in a similar manner or be applied to defence products.

Omega launched a commercial watch strap line using AMSilk's Biosteel that is 30% lighter and hypoallergenic. Adidas has been developing a shoe upper with them and Mercedes is exploring using Biosteel in interior parts, starting with door pulls. To focus on these and other products in their pipeline, in 2019 AMSilk sold their cosmetics business to Givaudan, the world's largest flavor and fragrance company. Granted, these products are all premium for now, but that's largely due to AMSilk's still small, but rapid growing manufacturing capacity.

Like most other biomaterials startups, AMSilk is supply-constrained. They can’t produce enough protein via their CMOs to meet demand. To address this, they are in aggressive scale up mode, as mentioned in the growth section above. Their capacity was 1 ton last year. They expect a six-fold surge to 6 tons this year and are aiming for several thousand tons of capacity by expanding their CMO network beyond Europe.

I’m impressed with AMSilk’s execution. They've raised $42 million, with only $7 million of that lasting from 2008 through last year, when they secured their series C. This is far less than their peers Spiber and Bolt and at least in part because they outsourced manufacturing, which is a huge cost. Despite their frugality, they have the highest current output of a startup producing fermentation-based spider silk protein and are ramping scale-up. Starting with cosmetics and coatings for medical applications probably enabled high value / low volume production for long enough to move down the cost curve. This was harder for Spiber or Bolt Threads to do given their focus on lower value apparel products.

Spiber is the other pioneer of fermentation-derived spider silk protein, branded Brewed Protein. Founded in 2007 and based in Yamagata, Japan, they have largely been focused on the apparel market as their beachhead. They have also developed concepts for fiber-reinforced materials with Toyota group companies for use in car doors instead of steel that are lighter and better shock absorbing. In that same project, they also developed polyurethane composite foam for car seats with Bridgestone, the tire maker. In apparel, they partnered with Goldwin to make a wool blend sweater, and North Face on a limited edition Moon Parka with the outer shell made from Brewed Protein. The jacket was delayed for several years years because of “supercontraction", which happens when spider silk protein becomes wet or is washed. Despite this setback, their spider silk is now in a (slightly less limited) commercial run of several hundred hoodies from Pangaia Lab.

Spiber has raised a whopping $640 million in equity and securitization financing. A large chunk of that is invested into building their upcoming demonstration plant in Thailand and commercial plant in the US in Iowa. Once they have these plants operating at capacity, they will be producing thousands of tons per year of spider silk protein. As they approach that scale in the next few years, they aim to be cost competitive with cashmere, then silk, and then even wool. Despite setbacks, this is pretty remarkable given the founders produced a mere 20 mg in 2008.

Bolt Threads is another startup that started by developing fermentation-based spider silk proteins. After being founded in 2009, Bolt did some limited run experiments with their fibers in ties and beanies and later launched their B-silk protein for cosmetics creams and other products. However, they've pivoted largely to Mylo, a mycelium-based leather using tech licensed from Ecovative. As CEO Dan Widmaier put recently, "Mylo is where the heat in the industry is right now". Bolt has raised $472 million.

Spider silk protein has naturally exceptional properties, tunability due to synbio and downstream processing, the traction in an early range of applications and finally the rapid and continued scale up of leading companies. It demonstrates promise as a leading platform for performance biomaterials in terms of both scale and potential.

Algal oil polymers from Checkerspot

Founded in 2016, Checkerspot is a Bay Area based startup making performance biomaterials. It is one of the only biomaterials companies vertically integrated from developing microbial strains all the way to directly selling products to consumers.

They use microalgal fermentation to produce an algal oil, which can then be processed into different materials. So far, they have commercialized an algal urethane, polyurethane and a wicking fabric coating. Checkerspot’s founders, Charles Dimmler and Scott Franklin, had both worked at Solazyme, one of the Cleantech 1.0 companies that didn’t make it. Solazyme’s direct to consumer algal oil products inspired Dimmler and Franklin to focus on building consumer products themselves. They both love skiing, and thought the algal oil could enhance the properties of skis. Indeed, Solazyme had earlier tested algal oil polymers in surfboards.

Checkerspot’s materials used in skis replace petroleum-based polyurethane in ski sidewalls. The sidewalls are 138% better at damping vibrations vs petroleum-based ABS sidewalls and 60% better tensile strength at skiing-friendly temperatures. It also does not need any glue to adhere to the ski. Their polyurethane used in ski cores is also lightweight, allowing their skis to be significantly lighter than average skis. The most surprising part is their price competitiveness with performance skis. Better performance effectively at price parity. I don’t think any other biomaterial company can claim that to the extent they can. They're either not using enough algal oil for prices to matter, or their algal oil is not overly expensive vs petroleum-based polymers, or both.

Vertical integration stands out most about Checkerspot’s business model. Most of their skis are produced and distributed by their own brand, WNDR Alpine, which has a manufacturing plant in Salt Lake City, Utah. No other biomaterials company I’m aware of has taken this full stack strain-to-product approach. Checkerspot has also partnered with other companies to use their performance materials. DPS, a premium ski maker has integrated their polyurethane sidewall into a line of skis, ink and chemical company DIC is using algal oil to add more color to their range, Algenist set up a strategic partnership to use their materials in skincare products and Gore is experimenting with the materials too.

Alongside their own DTC distribution through WNDR Alpine, Checkerspot is also leveraging B2B partnerships. They are building out algal oil as a platform molecule that could be processed and integrated into many different consumer products.

Other emerging performance biomaterials

Alongside spider silk protein and algal oil products, there are a growing number of startups focused on making performance biomaterials.

When Amyris sent out samples of farnesene early in its development, they probably didn’t expect a company to commercialize a performance tire. Kuraray, a Japanese plastics manufacturer, developed two novel materials by blending farnesene into their rubber products. The first is liquid farnesene rubber (LFR). When used in tires, it reduces hardening in cold temperatures, improving grip, reducing fuel use and is more energy efficient to manufacture. LFR has been commercialized in some of Dunlop’s winter tires in East Asia. Indeed the demand was so strong that Amyris's CEO John Melo said (emphasis mine): "Using LFR has caused notable interest by leading tire companies and has resulted in substantially stronger demand in 2017 than either Amyris or our collaboration partner had anticipated." LFR can also be used in adhesives, coatings and sporting goods.

Using farnesene, Kuraray has also developed hydrogenated styrene farnesene block copolymer (HSFC), which has superior grip performance for shoes, grip handles, mats, etc. It also has better damping properties. Kuraray’s farnesene derived materials are still combined with conventional polymers for now, but are produced more sustainably and with less emissions than petrochemical rubbers. Further, recycling tire rubbers could be much better, with LFR and HSFC being more incremental improvements. Still, they point to higher performance biomaterial improvements over commodity uses of plastics like tires.

The wide ranging performance applications for this one molecule developed by one company hint at the potential impact of biomaterials. Also, as drop-in chemicals and biomaterials scale up, expect to see more applications that integrate both drop-in and performance biomaterials together in products.

Tandem Repeat is commercializing Squitex, a composite biomaterial made by spinning squid-inspired protein and cellulose or acrylic together. The squid-inspired protein is cultivated in fermentation tanks using microbes engineered with tandem-repeated genetic sequences from squids. Hence the startup's name.

Melik Demirel is one of Tandem Repeat's cofounders and a professor at Penn State. He co-authored a a 2020 Nature paper demonstrating the rapid self-healing properties of other squid-inspired proteins. In the paper, the biomaterial locally heals in seconds, using only mild heat at 50°C/122°F, as shown in the video below with some tests in the paper showing healed areas being at least as strong as the pristine ones. State of the art comparable materials take at least an hour. The paper also reported experiments using an artificial muscle capable of lifting a dead load 3000 times its own mass, which exceeds biological muscle. This is shown in the image above.

Sorry, your browser doesn't support embedded videos.

Tandem Repeat is seeing strong interest in fashion brands looking to partner with them. Squitex's thermal properties can help keep clothing cooler when active. They are first targeting textile adhesives as a high value and low volume beachhead market, but may also look into PPA equipment and other markets that can best leverage Squitex's properties.

Humble Bee Bio is working on performance biopolymers inspired by the solitary Australian masked bee. The bee produces a polymer that is resistant to heat up to 240°C, is resistant to water, industrial solvents, acids and strong bases. Humble Bee Bio’s team are engineering yeast strains that can produce this polymer using fermentation. They are aiming to develop a proof of concept of their material to be used for fibers and fabric finishes by mid 2023, a 6-12 month timeline that would have been incredulous only 10 years ago. Humble Bee Bio has also just raised an oversubscribed round. Long term, they are aiming at a suite of biomaterials for textiles, medical devices, electronics, aerospace, defence, animal health and even construction. There's a ton of genetic potential in insects that could lead to performance materials that we just do not understand well today. For example, Raspy crickets make silk for shelter.

Bacterial cellulose is another biomaterial that has performance characteristics. Modern Synthesis is using bacterial cellulose to “microbially weave” materials that allows for more design freedom in textiles and films. Bucha Bio’s bacterial cellulose has tensile strength higher than polyurethane, and is targeting textile markets. Polybion has built a first of a kind plant that will produce 1.1 million sq. ft. of bacterial cellulose per year, with production and polymerization only taking 20 days. They are partnering with the world's largest shoe manufacturer and three largest German auto companies. Simplifyber's cellulose is plant-based, but it is poured into a 3D-printed mold to make a one-piece sneaker, shirt or other clothing.

So far, we have not talked about mycelium in this section. That’s because mycelium applications have usually not focused on performance. Mycelium leather in hats and other clothing, meat alternatives, other textiles, foams and packaging are some of the commercialized products so far. Though the focus has been on drop-ins and matching performance, there may be structural materials being explored for mycelium that have performance applications. As mentioned above, MyForest Foods' production capacity is aggressively ramping and will continue driving costs down.

Engineering mycelium and other biomaterials for performance should become easier as costs continue falling, processes improve and as our underlying scientific understanding improves. It bodes well for future applications.

Challenges for performance biomaterials

Like any new and growing industry, progress will not all be smooth sailing.

The biggest question perhaps is scaling and associated cost declines. Can spider silk (and mycelium) keep scaling production at a rapid rate? Can other startups follow and also scale production? I don’t know, and no one does. There are no perfect comparisons, but overall the signs are good. As discussed earlier, Spiber, AMSilk and Ecovative all have massive near-term scale up plans. Synbio chemical companies like Amyris, Geno and Lanzatech have demonstrated the ability to reach tens or hundreds of thousands of tons of capacity. They are still growing fast despite being in mostly commoditized markets. Performance biomaterials should have an easier time scaling in comparison because their tech-differentiated value will accelerate demand.

Related to this question is the bottleneck of fermentation capacity. While I attended the SynBioBeta conference in April, this was one of the most talked about challenges. It's worth remembering that supply constraints is a good problem to have overall and means biomanufacturing is booming. Demand for fermentation is strong at bench scale up to tens of thousands of liter tanks and beyond, with 6 to 12 month or more lead times. Well capitalized companies are building out more capacity (like Amyris, Geno, Spiber) and upstart CMOs are looking to new reactor designs and to embed more automation and data tracking. However, there’s a lag for investments in supply to catch up, especially for larger scale fermenters. Liberation Labs, started by experienced synbio executive Mark Werner, as well at least one funded stealth startup I know of is working on addressing this need. The lithium supply chain is a great analog, where investment has lagged surging EV-driven demand in recent years, but it is starting to catch up. Still, for fermentation capacity, there will be some short term pain before supply catches up.

For startups with lower technological readiness, there’s the technical risk of developing a proof of concept for a new biomaterial and bringing it to market. Titers have to dramatically improve from first results in a lab. However, unlike Spiber’s early days, the synbio stack makes it faster and cheaper than ever to develop new biomaterials. We saw this happen for Amyris and Geno above as they developed more molecules. Development and go-to-market timelines will keep falling and make it easier to commercialize performance materials.

A huge challenge in executing quickly is working with incumbent customers on their usually slow timelines, as discussed in the section above on drop-in materials. Leveraging DTC like Checkerspot or partnering with startups, both of which we’ll cover later, are ways to speed up iteration cycles.

The startups we’ve discussed so far mostly use sugars from crops as feedstocks for fermentation. Land and resource use of crops comes up as a problem as production capacity of fermentation scales. Corn, sugarcane and other feedstocks require land, but sugarcane expansion in Brazil, a key producer, is largely done by converting degraded livestock pastures. Currently 77% of all crop land is actually used for livestock pastures or crops for animal feed. Even today's biomanufacturing technology reduces land intensity. As an example, Impossible Foods's burger patty uses 96% less land to make vs beef. Many biomanufactured products from chemicals (Lanzatech) to foods (Air Protein, Solar Foods, Circe Bioscience) are using feedstocks like CO2 or carbon monoxide and hydrogen. This trend will only continue as scientists better harness types of bacteria which thrive on simple carbon-based molecules. Costs of hydrogen and other feedstocks will also fall with clean electricity prices, making these approaches more competitive over time.

Also, we can’t talk about biomaterials without mentioning Zymergen. From the outside, Zymergen looked like a cautionary tale of how not to execute on a new biomaterial. Their lack of success should not be a deterrent for startups building biomaterials. If anything, having a failure like this, reminiscent of Cleantech 1.0 companies, is probably a good thing for the companies actually building the future. I looked into Zymergen a little more closely in this Twitter thread. Ginkgo’s recent fire sale acquisition seems like a good way to bring on the IP from Zymergen's platform and gain their core engineering talent.

Future biomaterials will keep getting better

The present and near term future for performance biomaterials looks pretty good. Looking forward, we are in the very early stages of the potential of better properties at increasingly economic costs. Let’s briefly survey some of the emerging breakthroughs that may enable next decade’s biomaterials to well exceed what's possible today.

The synbio stack for biomanufacturing is only getting better. I'll recap what was covered above in the synbio stack section. Strains are faster to engineer and more automation and software is improving productivity of biomaterial startups. Fermentation capacity, though bottlenecked today, should ramp in the coming years with more investment to keep up with the growing range and scale of biomanufactured products. Startups, some in stealth, are working on improving the design of bioreactors and making scale up easier. Using microbes that feed on CO2, hydrogen and other small-molecule feedstocks could allow for novel materials. Further, current solid state fermentation and cell-free catalysis will also keep improving as more companies commercialize molecules using these technologies.

Biomanufacturing has relied on e. coli and yeast (s. cerevisiae) as workhorses in microbial fermentation. Almost all companies today use engineering strains of these two rather versatile microbes. Increasingly, new ventures are developing so called non-model organisms, which open up the design space for potential molecules (and materials) that can be made. We’re in the early stages of this, but startups like Wild Microbes, focused research organizations like Cultivarium and no doubt many research labs are pushing forward our understanding of non-model organisms.

Using cell-free enzyme catalysis approaches are also in their early days. A prominent startup is Solugen, a chemicals company, with a 10,000 ton capacity plant built last year in Houston. Startups like Rubi are developing enyzme-based pathways to make materials, while Invizyme and Aether are developing enzyme engineering platforms. Intropic Materials is using enzymes embedded in plastics to accelerate self-degradation.

As promising as biomaterials are, there are other performance-focused materials that could be key parts of a new materials paradigm. Let's take a look at these, before turning to how consumer-facing startups can partner with biomaterials producers.

Other performance materials

Graphene, which was first isolated using scotch tape, seems to have already survived a hype and trough cycle. Some of the remarkable properties of this one-atom thick 2D material include its incredible strength, hardness, elasticity and lightness. Applications are now booming as graphene is now hitting its own s-curve inflection point. Last year twelve thousand tons was produced globally as films, powders, nanoplatelets and in other forms. In the last three years according to IDTechEx, graphene production has surged over 4x, at a scorching 61% CAGR. It is scaling almost twice as fast as nylon or synthetic polymers overall at the same level of scale.

All that graphene is being used for supercapacitors, battery cooling, coatings for wind turbines, Head tennis racquets, and even in composites for Airbus and Fiat-Chrysler. Challenges for graphene include only being used as an additive, and still relatively high costs. But as production ramps, costs will come down and engineering will improve and we’ll likely see a lot more of this material used in the coming decades. Graphene manufacturing has historically relied on chemical vapor deposition, which is also used for semiconductor and solar cell fabrication but produces volatile by-products or CO2. There are alternative manufacturing processes being developed like flash graphene and using palm kernel shells as feedstocks.

Commoditized metals are probably not the first thing one thinks as performance materials. Yet, usage of many metals is constrained by price and supply, and often manufacturing processes are emissions intensive. Electrolysis of aluminum has been around for over a century, but electricity that gets cheaper and cleaner will unlock even more uses for this lightweight metal. Other metals that could see higher adoption as costs fall include magnesium, which is lighter than even aluminum and has superior damping, or titanium using hydrogen assisted reduction. A future where electric planes are made of lower cost lightweight metals and biomaterial composites is no longer science fiction.

Like graphene, additive manufacturing (AM or 3D printing) has been through a hype cycle and is coming out stronger. Though not new materials, AM is a range of processes that can improve structural properties of materials in novel ways. In metal AM, one promising startup is Seurat, named after Georges Seurat's pointillism-style paintings. Seurat's printers work by using a laser to micro-weld powder layers with clean electricity. They aim to aggressively bring costs down and scale up so that they can print even cheaper than commodity kitchen silverware by 2030. They have already partnered with established companies like Porsche, GM and Siemens. Another interesting startup is Relativity Space. They have engineered the world's largest 3D printers to print their rockets, including engines, with 100x less parts.

Meanwhile, AM to make synthetic polymers is also starting to scale quickly. The global polymer AM market is at a similar scale production to graphene, though growing at a slower 22% CAGR from 2016 to 2023 (estimated).

How can startups apply performance bio (and other) materials to create far better products? This question is one I’ve perhaps been thinking about the most as I’ve explored the terrain above. Let’s dive in.

Go-to-market and scaling demand

This decade is the first time since the age of polymers in which new classes of materials will help drive the performance of consumer products. Above, we’ve already surveyed performance (bio and non-bio) materials. Their novel properties open up the design space, much as synthetic fabrics and resins did for textiles, the Space Race and beyond during the mid 20th century.

Let’s explore strategies for biomaterials startups to go to market. The sum of these strategies help inform how demand scales up for the whole industry. We'll first outline two types of strategies used today. Then, we'll hone in on why I think startups sourcing from biomaterial partners will increasingly be a compelling alternative. Finally, we'll also talk about why DTC as a distribution model is important for driving growth.

Keep in mind that while I believe some approaches to be better than others, it’s better to have a plurality of strategies to see which ultimately work. As discussed in the section on drop-ins, there needs to be many shots on goal. I am just sharing what I find most interesting as I explore startup ideas.

1) Partnering with incumbent brands

The very decision-making and resource-allocation processes that are key to the success of established companies are the very processes that reject disruptive technologies... These are the reasons why great firms stumbled or failed when confronted with disruptive technological change. — Clayton Christensen in The Innovator's Dilemma

This is by far the most common strategy. Practically all biomaterial companies partner and sell their products to established companies in apparel, biomedical, automotive, aerospace and/or other industries. Benefits include incumbents having deep strength in making and distributing consumer products to their existing customer bases. Smaller brands are less exacting in the specifications they have, and the number of product units they need to move. Both Pangaia Lab and Goldwin's partnership with Spiber are good examples of this.

There are some drawbacks in my opinion, especially in working with larger companies. Perhaps the most limiting is that these companies have limited freedom to use completely different materials and properties to what they've used historically. Dan Widmaier, co-founder and CEO of Bolt Threads, had this to say about what incumbent buyers said when asked what they wanted from spider silk:

The number one request we used to get in the beginning of microsilk was "I would like merino wool but cheaper".

... that’s not very creative. Humans are good at incrementally innovating on something they know. There’s very few people who are very good at striking out into whitespace and correctly guessing the future on a product.

Also, incumbents want to adopt technologies that work within their manufacturing processes:

Something we really look for in terms of integration is that partner or startup understanding the supply chain and where they fit in. We've often struggled if partners just think that we’re going to reinvent the wheel and create a whole new supply chain.

— Adidas spokesperson. Biofabricate

Further, they move slowly and will likely take several years to bring a product to market, especially if it’s not in apparel. They are not likely to throw much of their marketing weight behind the product(s). Their large, established customer bases are as a whole not interested in products better suited for early adopters.

Early startups often simply don’t make enough material to use viably in their partner’s products. Patagonia needs thousands of units to launch a new product, Adidas aims to sell hundreds of thousands of shoes. Incumbents often ask for exacting specifications that are hard for startups to meet, and that's before talking about (current) price premiums. Partners may also have unrealistic expectations of scale up speed before the producer has even tuned its pilot or demonstration scale process.

The biggest challenge that we have now internally is everyone's kind of tired of doing pilots. We did enough of that and we just really want to be able to start offering products.

— Spokesperson for Stella McCartney (a fashion brand). Biofabricate

2) Vertical integration

In this context, vertical integration means doing the R&D and commercialization of both the molecule and the material, as well as owning direct to consumer distribution channels. One of the only, perhaps the only, example of this today is Checkerspot with their own WNDR Alpine brand.

Checkerspot's R&D expertise in algal fermentation is exceptional, as is their materials science to turn their algal oil into high-performance materials like the polyurethane used in WNDR Alpine’s products. WNDR integrates these biomaterials into skis and snowboards, and sells them at very competitive prices on their site.

Checkerspot’s vertical integration is impressive. I’ve seen few examples of synbio companies generally that vertically integrate, let alone biomaterials. The ones that seem to be doing it well like Amyris, Zbiotics and Cronos are integrating chemicals into cosmetics, food or health products.

However, I don’t think the vertically integrated approach is reproducible for most other founding teams. Checkerspot's founders, Charles Dimmler and Scott Franklin had both worked at Solazyme, also an algal oil company. Franklin has credited working on their consumer product as an inspiration for Checkerspot's DTC strategy. Despite being a relatively young biomaterials company founded in 2016, they were able to leverage the many years (and millions of $) of development that Solazyme had invested into algal oil R&D. As Dimmler said:

(Solazyme) really started to pick up momentum in 2008. So if you were to start the clock it took from 2008 to 2014/ 2015, about six plus years to get to commercial scale manufacturing. Checkerspot is building on a lot of the know how and lessons learned from that experience.

...that's a really important qualifier because if I'd say Checkerspot was founded in the summer of 2016 — we're four years old and we have three products on the market, that would convey that Checkerspot has somehow done something extraordinarily unique in bringing a product to market at a ridiculously fast pace.

Further, I think we'll increasingly see products integrating multiple biomaterials from more than one producer. For Checkerspot, it might be harder to source from another biomaterials manufacturer given it’s tough to be both the platform and the buyer. There are exceptions of course, like Tesla sourcing batteries from BYD, which is both an EV and battery manufacturer. Overall, it's hard to see many performance biomaterials companies going down the vertically integrated path.

3) Partnering with consumer product startups

Spiber and Ecovative are the only two examples I've seen of biomaterials producers partnering with consumer product startups. Both partner with Pangaia, a four year old materials-focused fashion brand, and Ecovative's collaboration is through their Fashion for Good cooperative. Despite the lack of current examples, let's walk through how these partnerships could look in the future and some potential differences in working with larger brands.

The core benefits of this approach are that the consumer product startups can build products that pull demand forward for biomaterials, and scale with the biomaterials producers. The producers of performance biomaterials that can grow faster will move down the cost curve sooner. Partnering with startups all in on making products that leverage the performance properties of biomaterials will, I think, grow demand faster.

Consumer startups can deeply innovate on the integration of one or more performance biomaterials into novel products. They are free of the creative constraints, large volume requirements and exacting requirements of incumbent companies. They have to ramp distribution as part of building the product, and can develop a tight customer feedback loop akin to what companies like Allbirds, Tesla and Fitbit did. These startups would bet their businesses on biomaterials as being core differentiators for not only their product, but their company.

Novel materials could get early adopter customers really excited to buy high performance products. Of all things, nylon stockings triggered this in the 1940s and I’ve written that few materials-driven innovations have done that since. I believe sustainable materials are becoming table stakes, and will not offer real benefit when everyone else uses them. The challenge will be in making products that people would love to use using world-class engineering.

Startups focused on engineering the materials into products can also cultivate strong relationships with many producers of performance biomaterials. Over time, approaches like cell-free, small molecule feedstocks and superior solid-state derived biomaterials probably become more available. No problem, as these consumer-facing startups can develop the expertise to integrate these as well and do it fast.

These consumer-facing startups could form in a range of industries, though the immediate pull might be towards apparel. However, areas like next generation mobility form-factors, aerospace and even robotics and other hardware products could be improved with performance materials as we’ll talk about shortly. The likely early products will be higher value goods made in reasonably small volumes, perhaps with proof of concepts engineered with biomaterial samples. As biomaterials prices will continue to fall as production ramps in the coming years, consumer startups will not need to auction jellyfish collagen book covers for over $12000, or charge $1400 for limited edition North Face jackets to gain traction. AMSilk and Spiber are already eyeing the aerospace and mobility industries as they scale, with AMSilk having partnerships with Airbus and Mercedes in place. This hints at where growth might be beyond apparel and textiles, though I think an eVTOL/eCTOL startup or e-bike/EV startup could build more compelling products that gain traction faster than incumbents.

There are companies in adjacent spaces emerging that are useful analogs as consumer facing products. Arcaea is leveraging Ginkgo’s strain development platform and is focusing on formulating fermentation-derived chemicals into cosmetics products. Startups like Vollebak and Graphene-X have been building brands around graphene in textiles and other novel materials, having kickstarted and preordered their way to early traction. Allbirds and On Running became billion dollar public companies (On expects to do over $1B in revenues this year) despite using existing materials in their shoes developed with novel approaches.

In the final section below, we'll take a longer view at what the potential of performance biomaterials could be.

Future applications

The early examples of consumer products using performance biomaterials are in apparel or sporting goods, e.g. Checkerspot. But what other types of products might biomaterials begin to be used in? This section outlines my far-from-comprehensive thoughts on this question, and how biomaterials might contribute to a more exciting future. The obvious narrative would be that they solve valuable problems that people will pay to be solved, for a growing variety of problems and larger groups of people over time. I think it’s worth exploring in a little more detail. By the way these are not predictions!

We’re still very early in the rise of performance biomaterials and other next-generation materials. Given that, it makes sense that the products available today are very much trying to do existing things better instead of brand new things. Over time, we’ll see a self-reinforcing feedback loop: more startups creating more products, increasing demand for more biomaterials, which will drive more product adoption. That will, like how other technologies have diffused historically, allow for increasingly complex products to be engineered that integrate performance biomaterials.

Two things about how this could play out. Firstly, 1+1 > 2. Integrating multiple performance biomaterials in one product could enhance benefits over and above applying them separately in different products. Of course, that’s with the caveat that the characteristics of the biomaterials combined makes sense for such a product.

Second, engineering biomaterials together with other technologies that make products better. Skeleton Technologies, which has raised over €200M making graphene-enabled supercapacitors, is an example of leveraging performance materials with supercap technology. Technologies that might play well with performance materials include battery-powered propulsion, miniaturized hardware, exponential compute, biosensors, robotics and more.

Smart clothing, in which textiles are integrated with electronic components, could continue to integrate performance materials. Self-thermally regulating clothing brands like Ministry of Supply's Mercury jacket have integrated batteries, heating elements and use a thermostat to heat to a comfortable temperature. Oros Apparel uses a super thin NASA-inspired aerogel layer to trap heat instead of thick down in their jackets. In some use cases, it just makes more sense to heat (or cool) one’s body directly instead of a heat pump for an entire room/home/building.

Performance biomaterials could also allow smart clothing to do much more. They could one day repair itself as discussed above for Tandem Repeat's squid-inspired protein. Graphene electrodes in a biosensor monitoring amino acids in sweat can give nutrition-tracking and recipe recommendations, as reported in a recent Nature paper by Caltech researchers. Biomaterials could even help brain-computer interfaces be more biocompatible in a similar way to what AMSilk’s spider silk does today for breast implants.

Mobility is another promising area, especially electric vertical/conventional take off and landing (eVTOL/eCTOL) aircraft. Lightweight biomaterial composites, like what Airbus is exploring with AMSilk, could be used as coverings, propeller blades or interior parts for eVTOLs and eCTOLs. Given how weight-constrained these vehicles are during takeoff and for flight range, the likely cost premium (for now) in using these composites could well be offset by range and weight benefits in the coming years. Improving battery performance will help. Airbus's partnership is to explore spider silk alternatives for carbon fiber reinforced polymer (CFRP) composites. Aerospace grade carbon fiber is about $90/kg today, less than cashmere and a little more than silk. As AMSilk, Spiber and others start to scale to tens of thousands of tons per year scale of spider silk protein in the coming years as planned, it should become cost-competitive and perhaps even more affordable than carbon fiber sooner than we think. This is great for commercial planes, but it should be even better for startups working on eVTOL/eCTOL or other aircraft with performance constraints. Other vehicles that could benefit from biomaterials include e-bikes, EVs, and even yet-undeveloped form factors.

Another application for novel biomaterials could be humanoid robots. They are closer to market and usefulness than we probably think, partly because of rapidly advancing AI algorithms and exponential compute. Biomaterials could play a key role in soft robotics. In the Nature paper mentioned above, the squid-inspired protein was tested as a pneumatic soft actuator that, when self-healed, still performed just as well as when it was pristine. These bioactuators allowed for experimental success gripping objects with non-flat shapes such as a cherry tomato. Further, the lightweight but high toughness of spider silk protein and other biomaterials could apply well to nimble and durable robots.

Over time, performance biomaterials will be better understood. As this happens, they will become integrated in increasingly complex products with other emerging technologies.

Conclusion

A future filled with performance biomaterials is coming fast. These materials are the tip of a new materials paradigm spear. Startups will integrate them into compelling new products, industries will be shaken up by them, and I am optimistic that people be more inspired to build the future.

Personally, I am in the early stages of exploring ideas for a consumer startup integrating performance biomaterials. Let’s talk more about this if interesting to you.

Reach out on Twitter or email.

Thanks to James Giammona, Eben Bayer, Catherine Tubb, Henry Lee, Yang Fan and Anna Delas for feedback on earlier drafts.

FANTASTIC!